Form REW 1 1040 Maine Revenue Services Real Estate 2021

What is the Form REW 1 1040 Maine Revenue Services Real Estate

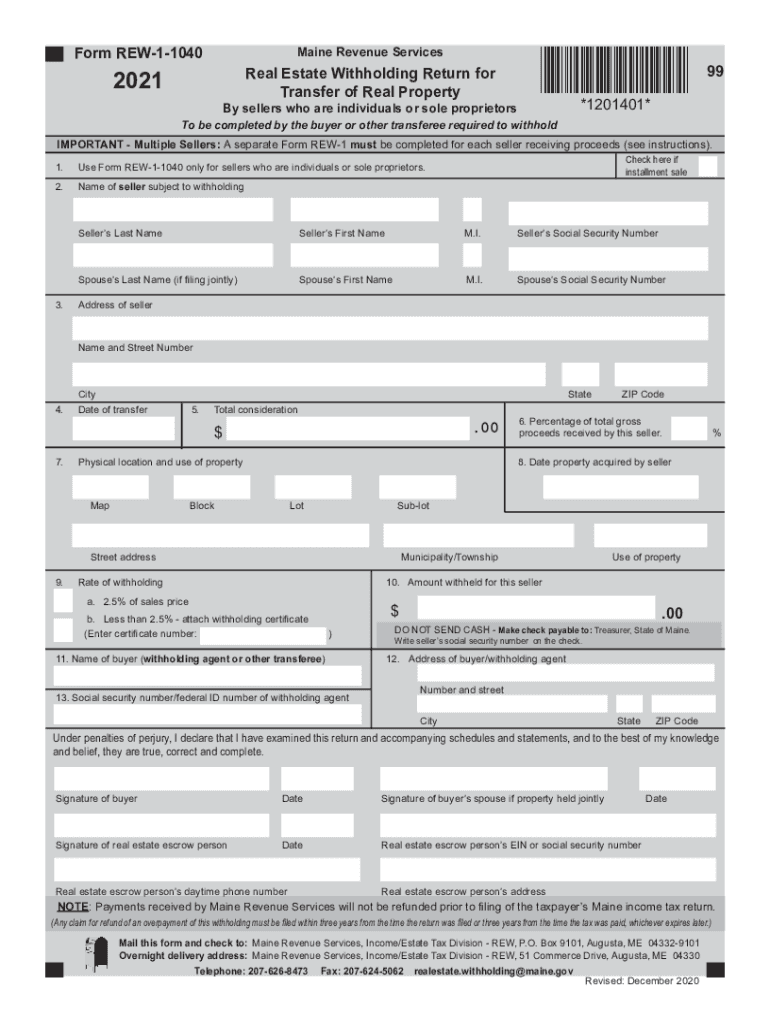

The Form REW 1 1040 is a crucial document used by the Maine Revenue Services for reporting real estate withholding. This form is specifically designed for sellers of real estate in Maine who are subject to withholding tax. When a property is sold, the buyer is required to withhold a portion of the proceeds to ensure that the seller fulfills their tax obligations. The REW 1 1040 form captures essential information about the transaction, including the seller's details, property information, and the amount withheld. This ensures compliance with state tax laws and facilitates the proper processing of tax payments.

Steps to complete the Form REW 1 1040 Maine Revenue Services Real Estate

Completing the Form REW 1 1040 involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect details about the property being sold, including the address, sale price, and the names of both the buyer and seller.

- Fill out the form: Enter the seller's information, including their Social Security number or Employer Identification Number, and complete the property details section.

- Calculate withholding amount: Determine the appropriate amount to be withheld based on the sale price and applicable tax rates.

- Sign and date the form: Ensure that the seller signs the form to validate the information provided.

- Submit the form: Follow the submission guidelines, which may include electronic filing or mailing the completed form to the Maine Revenue Services.

Legal use of the Form REW 1 1040 Maine Revenue Services Real Estate

The legal use of the Form REW 1 1040 is governed by Maine state tax laws. This form serves as a formal declaration of the withholding tax obligations related to real estate transactions. It is essential for ensuring that sellers comply with their tax responsibilities, as failure to submit this form can result in penalties. The form must be accurately completed and submitted within the specified time frame to avoid any legal issues. By using the REW 1 1040, both buyers and sellers can protect themselves from potential tax liabilities associated with real estate transactions.

How to obtain the Form REW 1 1040 Maine Revenue Services Real Estate

The Form REW 1 1040 can be obtained through several convenient methods:

- Maine Revenue Services website: The form is available for download directly from the official Maine Revenue Services website, ensuring that users have access to the most current version.

- Local tax offices: Individuals can visit local tax offices or municipal offices to request a physical copy of the form.

- Professional tax preparers: Many tax professionals and accountants can provide the form as part of their services, ensuring that it is filled out correctly.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form REW 1 1040 is critical for compliance. Typically, the form must be submitted at the time of the real estate transaction or shortly thereafter. It is advisable to check the Maine Revenue Services website for specific dates, as these can vary based on the type of transaction or any changes in state regulations. Missing the deadline may result in penalties or additional tax liabilities, making timely submission essential for all parties involved in the transaction.

Form Submission Methods (Online / Mail / In-Person)

The Form REW 1 1040 can be submitted through various methods, providing flexibility for users:

- Online submission: Some users may have the option to file the form electronically through the Maine Revenue Services online portal, streamlining the process.

- Mail: The completed form can be mailed to the appropriate address provided by the Maine Revenue Services, ensuring that it is sent to the correct department for processing.

- In-person submission: Individuals may also choose to deliver the form in person at designated tax offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete form rew 1 1040 maine revenue services 2021 real estate

Effortlessly Prepare Form REW 1 1040 Maine Revenue Services Real Estate on Any Device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without any hassles. Handle Form REW 1 1040 Maine Revenue Services Real Estate on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related operation today.

The Easiest Way to Edit and eSign Form REW 1 1040 Maine Revenue Services Real Estate without Stress

- Obtain Form REW 1 1040 Maine Revenue Services Real Estate and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Form REW 1 1040 Maine Revenue Services Real Estate and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rew 1 1040 maine revenue services 2021 real estate

Create this form in 5 minutes!

How to create an eSignature for the form rew 1 1040 maine revenue services 2021 real estate

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the form rew 1 1040 maine revenue?

The form rew 1 1040 maine revenue is a document required for filing personal income taxes in the state of Maine. It collects necessary information regarding your income and deductions. Completing this form accurately is crucial to ensure compliance with state tax laws.

-

How can airSlate SignNow help with the form rew 1 1040 maine revenue?

airSlate SignNow provides an efficient platform for managing and eSigning the form rew 1 1040 maine revenue. With its easy-to-use interface, you can quickly prepare, sign, and send documents securely. This streamlines the process, allowing for timely submissions and reduced paperwork.

-

What are the pricing options for airSlate SignNow when handling the form rew 1 1040 maine revenue?

airSlate SignNow offers flexible pricing plans to accommodate various needs. These plans are cost-effective and designed to provide access to essential features for managing documents like the form rew 1 1040 maine revenue. You can choose the plan that best fits your business requirements.

-

Can I integrate airSlate SignNow with other software for the form rew 1 1040 maine revenue?

Yes, airSlate SignNow supports integrations with several popular software applications. This allows for seamless data transfer and enhanced workflow management when handling the form rew 1 1040 maine revenue, enabling you to streamline your entire document management process.

-

What security features does airSlate SignNow offer for handling the form rew 1 1040 maine revenue?

airSlate SignNow prioritizes security with features such as encryption, two-factor authentication, and audit trails. These measures ensure that sensitive information related to the form rew 1 1040 maine revenue is protected throughout the signing process. You can confidently manage your documents knowing they are secure.

-

How can I collaborate with others on the form rew 1 1040 maine revenue using airSlate SignNow?

AirSlate SignNow enables easy collaboration through shared access to documents. You can invite others to review or sign the form rew 1 1040 maine revenue, allowing for real-time feedback and edits. This collaborative approach ensures that all necessary parties are involved in the process.

-

Is there customer support available for airSlate SignNow users filing the form rew 1 1040 maine revenue?

Yes, airSlate SignNow offers comprehensive customer support to assist users with any inquiries or issues related to the form rew 1 1040 maine revenue. Whether you have questions about the signing process or need technical assistance, their support team is available to help you.

Get more for Form REW 1 1040 Maine Revenue Services Real Estate

- Prn authorization letter 76441204 form

- Pto cash out form

- Dmv release of liability form pdf

- Broward county jury duty excusal form

- Or rtg 10 residential rental agreement rentegration form

- 10 day notice of petanimal violation form

- Pdf pharmacy prior authorization request form mercy care

- Ct low dose lung cancer screening order form

Find out other Form REW 1 1040 Maine Revenue Services Real Estate

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later