Annual Return 4567 Department of Treasury Formalu 2021

What is the Annual Return 4567 Department Of Treasury Formalu

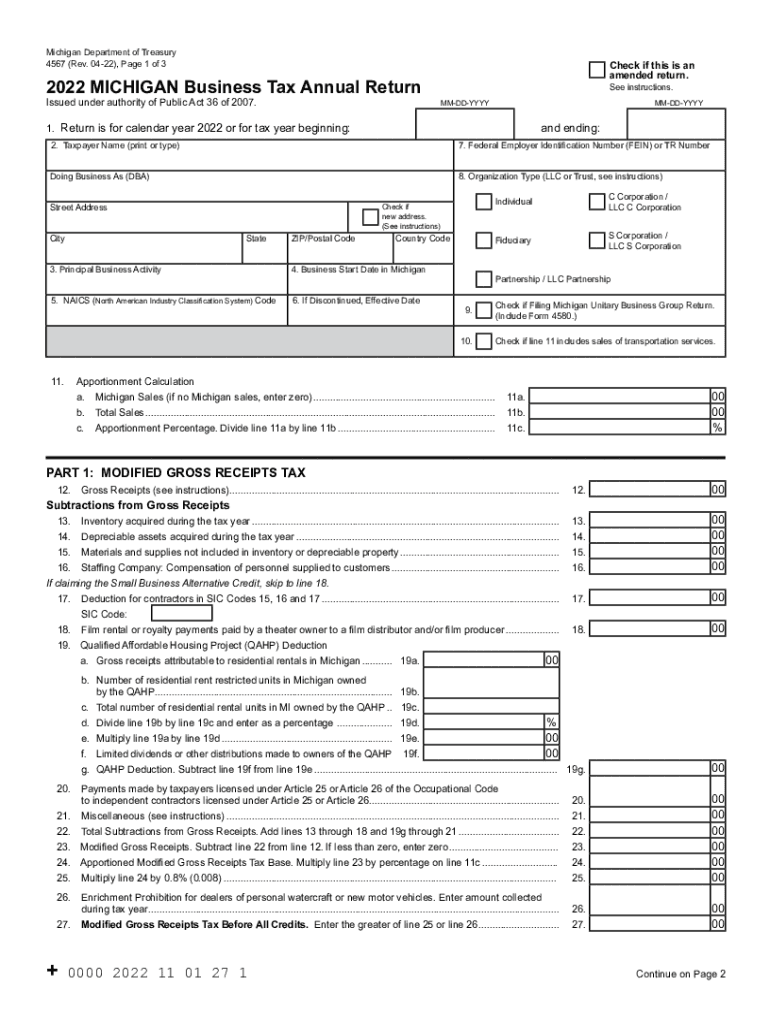

The Annual Return 4567 is a specific form issued by the Department of Treasury, designed for reporting financial information related to various entities. This form is essential for compliance with federal regulations, ensuring that businesses and organizations provide accurate and timely data regarding their financial activities. The information collected through this form helps the government monitor economic activities and enforce tax laws effectively.

How to use the Annual Return 4567 Department Of Treasury Formalu

Using the Annual Return 4567 involves several key steps. First, gather all necessary financial documents and data that pertain to the reporting period. Next, fill out the form accurately, ensuring that all sections are completed based on the provided guidelines. It is crucial to double-check the information for accuracy before submission. Finally, submit the form by the designated deadline to avoid any penalties.

Steps to complete the Annual Return 4567 Department Of Treasury Formalu

Completing the Annual Return 4567 requires a systematic approach:

- Review the form instructions thoroughly to understand the requirements.

- Collect all relevant financial records, including income statements and balance sheets.

- Fill out each section of the form, ensuring all figures are accurate and reflect the correct reporting period.

- Verify the completed form for any errors or omissions.

- Submit the form through the appropriate channel, whether online or via mail.

Filing Deadlines / Important Dates

Filing deadlines for the Annual Return 4567 are critical to ensure compliance. Typically, the form must be submitted by a specific date each year, often aligned with the end of the fiscal year for many entities. It is advisable to mark these dates on your calendar and prepare the necessary documentation in advance to avoid last-minute issues.

Required Documents

To complete the Annual Return 4567, certain documents are required. These may include:

- Financial statements, such as income statements and balance sheets.

- Tax identification numbers for the reporting entity.

- Any supporting documentation that verifies reported figures.

Having these documents ready will streamline the process and help ensure accuracy.

Penalties for Non-Compliance

Failing to file the Annual Return 4567 on time can result in significant penalties. These may include fines and interest on any unpaid taxes. Additionally, non-compliance can lead to audits or further scrutiny from the Department of Treasury. It is essential to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete annual return 4567 department of treasury formalu

Effortlessly Complete Annual Return 4567 Department Of Treasury Formalu on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any holdups. Manage Annual Return 4567 Department Of Treasury Formalu on any platform using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Modify and Electronically Sign Annual Return 4567 Department Of Treasury Formalu with Ease

- Find Annual Return 4567 Department Of Treasury Formalu and then click Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Highlight important sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, and mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Annual Return 4567 Department Of Treasury Formalu and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual return 4567 department of treasury formalu

Create this form in 5 minutes!

How to create an eSignature for the annual return 4567 department of treasury formalu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Annual Return 4567 Department Of Treasury Formalu?

The Annual Return 4567 Department Of Treasury Formalu is a required document for certain businesses to report their financial activities. It helps ensure compliance with federal regulations and provides the government with necessary financial data.

-

How can airSlate SignNow assist with completing the Annual Return 4567 Department Of Treasury Formalu?

airSlate SignNow simplifies the process of completing the Annual Return 4567 Department Of Treasury Formalu by offering an intuitive interface for document creation and signing. Our platform enables you to easily fill out forms, obtain necessary signatures, and store documents securely.

-

What are the pricing options for using airSlate SignNow for the Annual Return 4567 Department Of Treasury Formalu?

airSlate SignNow offers several pricing tiers to fit different business needs when handling the Annual Return 4567 Department Of Treasury Formalu. Our plans are designed to be cost-effective, ensuring that you receive maximum value while maintaining compliance.

-

What features does airSlate SignNow provide for eSigning the Annual Return 4567 Department Of Treasury Formalu?

With airSlate SignNow, you can easily eSign the Annual Return 4567 Department Of Treasury Formalu using secure, legally binding electronic signatures. Our platform also supports document tracking, templates, and team collaboration, making the process seamless.

-

Are there any integrations available for airSlate SignNow that help with the Annual Return 4567 Department Of Treasury Formalu?

Yes, airSlate SignNow offers integrations with various tools and software that can streamline your workflow when preparing the Annual Return 4567 Department Of Treasury Formalu. Connect with popular applications like Google Drive, Salesforce, and more to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the Annual Return 4567 Department Of Treasury Formalu?

Using airSlate SignNow for the Annual Return 4567 Department Of Treasury Formalu provides numerous benefits, including time savings, improved accuracy, and enhanced compliance. Our platform enables businesses to manage their documentation more efficiently and securely.

-

Is airSlate SignNow compliant with regulations related to the Annual Return 4567 Department Of Treasury Formalu?

Absolutely! airSlate SignNow adheres to industry regulations and standards, ensuring that your electronic signatures and document handling related to the Annual Return 4567 Department Of Treasury Formalu are compliant and secure.

Get more for Annual Return 4567 Department Of Treasury Formalu

- Port st lucie product approval affidavit form

- Background screening renewal form cloudfront net

- Affidavit of domestic partnership miami dade county pdfs dadeschools form

- Scgaa form

- Electrical permit application form

- Community servicevolunteer log sheet walton baseball waltonbaseball form

- Pre kindergarten syllabus b2013b dekalb county schools dekalb k12 ga form

- Affidavit of residence english fulton county schools school fultonschools form

Find out other Annual Return 4567 Department Of Treasury Formalu

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe