Fiduciary Tax Department of Revenue Kentucky Gov 2021

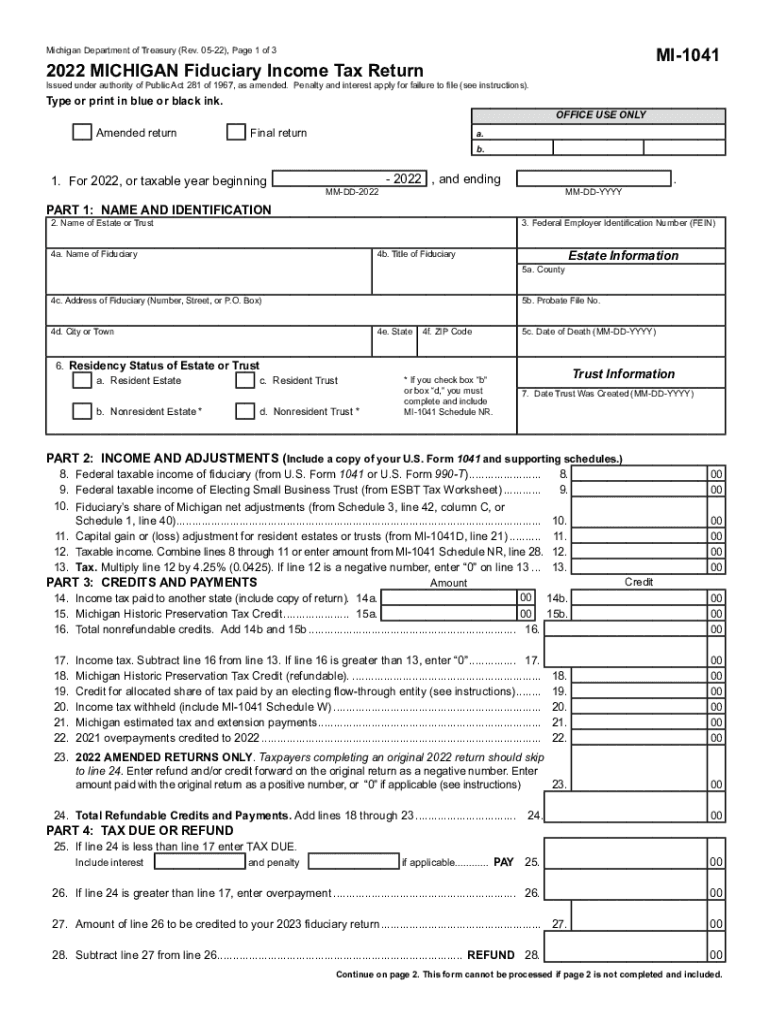

What is the Michigan MI 1041 Tax?

The Michigan MI 1041 tax is a fiduciary income tax form used for reporting income earned by estates and trusts in the state of Michigan. This form is essential for fiduciaries who manage the financial affairs of estates or trusts, ensuring that all income generated is reported accurately to the Michigan Department of Treasury. The tax applies to the income that exceeds the federal exemption amount, and it is crucial for compliance with state tax laws.

Steps to Complete the Michigan MI 1041 Tax Form

Filling out the Michigan MI 1041 tax form involves several key steps:

- Gather necessary documentation, including income statements, deductions, and any relevant financial records.

- Begin filling out the form with the estate or trust's identifying information, including the name, address, and tax identification number.

- Report all sources of income, including dividends, interest, and rental income, in the appropriate sections of the form.

- Calculate allowable deductions, which may include expenses related to the management of the estate or trust.

- Determine the total taxable income and apply the appropriate tax rate.

- Review the completed form for accuracy before submission.

Required Documents for Filing the Michigan MI 1041 Tax

To successfully file the Michigan MI 1041 tax, certain documents are required:

- Income statements for the estate or trust, including K-1 forms if applicable.

- Records of any deductions claimed, such as administrative expenses or charitable contributions.

- Previous tax returns for the estate or trust, if available.

- Any supporting documentation that verifies income or deductions.

Filing Deadlines for the Michigan MI 1041 Tax

Filing deadlines for the Michigan MI 1041 tax form are typically aligned with federal tax deadlines. Generally, the form must be submitted by the 15th day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this usually means the deadline is April 15. It is important to be aware of any potential extensions or specific circumstances that may affect the deadline.

Form Submission Methods for the Michigan MI 1041 Tax

The Michigan MI 1041 tax form can be submitted through various methods:

- Online: Filing electronically through the Michigan Department of Treasury's e-filing system is a convenient option.

- Mail: Completed forms can be printed and mailed to the designated address provided by the Michigan Department of Treasury.

- In-Person: Taxpayers may also choose to submit their forms in person at local tax offices, ensuring they receive immediate confirmation of submission.

Penalties for Non-Compliance with the Michigan MI 1041 Tax

Failure to comply with the Michigan MI 1041 tax requirements can result in various penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for willful neglect. It is essential for fiduciaries to ensure timely and accurate filing to avoid these consequences and maintain compliance with state tax regulations.

Quick guide on how to complete fiduciary tax department of revenue kentucky gov

Complete Fiduciary Tax Department Of Revenue Kentucky gov effortlessly on any device

Digital document management has gained signNow popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Fiduciary Tax Department Of Revenue Kentucky gov on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Fiduciary Tax Department Of Revenue Kentucky gov with ease

- Locate Fiduciary Tax Department Of Revenue Kentucky gov and click Get Form to initiate the process.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign Fiduciary Tax Department Of Revenue Kentucky gov to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiduciary tax department of revenue kentucky gov

Create this form in 5 minutes!

How to create an eSignature for the fiduciary tax department of revenue kentucky gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan MI 1041 tax form used for?

The Michigan MI 1041 tax form is utilized by estates and trusts to report income and calculate taxes owed in the state of Michigan. This form is essential for ensuring compliance with state tax laws and helps in accurately reflecting the financial activities of an estate or trust.

-

How can airSlate SignNow help me with my Michigan MI 1041 tax documents?

airSlate SignNow provides an efficient platform for sending and eSigning your Michigan MI 1041 tax documents, making the process faster and more secure. With our user-friendly interface, you can easily manage and track your tax-related paperwork, ensuring that you meet all deadlines effectively.

-

Is there a cost associated with using airSlate SignNow for Michigan MI 1041 tax filings?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including features tailored for managing Michigan MI 1041 tax filings. Choose a plan that suits your needs, and enjoy a cost-effective solution to streamline your document management and signing processes.

-

What features does airSlate SignNow offer for Michigan MI 1041 tax form management?

airSlate SignNow includes features such as document templates, customizable workflows, and secure eSignature options that facilitate the handling of Michigan MI 1041 tax forms. These tools help ensure that your documents are completed accurately and in compliance with state regulations.

-

Can I integrate airSlate SignNow with my accounting software for Michigan MI 1041 tax?

Absolutely! airSlate SignNow allows seamless integration with popular accounting software, enhancing your ability to manage Michigan MI 1041 tax documents alongside your financial records. This integration simplifies data flow and helps maintain accuracy in your tax filings.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Michigan MI 1041 tax, offers signNow benefits such as improved collaboration, reduced paper usage, and enhanced security. Our platform allows you to track document status and reminders, making tax filing stress-free.

-

How secure is airSlate SignNow when handling Michigan MI 1041 tax documents?

airSlate SignNow prioritizes security, utilizing encryption and secure access controls to protect your Michigan MI 1041 tax documents. With our adherence to compliance standards, you can trust that your sensitive information is safe while using our platform.

Get more for Fiduciary Tax Department Of Revenue Kentucky gov

- Candidate information form doc

- Unit custom camp t shirt order form atlanta area council atlantabsa

- Flash furniture credit application 12 doc form

- 19th annual bridal fair gainesville civic center gainesville ga gainesville form

- Scholarship application template mailchimp form

- Swimming lesson registration form

- Parents or guardians notice of no liability insura form

- Request to transfer form bniatl com

Find out other Fiduciary Tax Department Of Revenue Kentucky gov

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement