Form 1041 for Michigan No Download Needed 2017

What is the 2017 MI 1041?

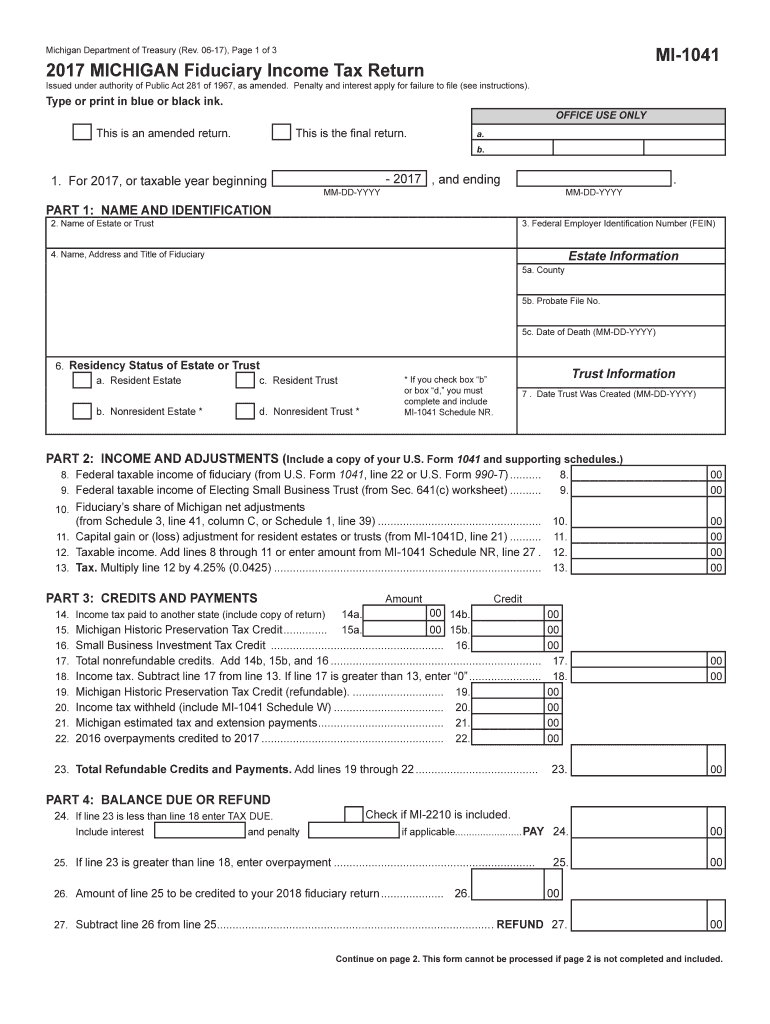

The 2017 MI 1041 is the Michigan fiduciary income tax return form used by estates and trusts to report income and calculate tax liabilities. This form is essential for fiduciaries managing estates or trusts that generate income during the tax year. It allows for the proper reporting of income, deductions, and credits applicable to the estate or trust, ensuring compliance with state tax regulations. The form also includes sections for detailing distributions made to beneficiaries, which can impact the tax responsibilities of both the fiduciary and the beneficiaries.

Steps to Complete the 2017 MI 1041

Completing the 2017 MI 1041 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, expense records, and details of distributions made to beneficiaries. Next, fill out the form with the required information, including the estate or trust's name, address, and taxpayer identification number. Carefully report all income earned, deductions claimed, and any applicable credits. After completing the form, review it thoroughly for any errors or omissions before signing and dating it. Finally, choose your submission method, whether online or via mail, to ensure timely filing.

Legal Use of the 2017 MI 1041

The legal use of the 2017 MI 1041 is crucial for fiduciaries to fulfill their tax obligations under Michigan law. This form must be filed by the due date to avoid penalties and interest on unpaid taxes. It is designed to ensure that all income generated by the estate or trust is reported accurately and that any tax due is calculated correctly. Fiduciaries must adhere to the specific instructions provided for the MI 1041 to maintain compliance with state tax laws and regulations. Failure to file or inaccuracies in the form can lead to legal repercussions, including audits and fines.

Filing Deadlines / Important Dates

Filing the 2017 MI 1041 must be completed by the due date to avoid penalties. Typically, the form is due on the same date as the federal Form 1041, which is the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the filing deadline is April 15 of the following year. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential for fiduciaries to mark these dates on their calendars to ensure timely submission.

Form Submission Methods

The 2017 MI 1041 can be submitted through various methods to accommodate different preferences. Fiduciaries have the option to file the form electronically using approved e-filing services, which can streamline the process and provide immediate confirmation of submission. Alternatively, the form can be printed and mailed to the appropriate Michigan Department of Treasury address. When mailing, it is advisable to use certified mail or a reliable courier service to ensure the form is received by the deadline. In-person submission is also an option at designated state offices, providing another avenue for timely filing.

Key Elements of the 2017 MI 1041

The 2017 MI 1041 includes several key elements that are critical for accurate reporting. These elements consist of income sections where fiduciaries report various types of income, including interest, dividends, and capital gains. The form also features sections for deductions, such as expenses related to the administration of the estate or trust. Additionally, fiduciaries must provide details about distributions made to beneficiaries, as these can affect both the fiduciary's and the beneficiaries' tax liabilities. Understanding these key components is essential for ensuring compliance and accurate tax reporting.

Quick guide on how to complete 2015 michigan schedule 1 2017 2019 form

Your assistance manual on how to prepare your Form 1041 For Michigan No Download Needed

If you’re curious about how to finalize and submit your Form 1041 For Michigan No Download Needed, here are several concise instructions on how to simplify tax processing.

To start, you just need to create your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document management tool that enables you to adjust, generate, and finalize your income tax files effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and revert to modify details as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Complete the following steps to achieve your Form 1041 For Michigan No Download Needed in just a few minutes:

- Create your account and start working on PDFs right away.

- Utilize our directory to find any IRS tax document; sift through various versions and schedules.

- Click Obtain document to access your Form 1041 For Michigan No Download Needed in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to add your legally-recognized eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save the modifications, print your copy, send it to your intended recipient, and download it to your device.

Utilize this manual to electronically submit your taxes using airSlate SignNow. Please be aware that submitting on paper may increase return mistakes and delay reimbursements. It’s important to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct 2015 michigan schedule 1 2017 2019 form

FAQs

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How can I get my registration ID, which I forgot to note down after filling part 1 of the SSC JEE 2015 form?

If you have successfully registered for cgl then you must be able to download your admit card using your name and date of birth. So I suppose there should not be any problem. Even if you want your registration Id then I suggest you to contact a fb group admin ( group name is ssc naukari, as I recall ) there you can get help from them. Best of luck.

Create this form in 5 minutes!

How to create an eSignature for the 2015 michigan schedule 1 2017 2019 form

How to make an eSignature for the 2015 Michigan Schedule 1 2017 2019 Form in the online mode

How to generate an electronic signature for your 2015 Michigan Schedule 1 2017 2019 Form in Google Chrome

How to generate an eSignature for putting it on the 2015 Michigan Schedule 1 2017 2019 Form in Gmail

How to generate an electronic signature for the 2015 Michigan Schedule 1 2017 2019 Form right from your mobile device

How to generate an electronic signature for the 2015 Michigan Schedule 1 2017 2019 Form on iOS

How to generate an eSignature for the 2015 Michigan Schedule 1 2017 2019 Form on Android devices

People also ask

-

What is Form 1041 for Michigan No Download Needed?

Form 1041 for Michigan No Download Needed is a digital solution that allows you to file the Michigan income tax return for estates and trusts without the hassle of paper forms. This service simplifies the filing process and ensures compliance with state regulations, all while being easily accessible online.

-

How does airSlate SignNow help with Form 1041 for Michigan No Download Needed?

airSlate SignNow streamlines the process of completing Form 1041 for Michigan No Download Needed by providing an intuitive interface for filling out and signing documents. Users can easily navigate through the form, ensuring all necessary information is included, which reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for Form 1041 for Michigan No Download Needed?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. The pricing includes access to Form 1041 for Michigan No Download Needed, along with additional features that enhance document management and e-signing capabilities.

-

What features are included in the Form 1041 for Michigan No Download Needed service?

The Form 1041 for Michigan No Download Needed service includes features like easy e-signing, document templates, and real-time collaboration tools. These features ensure that you can complete your tax filings efficiently and securely, making the process much simpler.

-

Can I integrate airSlate SignNow with other software for Form 1041 for Michigan No Download Needed?

Absolutely! airSlate SignNow supports integrations with various software platforms, allowing you to streamline your workflow. Whether you use accounting software or document management systems, you can incorporate Form 1041 for Michigan No Download Needed into your existing processes seamlessly.

-

How secure is my information when using Form 1041 for Michigan No Download Needed?

Security is a top priority for airSlate SignNow. When using Form 1041 for Michigan No Download Needed, your data is protected with advanced encryption and secure servers, ensuring your sensitive information remains confidential and safe from unauthorized access.

-

Can I access Form 1041 for Michigan No Download Needed from any device?

Yes, Form 1041 for Michigan No Download Needed is designed to be accessible from any device with an internet connection. This flexibility allows you to complete your tax filings on-the-go, whether you're using a desktop, tablet, or smartphone.

Get more for Form 1041 For Michigan No Download Needed

Find out other Form 1041 For Michigan No Download Needed

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile