Michigan Fiduciary Income Tax Return 2024-2026

What is the Michigan Fiduciary Income Tax Return

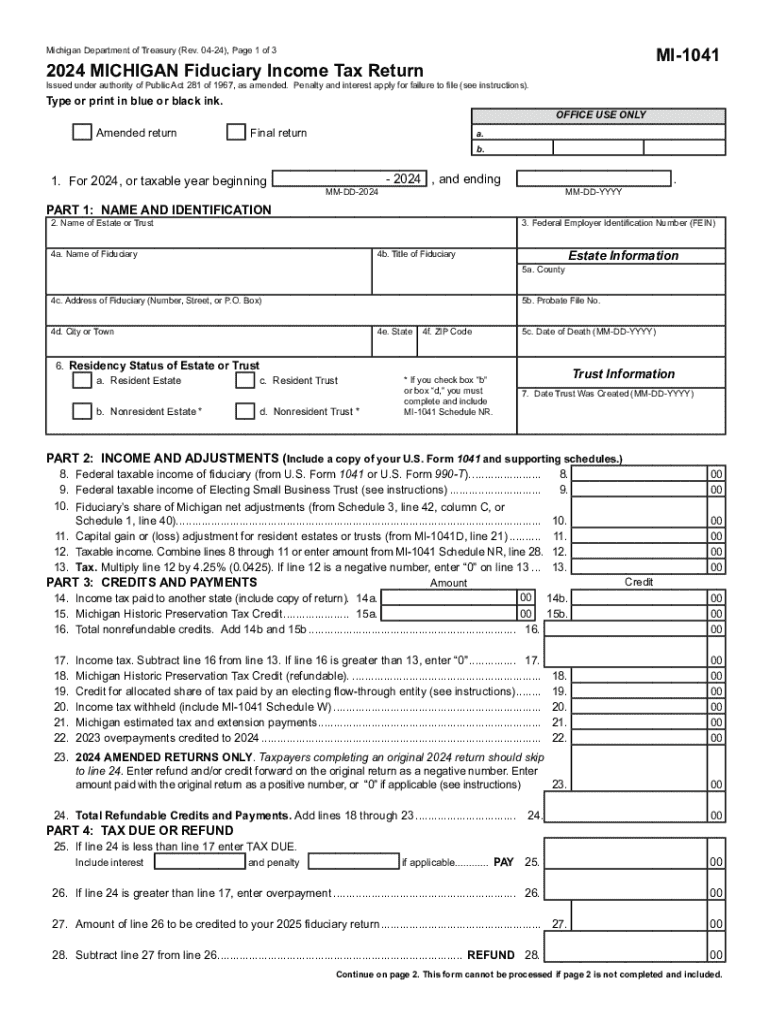

The Michigan Fiduciary Income Tax Return, commonly referred to as the MI 1041, is a tax form used by fiduciaries, such as executors or trustees, to report income received by estates or trusts. This form is essential for ensuring compliance with state tax laws and accurately reporting the income generated from the assets held in the estate or trust. The MI 1041 captures various types of income, deductions, and credits applicable to the estate or trust, allowing fiduciaries to calculate the tax owed to the state of Michigan.

Steps to complete the Michigan Fiduciary Income Tax Return

Completing the MI 1041 involves several key steps:

- Gather necessary documents: Collect all relevant financial statements, including income statements, expense records, and documentation of any deductions.

- Fill out the form: Begin with the basic information section, including the name and address of the estate or trust, and the fiduciary's details.

- Report income: Accurately list all sources of income received by the estate or trust, such as interest, dividends, and rental income.

- Claim deductions: Identify and apply any allowable deductions, such as administrative expenses or distributions to beneficiaries.

- Calculate tax liability: Use the provided tax tables to determine the tax owed based on the net income reported.

- Review and sign: Ensure all information is correct, sign the form, and date it before submission.

How to obtain the Michigan Fiduciary Income Tax Return

The MI 1041 form can be obtained through several convenient methods. It is available for download as a PDF from the Michigan Department of Treasury's website. Additionally, fiduciaries can request a physical copy by contacting their local tax office. Many tax preparation software programs also include the MI 1041, making it easier to fill out and file electronically.

Filing Deadlines / Important Dates

Fiduciaries must be aware of the filing deadlines for the MI 1041 to avoid penalties. The due date for filing the form is typically the same as the federal tax return deadline for estates and trusts, which is usually April fifteenth. However, if the estate or trust has a fiscal year, the return is due on the fifteenth day of the fourth month following the close of the fiscal year. It is advisable to check for any updates or changes to these dates each tax year.

Required Documents

When preparing to file the MI 1041, several documents are essential:

- Financial statements: Include bank statements, investment income reports, and any other documents reflecting the income received by the estate or trust.

- Expense records: Gather receipts and records of expenses related to the administration of the estate or trust, such as legal fees and accounting costs.

- Prior tax returns: Having copies of previous returns can help ensure consistency and accuracy in reporting.

Legal use of the Michigan Fiduciary Income Tax Return

The MI 1041 serves a critical legal function in the administration of estates and trusts. It ensures that fiduciaries fulfill their tax obligations under Michigan law, providing a transparent record of income and expenses. Properly filing this form helps protect fiduciaries from potential legal issues, including penalties for non-compliance. Additionally, it ensures that beneficiaries receive their rightful distributions after all tax liabilities are settled.

Create this form in 5 minutes or less

Find and fill out the correct michigan fiduciary income tax return

Create this form in 5 minutes!

How to create an eSignature for the michigan fiduciary income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mi 1041 form and how does airSlate SignNow help with it?

The mi 1041 form is used for Michigan income tax purposes, specifically for fiduciaries. airSlate SignNow simplifies the process of signing and sending this form electronically, ensuring compliance and efficiency. With our platform, you can easily manage your documents and get them signed quickly.

-

How much does airSlate SignNow cost for handling mi 1041 forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those who frequently handle mi 1041 forms. Our pricing is designed to be cost-effective, allowing you to save on printing and mailing costs. You can choose a plan that fits your budget and usage requirements.

-

What features does airSlate SignNow offer for mi 1041 document management?

airSlate SignNow provides a range of features for managing mi 1041 documents, including customizable templates, secure eSigning, and document tracking. These features streamline the process, making it easier to prepare and send your forms. Additionally, our platform ensures that all documents are stored securely and are easily accessible.

-

Can I integrate airSlate SignNow with other software for mi 1041 processing?

Yes, airSlate SignNow offers integrations with various software applications that can enhance your mi 1041 processing. Whether you use accounting software or document management systems, our platform can seamlessly connect with them. This integration helps you maintain a smooth workflow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for mi 1041 forms?

Using airSlate SignNow for mi 1041 forms provides numerous benefits, including faster turnaround times and reduced paperwork. Our electronic signature solution ensures that your documents are signed securely and legally. Additionally, you can track the status of your forms in real-time, which enhances accountability.

-

Is airSlate SignNow secure for handling sensitive mi 1041 information?

Absolutely, airSlate SignNow prioritizes security, especially when handling sensitive mi 1041 information. We utilize advanced encryption and compliance measures to protect your data. You can trust that your documents are safe and that your clients' information remains confidential.

-

How can I get started with airSlate SignNow for mi 1041 forms?

Getting started with airSlate SignNow for mi 1041 forms is easy. Simply sign up for an account on our website, choose a pricing plan, and start uploading your documents. Our user-friendly interface guides you through the process of preparing and sending your forms for eSignature.

Get more for Michigan Fiduciary Income Tax Return

- In re involuntary hospitalization of cm us law case form

- Fillable online buyers disclosure addendum fax email print form

- Mh 907 form

- Voluntary treatment agreement inv 14pdf fpdf doc docx form

- Mh 907c form

- Order for involuntary hospitalization due to court forms

- Mh 907h form

- Mental hygienethe wv young lawyers section form

Find out other Michigan Fiduciary Income Tax Return

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online