Form DR 309632 Florida Department of Revenue 2012

What is the Form DR 309632 Florida Department Of Revenue

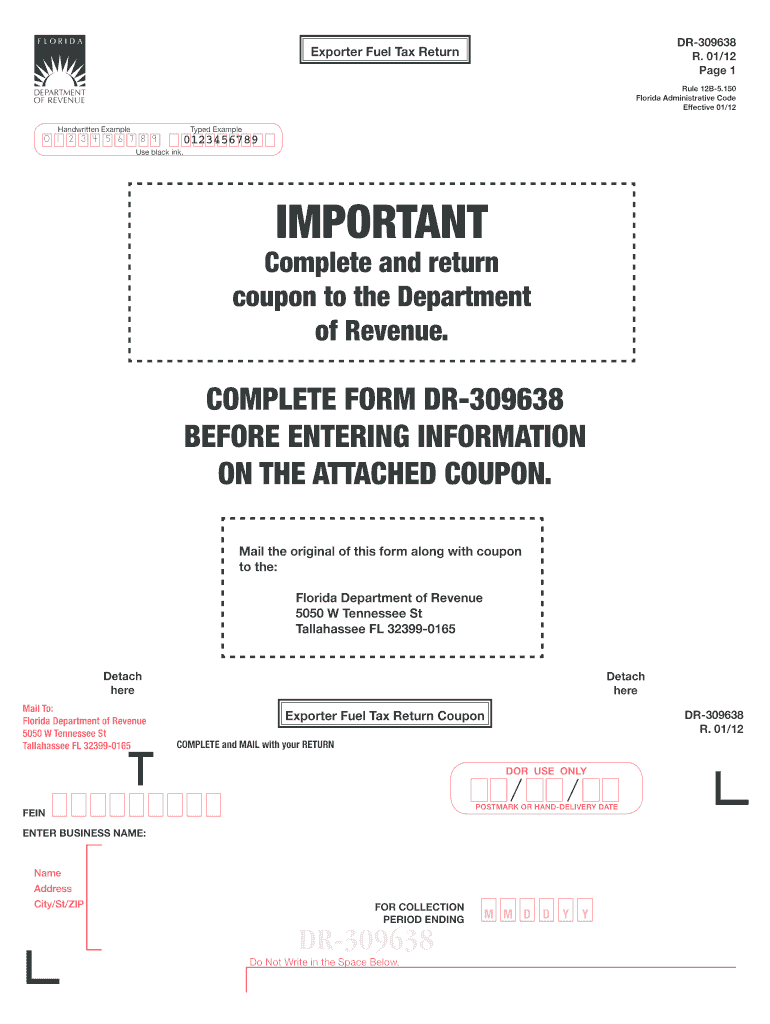

The Form DR 309632 is a document issued by the Florida Department of Revenue, primarily used for tax-related purposes. This form is essential for individuals and businesses to report and reconcile certain tax obligations. It serves as a means to ensure compliance with state tax laws and regulations, facilitating the accurate collection of taxes owed to the state.

How to use the Form DR 309632 Florida Department Of Revenue

To effectively use the Form DR 309632, individuals and businesses should first determine their eligibility and the specific tax obligations that apply to them. After confirming the need to file this form, users must accurately fill out all required fields, ensuring that all information is complete and truthful. Once completed, the form must be submitted to the Florida Department of Revenue by the specified deadline to avoid any penalties.

Steps to complete the Form DR 309632 Florida Department Of Revenue

Completing the Form DR 309632 involves several key steps:

- Gather necessary documents, such as previous tax returns and financial records.

- Carefully read the instructions provided with the form to understand each section.

- Fill in personal information, including name, address, and tax identification number.

- Report income and deductions accurately, following the guidelines for each line item.

- Review the completed form for any errors or omissions before submission.

Key elements of the Form DR 309632 Florida Department Of Revenue

The Form DR 309632 includes several key elements that must be accurately filled out. These elements typically include personal identification information, details regarding income sources, deductions claimed, and any applicable tax credits. Each section is designed to capture specific information that the Florida Department of Revenue requires for processing tax returns and ensuring compliance.

Form Submission Methods

There are multiple methods for submitting the Form DR 309632 to the Florida Department of Revenue. Taxpayers can choose to file the form online through the department's electronic filing system, which is often the quickest method. Alternatively, forms can be submitted via mail, ensuring that they are sent to the correct address as specified in the instructions. In-person submissions may also be possible at designated state offices, providing another option for those who prefer face-to-face assistance.

Penalties for Non-Compliance

Failure to comply with the requirements related to the Form DR 309632 can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action for serious violations. It is crucial for taxpayers to understand the importance of timely and accurate filing to avoid these negative consequences and maintain good standing with the Florida Department of Revenue.

Quick guide on how to complete form dr 309632 florida department of revenue

Effortlessly Prepare Form DR 309632 Florida Department Of Revenue on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers since you can obtain the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without holdups. Manage Form DR 309632 Florida Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and eSign Form DR 309632 Florida Department Of Revenue with Ease

- Find Form DR 309632 Florida Department Of Revenue and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form DR 309632 Florida Department Of Revenue to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form dr 309632 florida department of revenue

Create this form in 5 minutes!

How to create an eSignature for the form dr 309632 florida department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form DR 309632 Florida Department Of Revenue?

Form DR 309632 is a document used by the Florida Department of Revenue for specific tax-related purposes. It is essential for businesses to understand how to complete and submit this form accurately to maintain compliance. Using airSlate SignNow can streamline the process of completing and eSigning Form DR 309632.

-

How can airSlate SignNow help with Form DR 309632 Florida Department Of Revenue?

airSlate SignNow simplifies the process of filling out and eSigning Form DR 309632 Florida Department Of Revenue. Our platform allows you to fill out the form electronically, reducing errors and saving time. Additionally, you can easily share the form with necessary parties for efficient collaboration.

-

What are the key features of airSlate SignNow for handling Form DR 309632 Florida Department Of Revenue?

Key features of airSlate SignNow include customizable templates, secure eSigning, and real-time tracking of the document's status. These features ensure that your submission of Form DR 309632 Florida Department Of Revenue is handled efficiently and securely. Users also benefit from cloud storage and integration capabilities with other business tools.

-

Is there a cost associated with using airSlate SignNow for Form DR 309632 Florida Department Of Revenue?

Yes, there are various pricing plans available for airSlate SignNow, making it accessible for businesses of all sizes. With affordable options, you can choose the plan that fits your needs best while ensuring you can effectively eSign Form DR 309632 Florida Department Of Revenue. Contact our sales team for a detailed quote tailored to your requirements.

-

Can I integrate airSlate SignNow with other software for Form DR 309632 Florida Department Of Revenue?

Absolutely! airSlate SignNow offers seamless integrations with various popular applications, allowing you to streamline your workflow when handling Form DR 309632 Florida Department Of Revenue. By integrating with tools like CRM systems and project management software, you can ensure that all your necessary documents are connected and easily accessible.

-

What are the benefits of using airSlate SignNow for Form DR 309632 Florida Department Of Revenue?

Using airSlate SignNow for Form DR 309632 Florida Department Of Revenue offers several benefits, including enhanced efficiency, reduced paperwork, and improved security. The simple interface ensures that all users can easily navigate the platform, leading to quicker submission of the form. You also gain peace of mind with our advanced security measures for your sensitive information.

-

Is it easy to eSign Form DR 309632 Florida Department Of Revenue with airSlate SignNow?

Yes, eSigning Form DR 309632 Florida Department Of Revenue with airSlate SignNow is incredibly easy. The platform walks you through the signing process, ensuring that all required signatures are obtained effortlessly. Plus, you can track the status of the document to know when it has been signed and submitted.

Get more for Form DR 309632 Florida Department Of Revenue

- Tsp secret mlm hacks resources form

- Policy and procedure for appeal of site visit report hcphes form

- Meals tax stafford stafford va form

- Solicitation rfbis152008911 request for bid bid due internal services department 031715 120000 pm vendor no form

- Small group lesson18 grace form

- Fringe benefits tax fbt return 2014 when completing this return for help with completing this return refer to completing your form

- Get 419967696 form

- Aa na attendance form azbn

Find out other Form DR 309632 Florida Department Of Revenue

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form