MI 1041 MICHIGAN Fiduciary Income Tax Return 2023

What is the MI 1041 Michigan Fiduciary Income Tax Return

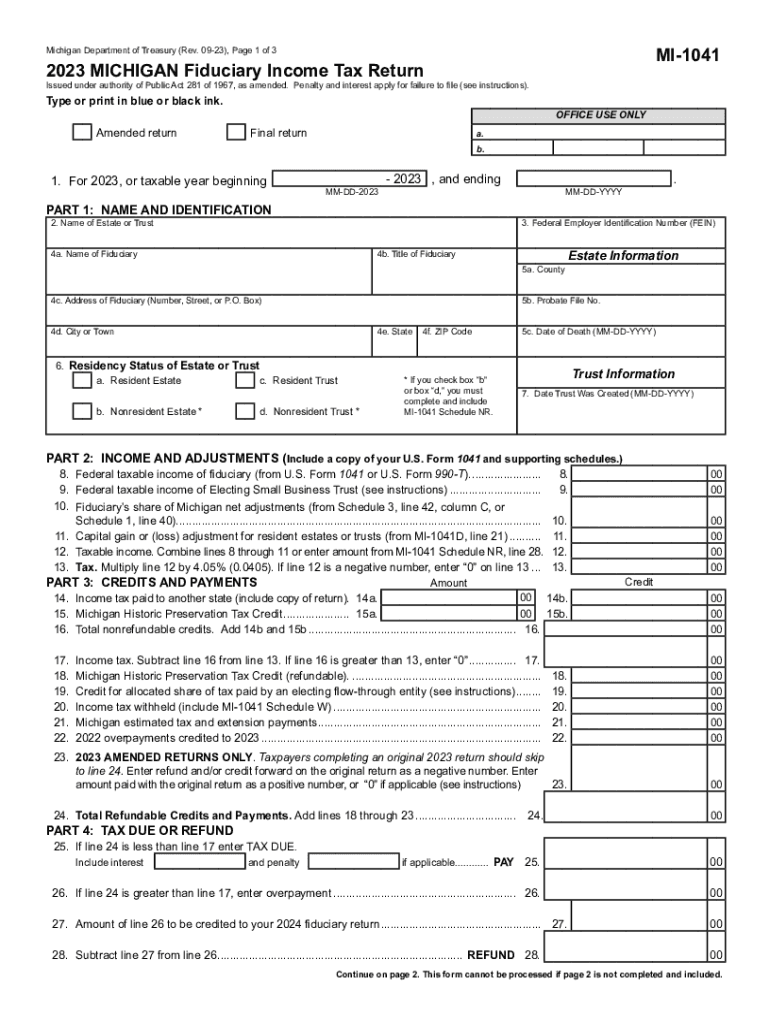

The MI 1041 is the Michigan Fiduciary Income Tax Return, designed for estates and trusts that earn income during the tax year. This form is essential for reporting the income generated by the assets held in the estate or trust. It allows fiduciaries to calculate the tax owed on behalf of the estate or trust, ensuring compliance with Michigan state tax laws. Understanding this form is crucial for managing the tax obligations associated with fiduciary responsibilities.

Steps to complete the MI 1041 Michigan Fiduciary Income Tax Return

Completing the MI 1041 involves several key steps:

- Gather necessary financial documents, including income statements and expense records related to the estate or trust.

- Fill out the MI 1041 form accurately, providing details about income, deductions, and credits applicable to the estate or trust.

- Calculate the total tax owed based on the income reported, utilizing the appropriate tax rates.

- Review the completed form for accuracy before submission to avoid potential penalties.

- Submit the MI 1041 by the designated deadline, either electronically or via mail.

Key elements of the MI 1041 Michigan Fiduciary Income Tax Return

The MI 1041 includes several key elements that must be accurately reported:

- Income: Report all income generated by the estate or trust, including interest, dividends, and capital gains.

- Deductions: Identify and list any allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Tax Credits: Include any applicable tax credits that can reduce the overall tax liability.

- Signature: The fiduciary must sign the return, certifying that the information provided is complete and accurate.

Filing Deadlines / Important Dates

Filing deadlines for the MI 1041 are crucial to avoid penalties. Typically, the return is due on April 15 following the end of the tax year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It's important to stay informed about any changes to these dates, as they can vary from year to year.

Form Submission Methods

The MI 1041 can be submitted through various methods to accommodate different preferences:

- Online: Many fiduciaries choose to file electronically through authorized tax software, which often simplifies the process.

- Mail: The form can also be printed and mailed to the appropriate Michigan Department of Treasury address.

- In-Person: For those who prefer personal interaction, submissions can be made at designated state offices.

Legal use of the MI 1041 Michigan Fiduciary Income Tax Return

The MI 1041 is legally required for estates and trusts that meet specific income thresholds. Filing this form ensures compliance with Michigan tax laws and helps avoid penalties for non-compliance. Fiduciaries must be aware of their legal obligations and ensure that the return is filed accurately and on time to uphold their responsibilities.

Quick guide on how to complete mi 1041 michigan fiduciary income tax return

Effortlessly Prepare MI 1041 MICHIGAN Fiduciary Income Tax Return on Any Device

Managing documents online has gained prominence among businesses and individuals. It offers an excellent environmentally friendly substitute to conventional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle MI 1041 MICHIGAN Fiduciary Income Tax Return on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign MI 1041 MICHIGAN Fiduciary Income Tax Return with Ease

- Find MI 1041 MICHIGAN Fiduciary Income Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign MI 1041 MICHIGAN Fiduciary Income Tax Return and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mi 1041 michigan fiduciary income tax return

Create this form in 5 minutes!

How to create an eSignature for the mi 1041 michigan fiduciary income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mi 1041 2023 form?

The mi 1041 2023 form is a tax document that Michigan businesses use to report income and expenses. Understanding this form is crucial for accurate tax filing and compliance. airSlate SignNow provides a seamless way to complete and eSign the mi 1041 2023 electronically.

-

How can airSlate SignNow help with the mi 1041 2023 filing process?

airSlate SignNow simplifies the filing process for the mi 1041 2023 by allowing users to fill out, sign, and send the document online. This reduces paperwork and enhances efficiency. Plus, you can track the document's progress in real-time.

-

What are the pricing plans for using airSlate SignNow with mi 1041 2023?

airSlate SignNow offers flexible pricing plans that cater to different business needs for handling the mi 1041 2023 form. You can select from individual plans to enterprise solutions. The competitive pricing makes it a cost-effective choice for businesses of all sizes.

-

What features does airSlate SignNow provide for the mi 1041 2023?

Key features of airSlate SignNow include easy document creation, secure eSigning, and customizable templates specifically for the mi 1041 2023. You can also integrate it with popular applications for even more functionality, streamlining the tax filing process.

-

Is airSlate SignNow compliant with tax regulations when using mi 1041 2023?

Yes, airSlate SignNow is compliant with all necessary legal standards, including those required for the mi 1041 2023. This ensures that all eSigned documents are legally binding and meet the highest security measures. You can file with confidence knowing you are within legal guidelines.

-

Can I integrate airSlate SignNow with other accounting software for mi 1041 2023?

Absolutely! airSlate SignNow supports integration with various accounting software, enhancing your ability to manage the mi 1041 2023 seamlessly. This integration allows for easy importing and exporting of data, making your tax preparation much more efficient.

-

What are the benefits of using airSlate SignNow for mi 1041 2023?

Using airSlate SignNow for your mi 1041 2023 filing provides numerous benefits, such as enhanced efficiency, reduced errors through easy document management, and time-saving eSigning features. Additionally, you can maintain a secure audit trail for all your documents.

Get more for MI 1041 MICHIGAN Fiduciary Income Tax Return

Find out other MI 1041 MICHIGAN Fiduciary Income Tax Return

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free