Maine Revenue Services Forms Real Estate Withholding 2020

What is the Maine Revenue Services Real Estate Withholding?

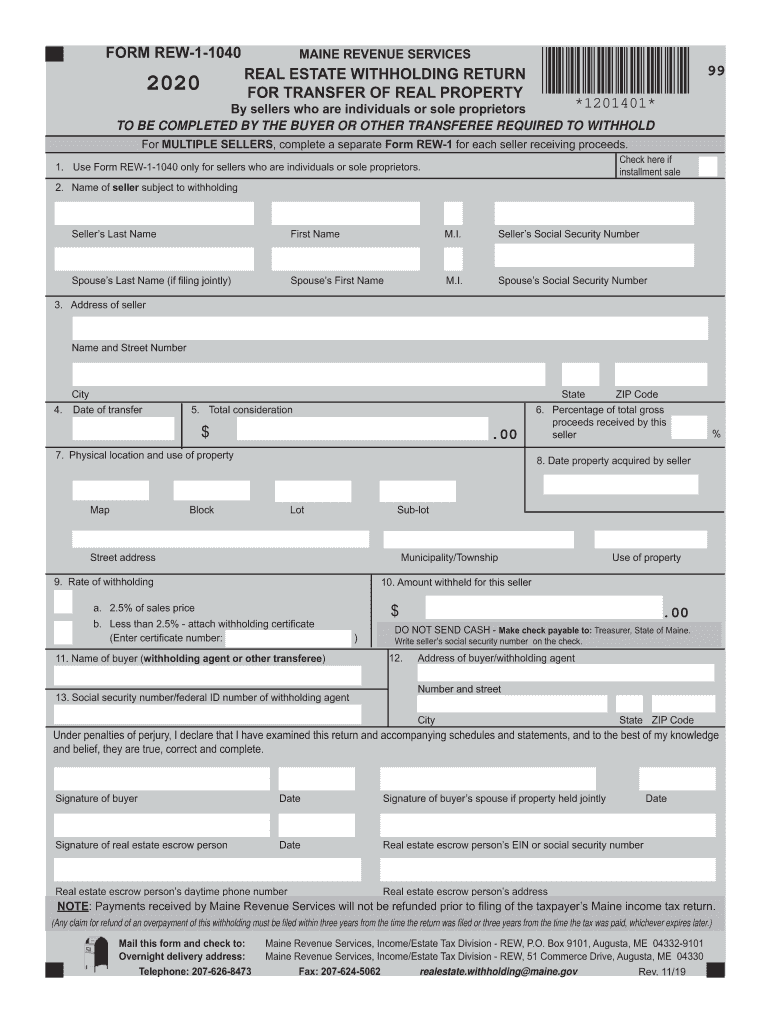

The Maine Revenue Services (MRS) Real Estate Withholding applies to the sale of real property in Maine. This withholding is designed to ensure that taxes owed on the sale are collected at the time of the transaction. The form rew 1 1040 is the official document used to report this withholding, which is required when a non-resident seller disposes of real estate in the state. This form helps the state collect taxes from sellers who may not be subject to Maine's tax jurisdiction after the sale.

Steps to Complete the Maine Revenue Services Real Estate Withholding

Completing the form rew 1 1040 involves several key steps:

- Gather necessary information, including the seller's details, property information, and the sale price.

- Calculate the withholding amount, which is typically a percentage of the sale price.

- Fill out the form rew 1 1040 accurately, ensuring all required fields are completed.

- Sign and date the form, confirming the accuracy of the information provided.

- Submit the form to the Maine Revenue Services, either electronically or by mail, along with any required payment.

Legal Use of the Maine Revenue Services Real Estate Withholding

The form rew 1 1040 is legally binding when completed and submitted according to Maine law. It serves as a declaration of the withholding amount and ensures compliance with state tax regulations. Proper use of this form protects both the seller and the buyer from potential tax liabilities. It is essential to understand that failure to file this form can result in penalties and interest charges.

Filing Deadlines / Important Dates

Timely submission of the form rew 1 1040 is crucial. The form must be filed at the time of the real estate transaction, typically on the closing date. Any delays in filing can lead to penalties. Additionally, it is important to be aware of any specific deadlines set by the Maine Revenue Services for the payment of withheld taxes, which may vary based on the transaction date.

Required Documents

To complete the form rew 1 1040, certain documents are necessary:

- Proof of the sale agreement or contract for the real estate transaction.

- Identification details of the seller, including tax identification numbers.

- Documentation of the sale price and any adjustments made during the transaction.

Form Submission Methods

The form rew 1 1040 can be submitted in various ways to accommodate different preferences:

- Online: Many users prefer to file electronically through the Maine Revenue Services website.

- Mail: The form can be printed and sent via postal service to the designated office.

- In-Person: Individuals may also choose to submit the form directly at a Maine Revenue Services office.

Quick guide on how to complete maine revenue services forms real estate withholding

Easily Prepare Maine Revenue Services Forms Real Estate Withholding on Any Device

Digital document management has become widely embraced by businesses and individuals alike. It serves as a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any delays. Manage Maine Revenue Services Forms Real Estate Withholding on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Maine Revenue Services Forms Real Estate Withholding Effortlessly

- Find Maine Revenue Services Forms Real Estate Withholding and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Maine Revenue Services Forms Real Estate Withholding to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine revenue services forms real estate withholding

Create this form in 5 minutes!

How to create an eSignature for the maine revenue services forms real estate withholding

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the form rew 1 1040 Maine revenue?

The form rew 1 1040 Maine revenue is a state tax form used for reporting income tax in Maine. It is essential for residents to complete this form accurately to ensure compliance with state tax regulations. Understanding this form helps in maximizing your tax benefits and avoiding penalties.

-

How can airSlate SignNow help with the form rew 1 1040 Maine revenue?

airSlate SignNow offers a seamless way to electronically sign and send the form rew 1 1040 Maine revenue. With its user-friendly interface, businesses can efficiently manage their tax documentation, ensuring timely submission and minimizing errors. This solution streamlines the entire signing process, making it easier for users.

-

Is there a cost associated with using airSlate SignNow for the form rew 1 1040 Maine revenue?

Yes, airSlate SignNow has flexible pricing plans tailored to different business needs. Depending on the features you require, you can choose from various subscription levels, ensuring cost-effectiveness while managing the form rew 1 1040 Maine revenue. This allows you to find a plan that suits your budget and requirements.

-

What features does airSlate SignNow provide for handling tax forms?

airSlate SignNow includes features such as customizable templates, document tracking, and secure cloud storage. These tools are especially beneficial for handling the form rew 1 1040 Maine revenue, enabling users to manage their tax documents efficiently. Users can also collaborate easily with legal and accounting teams through the platform.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow allows integration with various software platforms, enhancing your workflow for managing the form rew 1 1040 Maine revenue. This integration capability ensures that you can connect with accounting and tax preparation tools, improving overall efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for eSigning tax forms?

Using airSlate SignNow for eSigning tax forms like the form rew 1 1040 Maine revenue saves time and reduces paperwork. It ensures that your documents are signed securely and can be tracked every step of the way. This reliability is crucial during tax season, allowing users to focus on their financial strategies.

-

Is airSlate SignNow user-friendly for those new to eSigning tax documents?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for individuals unfamiliar with eSigning. Even if you are new to electronic documentation, the platform guides you through submitting the form rew 1 1040 Maine revenue step-by-step. Comprehensive customer support is also available to assist with any inquiries.

Get more for Maine Revenue Services Forms Real Estate Withholding

- Restraining order and 497430839 form

- Temporary restraining order 497430840 form

- Vulnerable adult form

- Domestic abuse 497430842 form

- Possession penalties form

- Petition return form

- Order to sheriff for firearms record check response of sheriff wisconsin form

- Order concerning return of firearms wisconsin form

Find out other Maine Revenue Services Forms Real Estate Withholding

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document