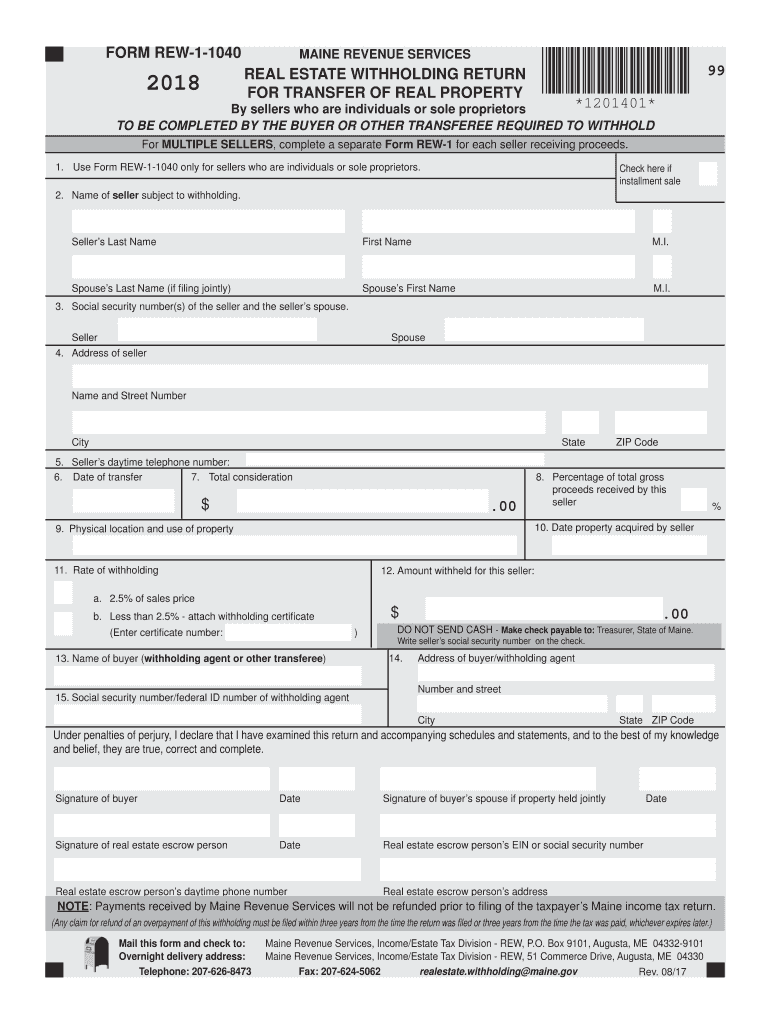

Rew 1 Maine 2018

What is the REW 1 Maine?

The REW 1 Maine is a specific form used for reporting and documenting individual income tax information in the state of Maine. This form is essential for residents who need to report their income accurately and comply with state tax regulations. It is particularly relevant for individuals who may have various sources of income, including wages, self-employment earnings, or other taxable income. Understanding the purpose and requirements of the REW 1 Maine is crucial for ensuring proper filing and compliance with state tax laws.

Steps to Complete the REW 1 Maine

Completing the REW 1 Maine involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2 forms, 1099s, and any other relevant income statements. Next, carefully fill out the form, ensuring that all income sources are reported accurately. Pay attention to specific instructions regarding deductions and credits that may apply to your situation. Once completed, review the form for any errors or omissions before submitting it to the appropriate state tax authority.

Legal Use of the REW 1 Maine

The legal use of the REW 1 Maine is governed by Maine state tax laws, which stipulate that individuals must report their income accurately to avoid penalties. The information provided on this form is used by the state to assess tax liabilities and ensure compliance with tax regulations. It is important to use the form correctly and submit it by the designated deadlines to maintain legal standing and avoid potential legal issues related to tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the REW 1 Maine are critical for taxpayers to observe. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. However, it is advisable to check for any changes or extensions that may apply. Missing the deadline can result in penalties and interest on unpaid taxes, so it is essential to stay informed about important dates related to the form and the overall tax filing process.

Required Documents

To complete the REW 1 Maine accurately, several documents are required. Taxpayers should have their W-2 forms, which report wages and salary information, as well as any 1099 forms that report other income sources. Additionally, documentation for deductions, such as receipts for business expenses or charitable contributions, may be necessary. Having all required documents ready will streamline the completion of the form and help ensure accurate reporting of income.

Form Submission Methods

The REW 1 Maine can be submitted through various methods, including online, by mail, or in person. For online submissions, taxpayers can use designated state tax platforms that facilitate electronic filing. If choosing to submit by mail, ensure that the form is sent to the correct address specified by the Maine Revenue Services. In-person submissions may be made at local tax offices, providing an opportunity for direct assistance if needed. Each method has its own processing times and requirements, so it is important to choose the most suitable option.

Eligibility Criteria

Eligibility for filing the REW 1 Maine typically includes individuals who are residents of Maine and have earned income during the tax year. This includes those who are self-employed, employees, or receive other forms of taxable income. Certain exemptions may apply based on age, disability status, or income level, which can affect the requirement to file. Understanding the eligibility criteria helps ensure that individuals meet their tax obligations appropriately.

Quick guide on how to complete spouses last name if filing jointly

Complete Rew 1 Maine effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for ordinary printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage Rew 1 Maine from any device using the airSlate SignNow Android or iOS apps and simplify any document-related tasks today.

The easiest way to modify and eSign Rew 1 Maine without hassle

- Find Rew 1 Maine and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more dealing with lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Rew 1 Maine and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct spouses last name if filing jointly

Create this form in 5 minutes!

How to create an eSignature for the spouses last name if filing jointly

How to make an electronic signature for the Spouses Last Name If Filing Jointly in the online mode

How to generate an electronic signature for the Spouses Last Name If Filing Jointly in Google Chrome

How to create an electronic signature for signing the Spouses Last Name If Filing Jointly in Gmail

How to create an electronic signature for the Spouses Last Name If Filing Jointly from your mobile device

How to create an electronic signature for the Spouses Last Name If Filing Jointly on iOS devices

How to make an eSignature for the Spouses Last Name If Filing Jointly on Android

People also ask

-

What is the rew 1 form individual and how can it be used with airSlate SignNow?

The rew 1 form individual is a specific document used for reporting certain information to tax authorities. With airSlate SignNow, you can easily complete and eSign this form online, ensuring that your submissions are secure and compliant. The platform simplifies the entire process, allowing you to focus on what matters most.

-

Is there a cost associated with using airSlate SignNow for the rew 1 form individual?

Yes, airSlate SignNow offers several pricing plans that cater to different needs, including the ability to eSign the rew 1 form individual. The cost-effective solution ensures that you get the most value for your investment while efficiently managing your documents. Pricing plans vary based on features and user requirements.

-

What features does airSlate SignNow provide for handling the rew 1 form individual?

AirSlate SignNow includes a range of features to manage the rew 1 form individual efficiently. These features include user-friendly templates, automated workflows, and real-time tracking of document status. This allows for a streamlined experience when preparing and eSigning your forms.

-

Can I customize the rew 1 form individual in airSlate SignNow?

Absolutely, airSlate SignNow allows you to customize the rew 1 form individual to meet your specific needs. You can easily add your branding, adjust fields, and include any additional information necessary before sending it for eSignature. This flexibility helps ensure your documents are personalized and professional.

-

How does airSlate SignNow enhance security for the rew 1 form individual?

AirSlate SignNow prioritizes security with advanced measures in place to protect your rew 1 form individual. The platform utilizes SSL encryption, secure storage, and compliance with various regulations to ensure your documents are safe from unauthorized access. You can feel confident that your sensitive information is well protected.

-

What integrations does airSlate SignNow support for the rew 1 form individual?

AirSlate SignNow offers a variety of integrations that can enhance your experience with the rew 1 form individual. You can connect the platform with popular applications like Google Drive, Salesforce, and Microsoft Office, making it easier to manage and share your documents effectively. These integrations streamline workflow and enhance productivity.

-

What benefits can I expect from using airSlate SignNow for the rew 1 form individual?

Using airSlate SignNow for the rew 1 form individual provides various benefits, including increased efficiency, cost savings, and improved document management. The platform’s intuitive design allows for quicker turnaround times on document processing, while its digital storage reduces the need for physical paperwork. These advantages contribute to a seamless business operation.

Get more for Rew 1 Maine

Find out other Rew 1 Maine

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself