Form 4506 T Rev 6

What is the Form 4506-T?

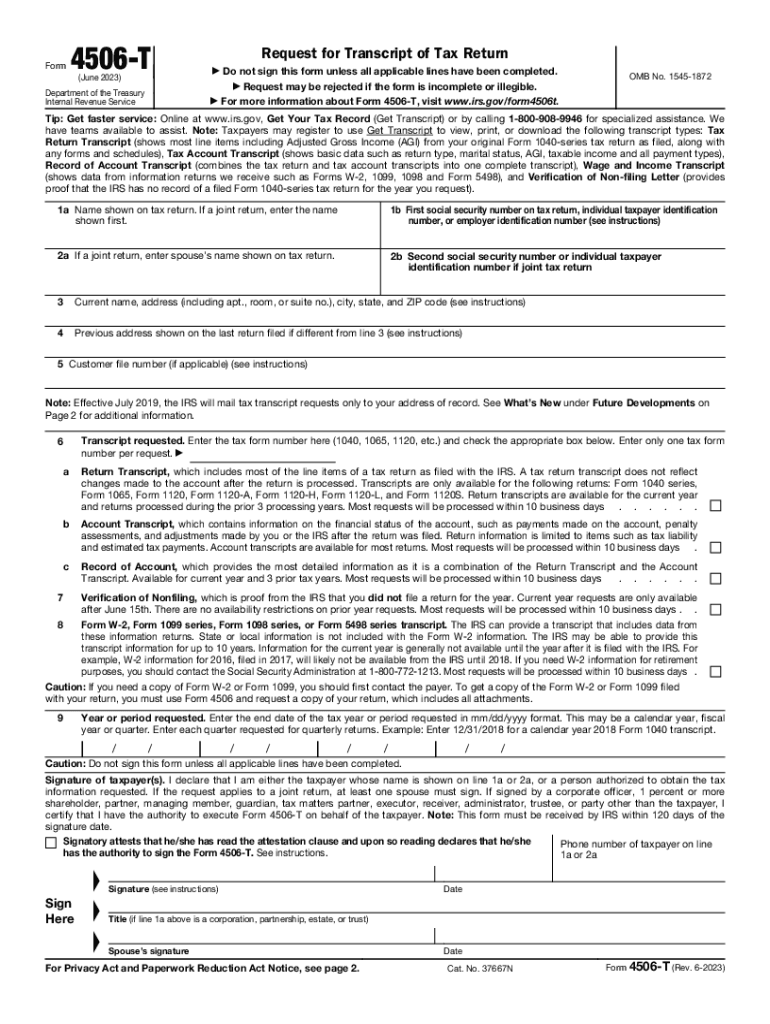

The Form 4506-T is an Internal Revenue Service (IRS) document used to request a transcript of a tax return. This form allows individuals to obtain their tax information directly from the IRS, which can be useful for various purposes, including applying for loans, verifying income, or fulfilling documentation requirements for educational institutions. The form is specifically designed to request transcripts for the most recent tax returns, as well as for prior years, depending on the needs of the requester.

How to Use the Form 4506-T

To effectively use the Form 4506-T, begin by downloading the form from the IRS website or obtaining a physical copy. Fill out the required sections, which include personal identification information, the type of transcript requested, and the tax years for which the transcripts are needed. Once completed, submit the form to the IRS via mail or fax, depending on the instructions provided for your specific request. The IRS typically processes requests within five to ten business days, although this can vary based on the volume of requests received.

Steps to Complete the Form 4506-T

Completing the Form 4506-T involves several key steps:

- Download the form from the IRS website or acquire a printed copy.

- Provide your name, Social Security number, and address in the appropriate fields.

- Indicate the type of transcript you are requesting, such as a tax return transcript or a record of account.

- Specify the tax years for which you need transcripts.

- Sign and date the form to validate your request.

- Submit the completed form via mail or fax to the designated IRS address or number.

IRS Guidelines for Form 4506-T

The IRS provides specific guidelines for completing and submitting the Form 4506-T. It is essential to ensure that all information is accurate and complete to avoid delays in processing. The IRS recommends checking the latest version of the form and the accompanying instructions to stay updated on any changes. Additionally, the form should be submitted to the IRS office that corresponds to your state of residence, as indicated in the instructions.

Required Documents for Form 4506-T

When submitting the Form 4506-T, no additional documents are typically required. However, it is advisable to have your identification documents ready, such as your Social Security card or driver’s license, in case the IRS needs to verify your identity. If you are requesting transcripts for someone else, you must provide a signed authorization from that individual, along with their identifying information.

Form Submission Methods

The Form 4506-T can be submitted to the IRS through various methods. You may choose to mail the form to the appropriate address based on your state or fax it to the designated number provided in the instructions. Some taxpayers may also have the option to submit the request online through the IRS website, depending on their eligibility and the type of transcript requested. It is important to follow the submission guidelines to ensure timely processing of your request.

Quick guide on how to complete form 4506 t rev 6

Complete Form 4506 T Rev 6 seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Form 4506 T Rev 6 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Form 4506 T Rev 6 effortlessly

- Obtain Form 4506 T Rev 6 and then click Get Form to begin.

- Use the tools we provide to finalize your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to preserve your modifications.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Form 4506 T Rev 6 and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4506 t rev 6

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 4506 t, and why is it important?

The form 4506 t is a tax form that enables individuals to request a transcript of their tax return from the IRS. This form is crucial for verifying income and tax information, especially when applying for loans or government programs. Using airSlate SignNow to manage the form 4506 t simplifies the process by allowing you to eSign and send documents securely.

-

How can airSlate SignNow help me with the form 4506 t?

airSlate SignNow streamlines the process of completing and submitting the form 4506 t by providing a user-friendly interface for eSigning documents. You can easily fill out the form, capture electronic signatures, and send it directly to the IRS. This not only saves time but also enhances accuracy in your submissions.

-

What are the pricing options for using airSlate SignNow for the form 4506 t?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with affordable options for small businesses. Each plan includes features that support the completion of the form 4506 t, such as unlimited eSigning and secure document storage. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for the form 4506 t in airSlate SignNow?

Yes, airSlate SignNow offers several integrations with popular apps and services that can enhance the experience of managing the form 4506 t. You can connect with platforms like Google Drive, Dropbox, and CRM systems to streamline your workflow. These integrations make it easier to store, share, and access your completed forms.

-

What security features does airSlate SignNow provide for the form 4506 t?

airSlate SignNow prioritizes security, ensuring your sensitive information is protected while working with the form 4506 t. Features like end-to-end encryption, audit trails, and secure cloud storage help safeguard your documents. This makes it a reliable choice for businesses handling confidential tax information.

-

Can I access the form 4506 t on mobile devices?

Absolutely! airSlate SignNow is fully optimized for mobile use, allowing you to complete and eSign the form 4506 t from your smartphone or tablet. This flexibility enables you to manage your documents on-the-go, ensuring that you can submit your forms whenever it's convenient for you.

-

How does airSlate SignNow ensure compliance when using the form 4506 t?

airSlate SignNow adheres to industry standards and regulations, ensuring that the handling of the form 4506 t remains compliant with legal requirements. The platform offers features such as secure eSigning and authentication processes, which help maintain the integrity of your transactions and compliance with IRS guidelines.

Get more for Form 4506 T Rev 6

- Archive orgdetailsb 001000357rebif rebidose beta 1a download borrow form

- Authorization release of medical records information

- Temporary restraining order court form

- Formsnew hampshire judicial branch

- Health status report form

- F a a form 5100 109 project evaluation review and development analysis faa form 5100 109 faa

- Ia renewal activity record ia renewal form

- Retiree health care account rhca assets at merrill form

Find out other Form 4506 T Rev 6

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement