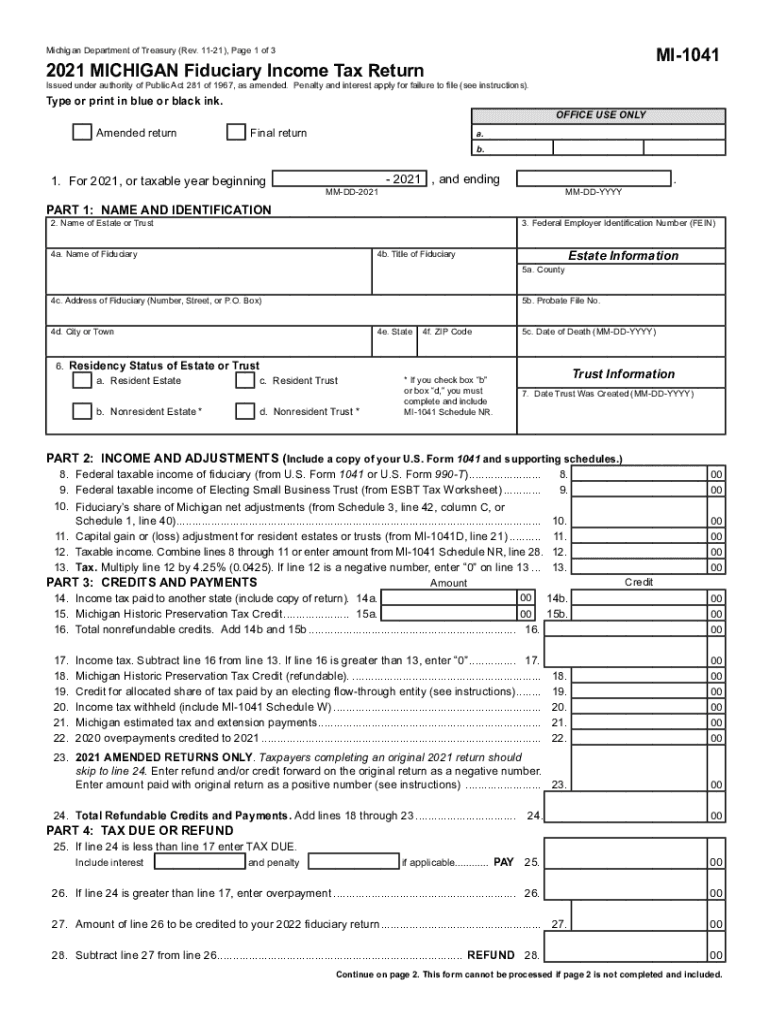

TREASURY Revenue Administrative Bulletin 1989 10 Michigan 2021

What is the Treasury Revenue Administrative Bulletin 1989-10 Michigan?

The Treasury Revenue Administrative Bulletin 1989-10 provides guidance on the application of Michigan's income tax laws, particularly regarding the treatment of certain income types and deductions. This bulletin clarifies how specific tax provisions should be interpreted and applied, ensuring compliance with state regulations. It serves as an essential resource for taxpayers and tax professionals navigating Michigan's tax landscape.

Key elements of the Treasury Revenue Administrative Bulletin 1989-10 Michigan

This bulletin outlines several key elements that are crucial for understanding Michigan's income tax regulations. It includes:

- Definitions: Clear definitions of terms used within the tax code.

- Income Types: Specific types of income that are subject to taxation.

- Deductions: Guidelines on allowable deductions to reduce taxable income.

- Compliance: Requirements for maintaining compliance with state tax laws.

Steps to complete the Treasury Revenue Administrative Bulletin 1989-10 Michigan

Completing the requirements outlined in the Treasury Revenue Administrative Bulletin 1989-10 involves several steps:

- Review the bulletin to understand the applicable tax laws.

- Gather necessary documentation related to income and deductions.

- Calculate taxable income based on the guidelines provided.

- Complete the appropriate tax forms, ensuring all information aligns with the bulletin's instructions.

- Submit the forms by the designated filing deadline.

Filing Deadlines / Important Dates

Taxpayers should be aware of critical filing deadlines to avoid penalties. Generally, Michigan income tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Michigan Department of Treasury's official website for any updates on deadlines or changes in tax law.

Penalties for Non-Compliance

Failure to comply with the guidelines set forth in the Treasury Revenue Administrative Bulletin 1989-10 can result in various penalties. These may include:

- Late Filing Penalties: Fees imposed for submitting tax returns after the deadline.

- Interest Charges: Accumulated interest on unpaid taxes.

- Audits: Increased scrutiny from tax authorities, potentially leading to further penalties.

IRS Guidelines

While the Treasury Revenue Administrative Bulletin focuses on state regulations, it is essential to align with IRS guidelines as well. This includes understanding federal tax laws that may impact state tax filings. Taxpayers should ensure they are compliant with both federal and state requirements to avoid complications.

Quick guide on how to complete treasury revenue administrative bulletin 1989 10 michigan

Effortlessly Prepare TREASURY Revenue Administrative Bulletin 1989 10 Michigan on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage TREASURY Revenue Administrative Bulletin 1989 10 Michigan on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign TREASURY Revenue Administrative Bulletin 1989 10 Michigan effortlessly

- Locate TREASURY Revenue Administrative Bulletin 1989 10 Michigan and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors necessitating reprinted document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your device of choice. Edit and electronically sign TREASURY Revenue Administrative Bulletin 1989 10 Michigan and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct treasury revenue administrative bulletin 1989 10 michigan

Create this form in 5 minutes!

People also ask

-

What is a tax schedule 1 and why is it important?

A tax schedule 1 is a crucial form used by the IRS for reporting individual income and adjustments to income. Understanding this schedule is important for accurately completing your tax return and ensuring compliance with tax laws. With airSlate SignNow, you can eSign your tax documents quickly, making the process smoother and more efficient.

-

How can airSlate SignNow help with managing my tax schedule 1?

AirSlate SignNow allows you to easily eSign and send your tax schedule 1 documents securely online. This solution simplifies the workflow, ensures your documents are legally binding, and gives you instant access to completed forms. By using our platform, you can streamline your tax preparation process and reduce errors.

-

Is there a cost associated with using airSlate SignNow to manage tax schedule 1?

While airSlate SignNow offers various pricing plans, using our platform to manage your tax schedule 1 can save you time and increase productivity. We provide cost-effective solutions that cater to businesses of all sizes. Additionally, the ease of handling tax documents digitally may reduce overall filing costs.

-

What features does airSlate SignNow offer for tax schedule 1 processing?

AirSlate SignNow includes features like document templates, automated workflows, and secure eSigning for tax schedule 1 and other important documents. With our user-friendly interface, users can easily create, edit, and sign tax documents without hassle. This level of functionality helps ensure that your tax submissions are well-organized and compliant.

-

Can I integrate airSlate SignNow with other software for tax schedule 1?

Yes, airSlate SignNow offers integration capabilities with various accounting and tax software to enhance your experience with tax schedule 1. This allows you to sync your documents and streamline your workflow seamlessly. With integration, you can manage documents more efficiently, ensuring you never miss a deadline.

-

How does airSlate SignNow enhance the security of my tax schedule 1 documents?

AirSlate SignNow prioritizes the security of your tax schedule 1 documents through advanced encryption and secure cloud storage. This means your sensitive tax information is always protected from unauthorized access. Our platform also complies with legal standards for eSigning, ensuring your documents maintain their legal validity.

-

Is it easy to invite others to eSign my tax schedule 1 using airSlate SignNow?

Absolutely! AirSlate SignNow makes it easy to invite others to eSign your tax schedule 1 documents. You can simply send a request via email, and the invitees can sign electronically with just a few clicks, streamlining the entire process and saving you time.

Get more for TREASURY Revenue Administrative Bulletin 1989 10 Michigan

- Warranty deed from husband to himself and wife north dakota form

- Quitclaim deed from husband to himself and wife north dakota form

- Quitclaim deed from husband and wife to husband and wife north dakota form

- Warranty deed from husband and wife to husband and wife north dakota form

- North dakota agreement form

- Postnuptial property agreement north dakota north dakota form

- North dakota agreement 497317435 form

- Quitclaim deed from husband and wife to an individual north dakota form

Find out other TREASURY Revenue Administrative Bulletin 1989 10 Michigan

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter