Failure to File Form CT 706 NT EXT 2022

What is the Failure To File Form CT 706 NT EXT

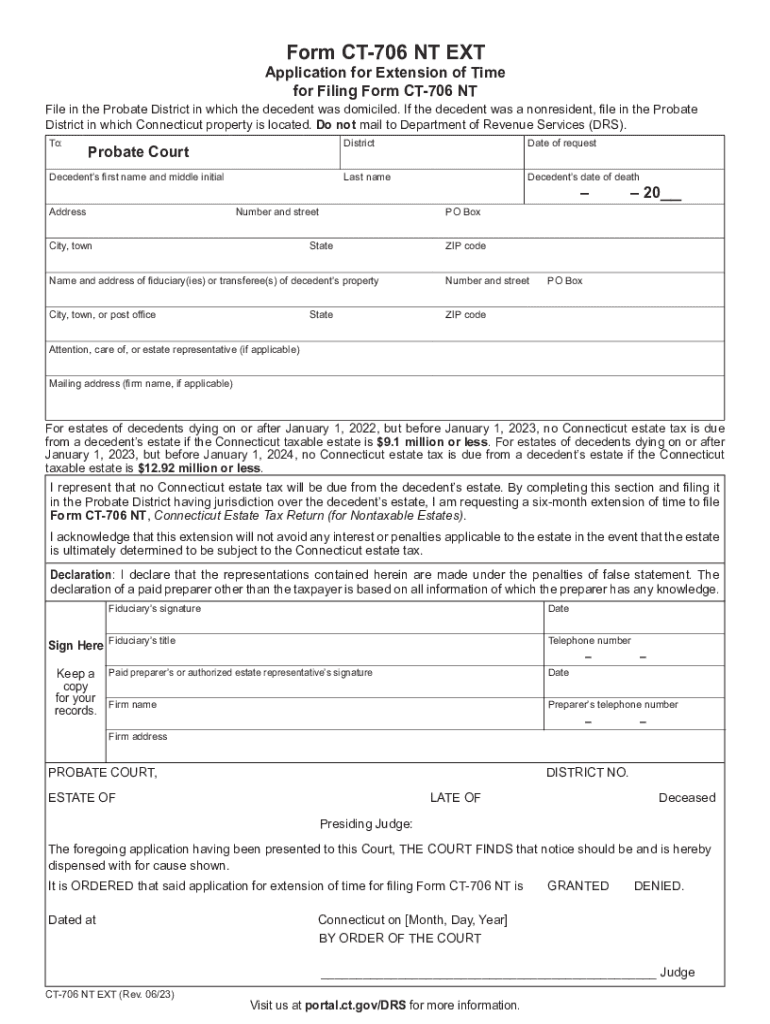

The Failure To File Form CT 706 NT EXT is a specific document used in Connecticut for extending the deadline to file the Connecticut estate tax return. This form is essential for executors and administrators of estates that are required to report and pay estate taxes in the state. It allows for an extension beyond the standard filing deadline, providing additional time to gather necessary information and complete the estate tax return accurately.

Key Elements of the Failure To File Form CT 706 NT EXT

Understanding the key elements of the Failure To File Form CT 706 NT EXT is crucial for proper compliance. The form typically includes the following components:

- Identification Information: This section requires details about the decedent, including name, date of death, and Social Security number.

- Executor Information: The executor or administrator's name and contact information must be provided.

- Requested Extension Period: The form allows the filer to specify the duration of the extension being requested.

- Signature and Date: The form must be signed by the executor or administrator, along with the date of signing.

Steps to Complete the Failure To File Form CT 706 NT EXT

Completing the Failure To File Form CT 706 NT EXT involves several important steps:

- Gather Required Information: Collect all necessary documentation related to the estate, including financial records and the decedent's information.

- Fill Out the Form: Carefully complete each section of the form, ensuring accuracy in all details provided.

- Review for Errors: Double-check the completed form for any mistakes or missing information.

- Sign and Date: Ensure that the form is signed by the appropriate party and dated correctly.

- Submit the Form: Send the completed form to the appropriate Connecticut tax authority by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Failure To File Form CT 706 NT EXT are critical to avoid penalties. Generally, the form must be submitted by the original due date of the estate tax return. It is important to keep track of these dates:

- The standard due date for the Connecticut estate tax return is nine months after the date of death.

- If an extension is granted, the new deadline will be specified in the approval notice.

Legal Use of the Failure To File Form CT 706 NT EXT

The legal use of the Failure To File Form CT 706 NT EXT is governed by Connecticut state law. This form is legally binding and must be used appropriately to ensure compliance with estate tax regulations. Filing this form correctly allows executors to avoid penalties associated with late submissions and provides the necessary legal framework for managing estate tax obligations.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Failure To File Form CT 706 NT EXT can result in significant penalties. These may include:

- Late Filing Penalties: Financial penalties may be imposed for failing to file the form by the due date.

- Interest on Unpaid Taxes: Interest may accrue on any unpaid estate taxes if the return is not filed on time.

- Legal Consequences: Continued non-compliance may lead to further legal action by state authorities.

Quick guide on how to complete failure to file form ct 706 nt ext

Finalize Failure To File Form CT 706 NT EXT seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Failure To File Form CT 706 NT EXT on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related workflow now.

The simplest method to alter and electronically sign Failure To File Form CT 706 NT EXT effortlessly

- Obtain Failure To File Form CT 706 NT EXT and click on Get Form to begin.

- Utilize the tools provided to complete your template.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Decide how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Failure To File Form CT 706 NT EXT to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct failure to file form ct 706 nt ext

Create this form in 5 minutes!

How to create an eSignature for the failure to file form ct 706 nt ext

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct ct 706 nt and how does it benefit my business?

The ct ct 706 nt is a powerful document signing solution that streamlines the eSigning process for businesses. By utilizing this tool, companies can enhance their workflow efficiency and reduce turnaround times on important documents. Its user-friendly interface makes it easy for teams to collaborate effectively.

-

How does airSlate SignNow integrate with the ct ct 706 nt?

airSlate SignNow seamlessly integrates with the ct ct 706 nt, allowing users to easily manage and sign documents within their existing workflow. This integration helps businesses automate tasks, thereby saving time and resources. With the ct ct 706 nt, you can enjoy a more efficient document management experience.

-

Is there a pricing plan that includes the ct ct 706 nt for small businesses?

Yes, airSlate SignNow offers various pricing plans that cater to small businesses needing the ct ct 706 nt. These plans are designed to be budget-friendly while ensuring access to essential features for efficient eSigning. Contact our sales team for detailed pricing options tailored to your needs.

-

What features does the ct ct 706 nt offer?

The ct ct 706 nt offers a range of features including document templates, secure storage, and real-time tracking of signatures. These features are designed to enhance user experience and ensure that important documents are handled safely. Utilizing these capabilities can signNowly improve your document workflow.

-

Can I use the ct ct 706 nt on mobile devices?

Absolutely! The ct ct 706 nt is mobile-friendly, allowing users to sign documents on-the-go using their smartphones or tablets. This flexibility empowers businesses to remain productive irrespective of their location. Ensuring accessibility on mobile devices is crucial for modern business operations.

-

What security measures are in place for the ct ct 706 nt?

The ct ct 706 nt employs top-notch security protocols to protect your documents and sensitive information. Features such as encryption and audit trails ensure that every transaction is secure and compliant with legal standards. You can trust that your documents are safe with airSlate SignNow's technologies.

-

How can the ct ct 706 nt improve my team's productivity?

By utilizing the ct ct 706 nt, your team can signNowly increase productivity through streamlined document signing processes. This tool reduces delays associated with manual signatures and simplifies communication between team members. As a result, tasks are completed more efficiently, allowing your business to focus on growth.

Get more for Failure To File Form CT 706 NT EXT

- Ymca camp erdman letter to my counselor ymcahonolulu form

- Niacc transcript request form

- Eeo questionnaire unified government of wyandotte county wycokck form

- Supplemental information on water quality considerations

- Reo addendum form

- Idx medical software tutorial form

- Send original form with person whenever transferred or

- Dental reimbursement plumbers amp pipefitters local 145 form

Find out other Failure To File Form CT 706 NT EXT

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement