Nonresident Request for Release from Withholding, 44017 2019

Understanding the Nonresident Request for Release from Withholding, 44017

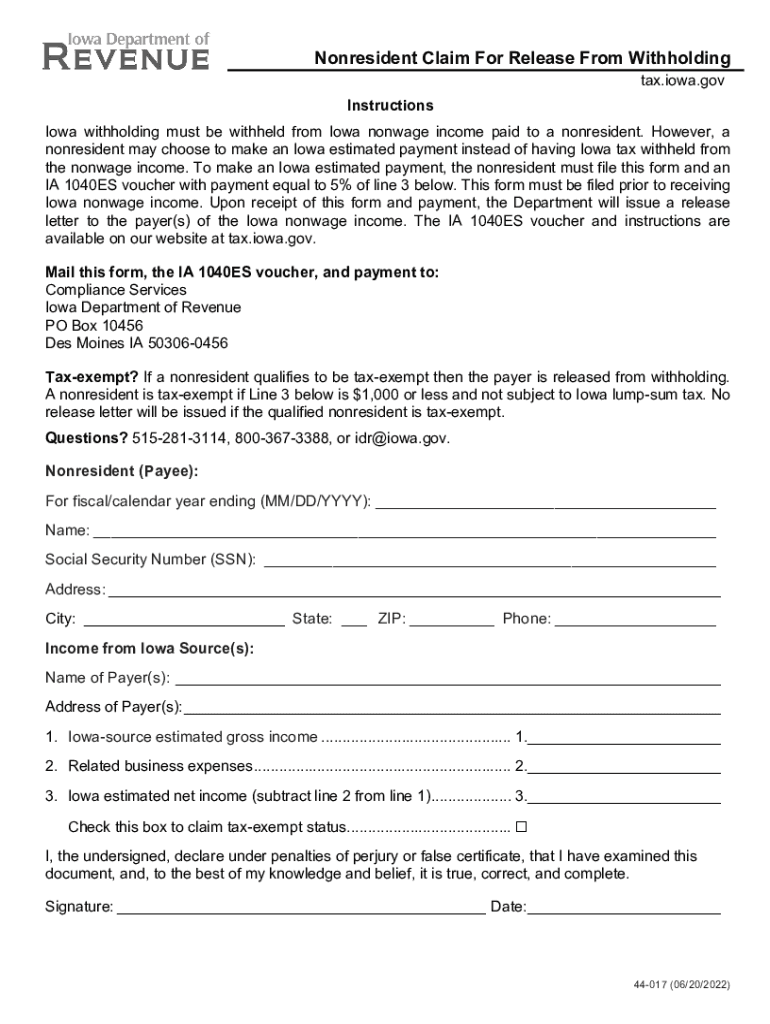

The Nonresident Request for Release from Withholding, form 44017, is designed for nonresident taxpayers in Iowa who seek to have their income tax withheld released. This form allows individuals who are not residents of Iowa but earn income from Iowa sources to request a refund of the withheld taxes. Understanding this form is essential for ensuring compliance with Iowa tax regulations while maximizing potential refunds for eligible nonresidents.

Steps to Complete the Nonresident Request for Release from Withholding, 44017

Completing the Nonresident Request for Release from Withholding involves several key steps:

- Gather necessary information, including your Social Security number, Iowa income details, and any withholding amounts.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Submit the form to the appropriate Iowa tax authority, either online or via mail, depending on your preference.

Following these steps carefully can help streamline the process and ensure timely processing of your request.

Eligibility Criteria for the Nonresident Request for Release from Withholding, 44017

To qualify for the Nonresident Request for Release from Withholding, certain eligibility criteria must be met:

- You must be a nonresident of Iowa earning income from Iowa sources.

- The income subject to withholding must be clearly documented.

- You must not have any outstanding tax liabilities in Iowa.

Meeting these criteria is essential for a successful request and to avoid complications during the filing process.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Nonresident Request for Release from Withholding. Typically, forms should be submitted by April 30 of the year following the tax year in which the income was earned. Missing this deadline may result in delays or denial of your request. Keeping track of these important dates will help ensure compliance with Iowa tax regulations.

Required Documents for Submission

When submitting the Nonresident Request for Release from Withholding, certain documents are required to support your application:

- Completed form 44017.

- Documentation of Iowa-source income.

- Proof of withholding amounts, such as pay stubs or tax statements.

Having these documents ready will facilitate a smoother submission process and help prevent any issues with your request.

Form Submission Methods

The Nonresident Request for Release from Withholding can be submitted through various methods:

- Online submission via the Iowa Department of Revenue's website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local tax offices, if applicable.

Choosing the appropriate submission method can impact the speed and efficiency of processing your request.

Quick guide on how to complete nonresident request for release from withholding 44017

Prepare Nonresident Request For Release From Withholding, 44017 effortlessly on any device

The management of online documents has gained immense traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Nonresident Request For Release From Withholding, 44017 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Nonresident Request For Release From Withholding, 44017 seamlessly

- Locate Nonresident Request For Release From Withholding, 44017 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that task.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Nonresident Request For Release From Withholding, 44017 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nonresident request for release from withholding 44017

Create this form in 5 minutes!

How to create an eSignature for the nonresident request for release from withholding 44017

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to tax Iowa information?

airSlate SignNow is an eSignature solution that allows users to send and electronically sign documents efficiently. It provides a user-friendly interface that can help businesses manage their tax Iowa information by streamlining document workflows, making it easier to stay compliant with state regulations.

-

How can airSlate SignNow help me with my tax Iowa information?

With airSlate SignNow, you can easily create, send, and track important tax Iowa information documents. The platform allows for secure electronic signatures, ensuring that your tax records are managed safely and in compliance with Iowa state requirements, thus simplifying the filing process.

-

What features does airSlate SignNow offer for managing tax Iowa information?

airSlate SignNow offers several powerful features, including customizable templates, real-time tracking of document status, and integration with popular cloud services. These tools allow you to organize and manage your tax Iowa information seamlessly while maintaining compliance and efficiency.

-

Is airSlate SignNow cost-effective for handling tax Iowa information?

Yes, airSlate SignNow is designed to provide a cost-effective solution for businesses managing tax Iowa information. With its competitive pricing plans, you can save on printing and mailing costs while improving your overall document management processes.

-

Can I integrate airSlate SignNow with other applications for handling tax Iowa information?

Absolutely! airSlate SignNow offers integrations with a variety of popular applications, allowing you to synchronize your tax Iowa information with tools you already use, such as CRM or accounting software. This integration helps streamline workflows and minimizes data entry errors.

-

What are the benefits of using airSlate SignNow for tax Iowa information?

Using airSlate SignNow for your tax Iowa information provides numerous benefits, including enhanced security, improved compliance, and faster turnaround times for document processing. By adopting this digital solution, you can reduce the risks associated with paper documents and ensure that your tax-related tasks are efficiently completed.

-

How does airSlate SignNow ensure the security of my tax Iowa information?

airSlate SignNow prioritizes the security of your tax Iowa information by employing robust encryption protocols and secure servers to protect your documents. Additionally, the platform complies with industry standards and regulations, ensuring your sensitive data remains confidential and secure.

Get more for Nonresident Request For Release From Withholding, 44017

- Caregiver excuse for jury duty form

- Marriage certificatenevada county ca form

- Trial by declaration sample letter form

- Home superior court of california county of san luis obispo form

- Form 3005 california deed of trust information

- Ca trust form

- Reporter transcript request superior court of california form

- California husband 495567678 form

Find out other Nonresident Request For Release From Withholding, 44017

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation