4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule for Standard Members 2021

What is the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

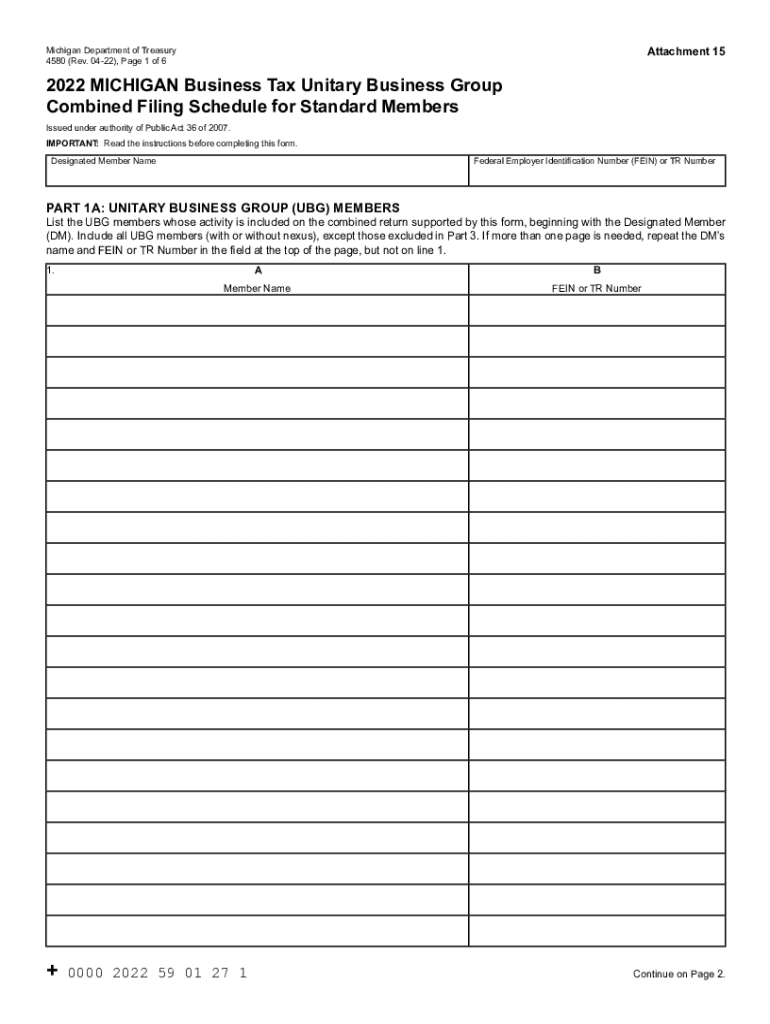

The 4580 form, known as the Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members, is a crucial document for businesses operating as part of a unitary business group in Michigan. This form allows standard members of the group to report their business tax obligations collectively, streamlining the filing process. By using this schedule, businesses can simplify their tax reporting and ensure compliance with state tax laws.

How to use the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

To effectively use the 4580 form, businesses must first gather all relevant financial information from each member of the unitary group. Each member's income, deductions, and tax credits should be consolidated to reflect the group's overall tax position. The completed form must be submitted to the Michigan Department of Treasury, ensuring that all figures are accurate and align with the group's financial statements. This collective approach helps in accurately calculating the tax liability for the entire unitary business group.

Steps to complete the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

Completing the 4580 form involves several key steps:

- Gather financial data from each member of the unitary business group.

- Calculate the total income, deductions, and credits for the group.

- Fill out the 4580 form with the consolidated figures.

- Review the form for accuracy, ensuring compliance with Michigan tax regulations.

- Submit the completed form to the Michigan Department of Treasury by the designated deadline.

Required Documents

When completing the 4580 form, businesses should have the following documents ready:

- Financial statements for each member of the unitary business group.

- Previous tax returns for all members.

- Documentation of any tax credits or deductions being claimed.

- Any additional supporting documents required by the Michigan Department of Treasury.

Filing Deadlines / Important Dates

It is essential for businesses to be aware of the filing deadlines associated with the 4580 form. Typically, the form is due on the last day of the fourth month following the end of the business's tax year. For example, if a business operates on a calendar year, the filing deadline would be April 30. Missing this deadline can result in penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the 4580 form can lead to significant penalties. Businesses may face financial repercussions, including fines and interest on unpaid taxes. Additionally, failure to file accurately can result in audits or further scrutiny from the Michigan Department of Treasury, which could complicate future filings and increase overall tax liability.

Quick guide on how to complete 4580 michigan business tax unitary business group combined filing schedule for standard members

Complete 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents quickly and without delays. Manage 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members on any device with the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

Effortlessly modify and eSign 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

- Locate 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Identify important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4580 michigan business tax unitary business group combined filing schedule for standard members

Create this form in 5 minutes!

How to create an eSignature for the 4580 michigan business tax unitary business group combined filing schedule for standard members

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members?

The 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members is a tax form used by standard members of a unitary business group to report their income, deductions, and tax obligations. It streamlines the filing process for businesses operating in Michigan, making it easier to comply with state tax regulations.

-

How can airSlate SignNow assist with the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members?

airSlate SignNow provides an intuitive platform that allows businesses to create, send, and eSign the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members seamlessly. This saves time and reduces administrative burdens by automating document management and ensuring compliance with tax filing requirements.

-

What features does airSlate SignNow offer for managing tax documents like the 4580 schedule?

airSlate SignNow offers features such as document templates, eSignature capabilities, mobile access, and team collaboration tools. These functionalities help businesses efficiently prepare and sign the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members, ensuring a smooth and compliant filing process.

-

Is there a pricing plan for using airSlate SignNow for the 4580 filing process?

Yes, airSlate SignNow provides various pricing plans ideal for businesses of all sizes. Each plan includes access to essential features that facilitate the completion and submission of the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members, making it a cost-effective solution.

-

Can I integrate airSlate SignNow with other financial software for handling the 4580 schedule?

Absolutely! airSlate SignNow integrates with popular financial and accounting software, allowing businesses to connect their systems for a more streamlined approach. This integration can simplify the preparation of the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for filing the 4580 schedule?

Utilizing airSlate SignNow for the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members provides numerous benefits, including faster processing times, enhanced accuracy, and improved compliance. This helps businesses save time and resources, enabling them to focus on their core operations.

-

How does airSlate SignNow ensure the security of my documents related to the 4580 filing?

airSlate SignNow prioritizes document security by employing strong encryption, secure cloud storage, and authentication protocols. These measures ensure that your sensitive information related to the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members remains protected throughout the filing process.

Get more for 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

- Team professionalism rating report form

- Liability waiver and release parade doc form

- The tom and betty cloyd scholarship deadline for form

- Preservation program kcha form

- Outdoor bazaar information rules ampamp application

- Www psd1 orgcmslibc l booth education service center 1215 w lewis street form

- Rzp application form

- Columbia fire fire sprinkler systemsfire protection service form

Find out other 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors