Www Maine Gov Revenue SitesForm REW 1 1040 Real Estate Withholding Return Maine Gov 2022

Understanding the Maine REW-1 1040 Real Estate Withholding Return

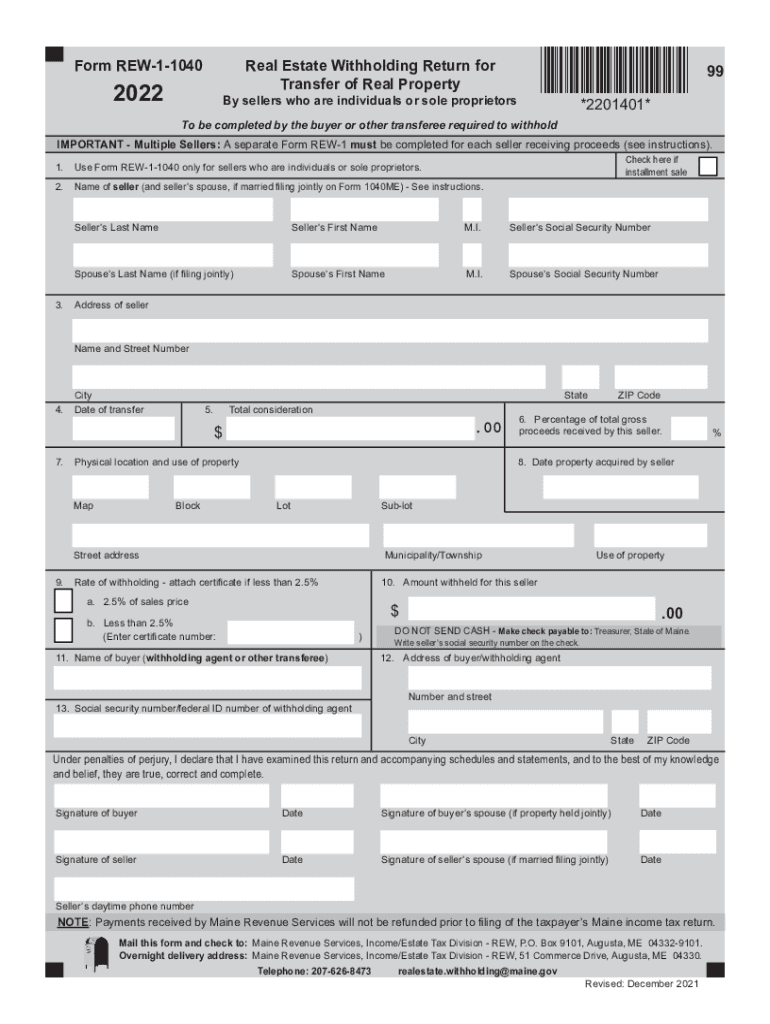

The Maine REW-1 1040 form is essential for individuals and entities involved in real estate transactions within the state. This form is used to report and remit withholding tax on the sale of real property. When a property is sold, the buyer is required to withhold a percentage of the sale price to ensure that taxes owed by the seller are paid. This process helps maintain compliance with state tax regulations and protects the interests of the state in collecting tax revenue.

Steps to Complete the Maine REW-1 1040 Form

Completing the Maine REW-1 1040 form involves several key steps:

- Gather necessary information: Collect details about the property, including the sale price, seller information, and buyer information.

- Calculate the withholding amount: Determine the required withholding based on the sale price and applicable tax rates.

- Fill out the form: Enter all relevant information accurately in the designated fields of the REW-1 1040 form.

- Review for accuracy: Double-check all entries to ensure that there are no errors or omissions.

- Submit the form: File the completed form with the Maine Revenue Services, either online or via mail, as per the submission guidelines.

Key Elements of the Maine REW-1 1040 Form

The Maine REW-1 1040 form includes several critical components:

- Property Information: Details about the property being sold, including its address and identification number.

- Seller Information: Name, address, and taxpayer identification number of the seller.

- Buyer Information: Name, address, and taxpayer identification number of the buyer.

- Withholding Amount: The calculated amount to be withheld based on the sale price.

- Signature: Signatures of both the buyer and seller to validate the information provided.

Filing Deadlines for the Maine REW-1 1040 Form

Timely submission of the Maine REW-1 1040 form is crucial to avoid penalties. The form must be filed within a specific timeframe following the closing of the real estate transaction. Generally, the withholding amount must be submitted along with the form by the 15th day of the month following the sale. It is advisable to check the Maine Revenue Services website for any updates or changes to these deadlines.

Legal Use of the Maine REW-1 1040 Form

The Maine REW-1 1040 form is legally binding when completed and submitted according to state regulations. It serves as a formal declaration of withholding tax obligations related to real estate transactions. Compliance with the filing requirements ensures that both buyers and sellers fulfill their tax responsibilities under Maine law, thereby avoiding potential legal issues or penalties.

Who Issues the Maine REW-1 1040 Form

The Maine REW-1 1040 form is issued by the Maine Revenue Services (MRS). This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The MRS provides resources and guidance on how to complete the form correctly, as well as information on any updates to tax regulations that may affect the withholding process.

Quick guide on how to complete wwwmainegov revenue sitesform rew 1 1040 real estate withholding return mainegov

Easily Prepare Www maine gov Revenue SitesForm REW 1 1040 Real Estate Withholding Return Maine gov on Any Device

Online document management has gained popularity among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and efficiently. Manage Www maine gov Revenue SitesForm REW 1 1040 Real Estate Withholding Return Maine gov on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Simplest Way to Modify and Electronically Sign Www maine gov Revenue SitesForm REW 1 1040 Real Estate Withholding Return Maine gov Effortlessly

- Locate Www maine gov Revenue SitesForm REW 1 1040 Real Estate Withholding Return Maine gov and click Get Form to start.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you select. Modify and electronically sign Www maine gov Revenue SitesForm REW 1 1040 Real Estate Withholding Return Maine gov and guarantee outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwmainegov revenue sitesform rew 1 1040 real estate withholding return mainegov

Create this form in 5 minutes!

How to create an eSignature for the wwwmainegov revenue sitesform rew 1 1040 real estate withholding return mainegov

How to make an e-signature for a PDF file in the online mode

How to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What are Maine REW forms?

Maine REW forms are essential documents used for real estate transactions in Maine. They facilitate the process of submitting and managing property-related paperwork efficiently. Understanding these forms is crucial for anyone involved in real estate activities in the state.

-

How can airSlate SignNow help with Maine REW forms?

airSlate SignNow provides a user-friendly platform that simplifies the signing and management of Maine REW forms. With our eSignature solution, you can securely send and receive these documents from anywhere, ensuring a smooth transaction process. Our tools streamline workflows, saving you time and reducing paperwork hassles.

-

Are there any pricing options for using airSlate SignNow with Maine REW forms?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs when handling Maine REW forms. Whether you're a solo agent or part of a large brokerage, our affordable plans provide the necessary features for document management. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for Maine REW forms?

airSlate SignNow includes features such as customizable templates, document tracking, and in-app collaboration specifically designed for managing Maine REW forms. Our platform also supports secure eSignatures, making it easy to authenticate documents quickly. These features enhance efficiency and ensure compliance with local regulations.

-

Is airSlate SignNow secure for handling Maine REW forms?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption methods to protect your Maine REW forms. Our platform adheres to strict compliance standards, ensuring that all transactions and documents are handled safely and securely. You can trust us to keep your sensitive information safe.

-

Can airSlate SignNow integrate with other real estate tools?

Yes, airSlate SignNow integrates with various real estate management tools to help you manage Maine REW forms seamlessly. This includes CRM systems, listing services, and accounting software. These integrations enhance your workflow and allow for better coordination across your business operations.

-

How quickly can I get started with signing Maine REW forms on airSlate SignNow?

Getting started with airSlate SignNow for Maine REW forms is quick and easy. You can sign up for an account and begin using it within minutes. Our user-friendly interface simplifies the process so that you can upload, send, and sign documents without any technical complications.

Get more for Www maine gov Revenue SitesForm REW 1 1040 Real Estate Withholding Return Maine gov

- Quitclaim deed from individual to corporation new jersey form

- Warranty deed from individual to corporation new jersey form

- Nj lien 497319180 form

- Written request by owner to provide list mechanic liens individual new jersey form

- Quitclaim deed from individual to llc new jersey form

- Warranty deed from individual to llc new jersey form

- New jersey corporation 497319185 form

- Written request by contractor to provide list mechanic liens individual new jersey form

Find out other Www maine gov Revenue SitesForm REW 1 1040 Real Estate Withholding Return Maine gov

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile