Real Estate Withholding Return for Transfer of Real Property 99 2014

What is the Real Estate Withholding Return For Transfer Of Real Property 99

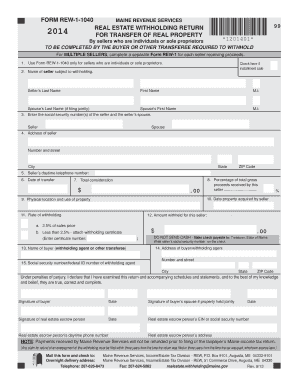

The Real Estate Withholding Return for Transfer of Real Property 99 is a tax form used in the United States, specifically for reporting the sale of real estate by a non-resident seller. This form is essential for ensuring that the appropriate taxes are withheld from the proceeds of the sale, thereby complying with state tax laws. It is primarily utilized by buyers who are responsible for withholding a portion of the sale price to remit to the state tax authority. This process helps to secure tax obligations that may arise from the seller's transaction.

Steps to complete the Real Estate Withholding Return For Transfer Of Real Property 99

Completing the Real Estate Withholding Return for Transfer of Real Property 99 involves several key steps. First, gather all necessary information, including the seller's details, property information, and sale price. Next, accurately fill out the form, ensuring that all fields are completed correctly. Pay special attention to the withholding amount, which is typically based on a percentage of the sale price. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. It is advisable to keep a copy for your records.

How to obtain the Real Estate Withholding Return For Transfer Of Real Property 99

The Real Estate Withholding Return for Transfer of Real Property 99 can be obtained through various channels. Most commonly, it is available on the official state tax authority's website. Additionally, real estate professionals, such as agents and brokers, may provide copies of the form to their clients. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Key elements of the Real Estate Withholding Return For Transfer Of Real Property 99

Several key elements must be included in the Real Estate Withholding Return for Transfer of Real Property 99 to ensure its validity. These elements include the seller's name and address, the buyer's information, property details, and the sale price. Additionally, the form requires the withholding amount, which is calculated based on the sale price. Providing accurate and complete information is crucial to avoid delays or penalties associated with the submission of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Real Estate Withholding Return for Transfer of Real Property 99 are critical to ensure compliance with tax regulations. Generally, the form must be submitted within a specific timeframe after the sale of the property. It is essential to check the state tax authority's guidelines for exact deadlines, as they may vary by state. Missing these deadlines can result in penalties or additional taxes owed, making timely submission a priority for all parties involved in the transaction.

Penalties for Non-Compliance

Failure to comply with the requirements of the Real Estate Withholding Return for Transfer of Real Property 99 can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from tax authorities. It is essential for both buyers and sellers to understand their responsibilities regarding withholding and filing this form to avoid these consequences. Ensuring accurate completion and timely submission can help mitigate the risk of penalties associated with non-compliance.

Quick guide on how to complete real estate withholding return for transfer of real property 99

Easily prepare Real Estate Withholding Return For Transfer Of Real Property 99 on any device

Managing documents online has gained traction among companies and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and safely store it online. airSlate SignNow provides you with all the resources needed to create, alter, and eSign your documents swiftly without delays. Handle Real Estate Withholding Return For Transfer Of Real Property 99 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The most effective way to change and eSign Real Estate Withholding Return For Transfer Of Real Property 99 effortlessly

- Find Real Estate Withholding Return For Transfer Of Real Property 99 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow manages your document needs with just a few clicks from any device you prefer. Modify and eSign Real Estate Withholding Return For Transfer Of Real Property 99 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct real estate withholding return for transfer of real property 99

Create this form in 5 minutes!

How to create an eSignature for the real estate withholding return for transfer of real property 99

How to generate an eSignature for the Real Estate Withholding Return For Transfer Of Real Property 99 in the online mode

How to create an electronic signature for your Real Estate Withholding Return For Transfer Of Real Property 99 in Chrome

How to create an eSignature for putting it on the Real Estate Withholding Return For Transfer Of Real Property 99 in Gmail

How to make an electronic signature for the Real Estate Withholding Return For Transfer Of Real Property 99 from your mobile device

How to make an eSignature for the Real Estate Withholding Return For Transfer Of Real Property 99 on iOS devices

How to make an eSignature for the Real Estate Withholding Return For Transfer Of Real Property 99 on Android OS

People also ask

-

What is the Real Estate Withholding Return For Transfer Of Real Property 99?

The Real Estate Withholding Return For Transfer Of Real Property 99 is a form required by certain states when real property is sold or transferred. This document ensures that applicable withholding taxes are paid on the sale, and it provides crucial information to streamline the transaction process. Understanding this form is essential for sellers in real estate transactions.

-

How does airSlate SignNow simplify the submission of the Real Estate Withholding Return For Transfer Of Real Property 99?

airSlate SignNow offers an intuitive eSignature platform that allows users to fill out and sign the Real Estate Withholding Return For Transfer Of Real Property 99 electronically. This eliminates the need for physical paperwork, streamlining the submission process. Users can track document statuses in real time, enhancing efficiency.

-

Are there any costs associated with using airSlate SignNow for the Real Estate Withholding Return For Transfer Of Real Property 99?

Yes, airSlate SignNow operates on a subscription-based model with various pricing tiers. Our plans are designed to suit different business needs, ensuring cost-effective solutions for managing the Real Estate Withholding Return For Transfer Of Real Property 99. Each plan offers access to essential features that simplify document management and eSigning.

-

What features does airSlate SignNow offer for managing the Real Estate Withholding Return For Transfer Of Real Property 99?

airSlate SignNow provides a robust set of features including template creation, automated workflows, and secure document storage. These features help users efficiently handle the Real Estate Withholding Return For Transfer Of Real Property 99. Additionally, advanced options such as bulk sending or reminders enhance productivity.

-

Can airSlate SignNow integrate with other real estate software when handling the Real Estate Withholding Return For Transfer Of Real Property 99?

Absolutely! airSlate SignNow seamlessly integrates with various real estate software applications, allowing users to manage the Real Estate Withholding Return For Transfer Of Real Property 99 within their preferred working environment. This interoperability enhances workflow efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for the Real Estate Withholding Return For Transfer Of Real Property 99?

The primary benefits include increased efficiency, reduced paper usage, and improved compliance with state requirements. airSlate SignNow simplifies the completion and submission of the Real Estate Withholding Return For Transfer Of Real Property 99, while also providing secure storage for all documents involved in the transaction.

-

Is airSlate SignNow secure for processing the Real Estate Withholding Return For Transfer Of Real Property 99?

Yes, airSlate SignNow prioritizes security and employs industry-standard encryption to protect your documents. All transactions involving the Real Estate Withholding Return For Transfer Of Real Property 99 are secure and compliant with relevant regulations. Users can trust that their sensitive information is safeguarded.

Get more for Real Estate Withholding Return For Transfer Of Real Property 99

Find out other Real Estate Withholding Return For Transfer Of Real Property 99

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT