I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1 2022

What is the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1

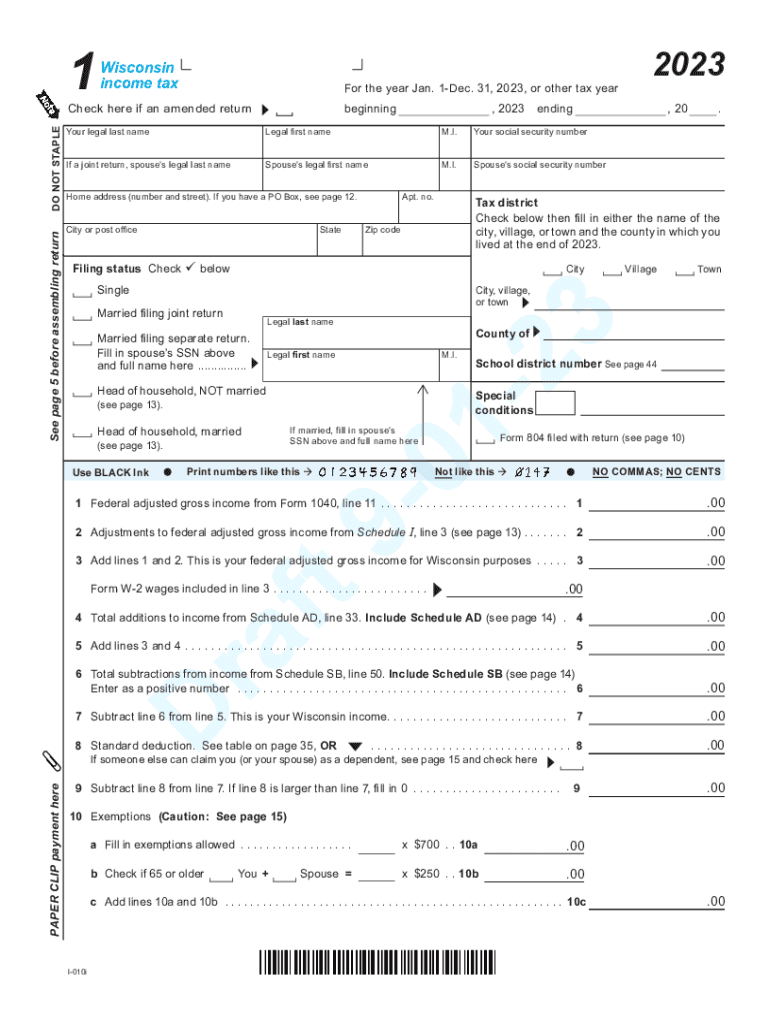

The I 010 Form 1 is the official Wisconsin income tax form used by residents to report their income and calculate their tax liability for the state. This form is essential for individuals who earn income in Wisconsin, as it helps determine the amount of state tax owed or the refund due after filing. The form includes sections for reporting various types of income, deductions, and credits that may apply to the taxpayer's situation.

How to use the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1

To effectively use the I 010 Form 1, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. The form is divided into sections that guide users through reporting their income, claiming deductions, and calculating tax credits. It is important to follow the instructions carefully to ensure accurate reporting. Taxpayers can complete the form by hand or use digital platforms that support electronic filing.

Steps to complete the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1

Completing the I 010 Form 1 involves several steps:

- Gather all required documents, such as income statements and previous tax returns.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Claim applicable deductions and tax credits to reduce taxable income.

- Calculate the total tax owed or refund due based on the provided information.

- Review the completed form for accuracy before submission.

How to obtain the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1

The I 010 Form 1 can be obtained through several means. Taxpayers can download the form directly from the Wisconsin Department of Revenue website or request a physical copy by contacting their local tax office. Additionally, many tax preparation software programs include the form, allowing users to fill it out electronically and file their taxes online.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the I 010 Form 1. Typically, the deadline for submitting the form is April 15 of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also keep in mind any extensions that may apply, as well as the importance of timely filing to avoid penalties.

Required Documents

When completing the I 010 Form 1, taxpayers need to gather specific documents to ensure accurate reporting. Required documents typically include:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Quick guide on how to complete i 010 form 1 wisconsin income tax wisconsin income tax form 1

Complete I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1 with ease

- Locate I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click on the Done button to save your modifications.

- Choose how you would like to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1 and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct i 010 form 1 wisconsin income tax wisconsin income tax form 1

Create this form in 5 minutes!

How to create an eSignature for the i 010 form 1 wisconsin income tax wisconsin income tax form 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1?

The I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1 is the primary form used by Wisconsin residents to file their state income taxes. It allows taxpayers to report their income, claim deductions, and calculate their tax liability. airSlate SignNow simplifies the signing and submission of this form, ensuring an efficient and secure e-signature process.

-

How can airSlate SignNow help with the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1?

airSlate SignNow provides an intuitive platform for completing and eSigning the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1. Users can easily upload the form, fill it out digitally, and send it for signatures. This streamlines the filing process, saving time and reducing the likelihood of errors.

-

Is there a cost associated with using airSlate SignNow for the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1?

Yes, airSlate SignNow offers several pricing plans tailored to different user needs. While there is a cost for accessing the features, the investment is justified by the efficiency and time savings for handling the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1. Consider a plan that fits your requirements to maximize your experience.

-

Can I integrate airSlate SignNow with other software for filing my I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage your finances. By incorporating these tools, you can simplify the process of preparing and signing your I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1 without switching between multiple applications.

-

What features does airSlate SignNow offer for the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1?

airSlate SignNow includes features such as document templates, in-person signing, and status tracking to enhance the management of the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1. Users can create custom workflows, set reminders for deadlines, and keep track of who has signed the document. These features help ensure a smooth and compliant filing process.

-

How secure is airSlate SignNow when using the I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1?

Security is a priority for airSlate SignNow. The platform uses industry-leading encryption and complies with data protection regulations to ensure the safe handling of your I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1. You can trust that your sensitive information will be kept private and secure throughout the eSigning process.

-

What benefits can I expect when using airSlate SignNow for my tax filings?

Using airSlate SignNow for your I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1 offers numerous benefits, including faster processing times and reduced paperwork. The platform allows you to collaborate with multiple parties easily, helping to ensure that everything is completed correctly. Plus, the ease of use means less time spent on administrative tasks.

Get more for I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1

- Report on compaction density by nuclear methodtr42 form

- Penndot fleet registration supplemental application form

- Ga single trip permit form

- Complete this form if you wish for the department of driver services dds to review a driver s ability to drive safely dds ga

- Www cameronpark orgcameron park community services district form

- Dog license information for

- Tabulation form city of berkeley

- Demolition permit release form

Find out other I 010 Form 1 Wisconsin Income Tax Wisconsin Income Tax Form 1

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document