Michigan Fiduciary Income Tax Return Michigan Fiduciary Income Tax Return 2020

What is the Michigan Fiduciary Income Tax Return?

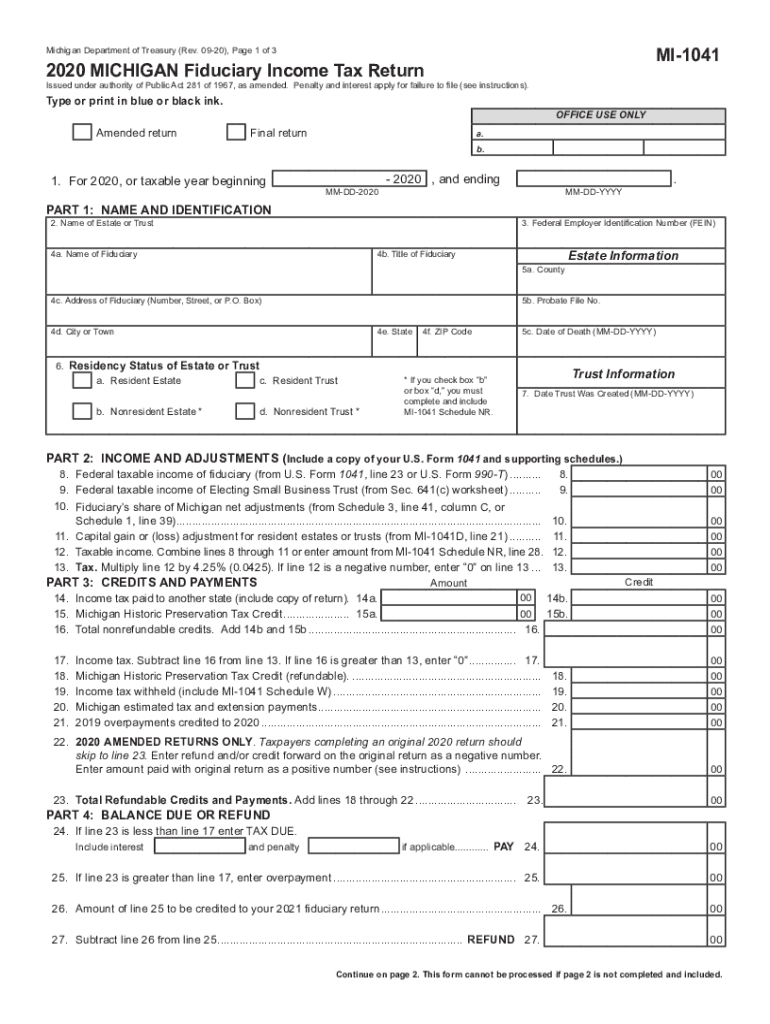

The Michigan Fiduciary Income Tax Return, known as the MI 1041, is a tax form used by estates and trusts in Michigan to report income generated during the tax year. This form is essential for fiduciaries responsible for managing the financial affairs of an estate or trust. It captures various types of income, deductions, and credits applicable to the estate or trust, ensuring compliance with state tax laws. By accurately completing the MI 1041, fiduciaries can fulfill their legal obligations while ensuring that income is taxed appropriately.

Steps to Complete the Michigan Fiduciary Income Tax Return

Completing the MI 1041 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements, deduction records, and any relevant schedules. Next, fill out the form by reporting all income received by the estate or trust, such as interest, dividends, and rental income. Deduct allowable expenses, including administrative costs and distributions to beneficiaries. After completing the form, review it thoroughly for accuracy, and ensure all required signatures are present. Finally, submit the MI 1041 by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the MI 1041 are crucial for compliance. Generally, the return is due on the 15th day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, the deadline is April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Fiduciaries should also be aware of any extensions available, which can provide additional time to file the return, though any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents for the Michigan Fiduciary Income Tax Return

To complete the MI 1041 accurately, several documents are required. These include income statements such as Form 1099 for interest and dividends, records of rental income, and documentation of any deductions claimed. Additionally, fiduciaries should gather information on distributions made to beneficiaries, as these can affect the taxable income of the estate or trust. Keeping organized records will facilitate the completion of the MI 1041 and ensure compliance with state tax regulations.

Legal Use of the Michigan Fiduciary Income Tax Return

The MI 1041 serves a critical legal function in the administration of estates and trusts. It ensures that fiduciaries report income accurately and pay the appropriate taxes on behalf of the estate or trust. By filing this return, fiduciaries fulfill their legal obligations, protecting themselves from potential legal repercussions associated with non-compliance. Understanding the legal implications of the MI 1041 is essential for fiduciaries to manage their responsibilities effectively.

Key Elements of the Michigan Fiduciary Income Tax Return

Key elements of the MI 1041 include sections for reporting various types of income, deductions, and credits. The form requires fiduciaries to provide detailed information about the estate or trust, including its name, address, and tax identification number. Additionally, fiduciaries must report distributions made to beneficiaries, as these can impact the overall tax liability. Understanding these key elements is vital for completing the form accurately and ensuring compliance with Michigan tax laws.

Quick guide on how to complete 2020 michigan fiduciary income tax return 2020 michigan fiduciary income tax return

Effortlessly Prepare Michigan Fiduciary Income Tax Return Michigan Fiduciary Income Tax Return on Any Device

Web-based document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, update, and electronically sign your files quickly and without holdups. Manage Michigan Fiduciary Income Tax Return Michigan Fiduciary Income Tax Return on any device with the airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

The easiest method to modify and electronically sign Michigan Fiduciary Income Tax Return Michigan Fiduciary Income Tax Return effortlessly

- Find Michigan Fiduciary Income Tax Return Michigan Fiduciary Income Tax Return and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or conceal sensitive information with tools specifically available for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes that require printing new versions. airSlate SignNow addresses your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Michigan Fiduciary Income Tax Return Michigan Fiduciary Income Tax Return while ensuring clear communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 michigan fiduciary income tax return 2020 michigan fiduciary income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 michigan fiduciary income tax return 2020 michigan fiduciary income tax return

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the mi 1041 form and who needs to file it?

The mi 1041 form is a Michigan tax return form for estates and trusts. If you are managing an estate or trust in Michigan with income over a certain threshold, you are required to file the mi 1041. This form helps ensure compliance with state tax laws while accurately reporting income received by the estate or trust.

-

How can airSlate SignNow help with the mi 1041 filing process?

airSlate SignNow provides a seamless solution for managing the documentation associated with the mi 1041 filing. With easy-to-use eSigning features, you can gather necessary signatures and ensure that all documents are organized and accessible online, streamlining the filing process signNowly.

-

What are the pricing options for airSlate SignNow related to mi 1041 documents?

airSlate SignNow offers a range of pricing plans that accommodate businesses of all sizes looking to manage mi 1041 filings efficiently. Plans typically include a free trial and various tiers that provide additional features, such as unlimited templates and advanced integrations, to suit varying needs.

-

What features does airSlate SignNow provide for effective mi 1041 document management?

With airSlate SignNow, users can leverage features such as customizable templates, secure cloud storage, and automated reminders to manage mi 1041 documents effectively. The platform is designed to facilitate collaboration among team members, ensuring that all related documentation is processed swiftly.

-

How does airSlate SignNow ensure the security of mi 1041 documents?

Security is paramount when dealing with sensitive documents like the mi 1041. airSlate SignNow employs advanced encryption methods and strict compliance measures to protect your documents, giving you peace of mind that your data is secure during the signing and storage process.

-

Can I integrate airSlate SignNow with other accounting software for mi 1041 filings?

Yes, airSlate SignNow offers various integrations with popular accounting software, making it easier to manage the financial aspects of your mi 1041 filings. This integration helps streamline data transfer and ensures all necessary information is accurately reflected in your documents.

-

What benefits can I gain from using airSlate SignNow for mi 1041 compliance?

Using airSlate SignNow for mi 1041 compliance can signNowly enhance your operational efficiency. The platform reduces paperwork, saves time with easy eSignatures, and provides a reliable way to store and retrieve critical documents, allowing you to focus on other essential tasks.

Get more for Michigan Fiduciary Income Tax Return Michigan Fiduciary Income Tax Return

Find out other Michigan Fiduciary Income Tax Return Michigan Fiduciary Income Tax Return

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter