Form 1099 NEC Rev January 2024 Nonemployee Compensation 2024

What is the Form 1099 NEC Rev January 2024 Nonemployee Compensation

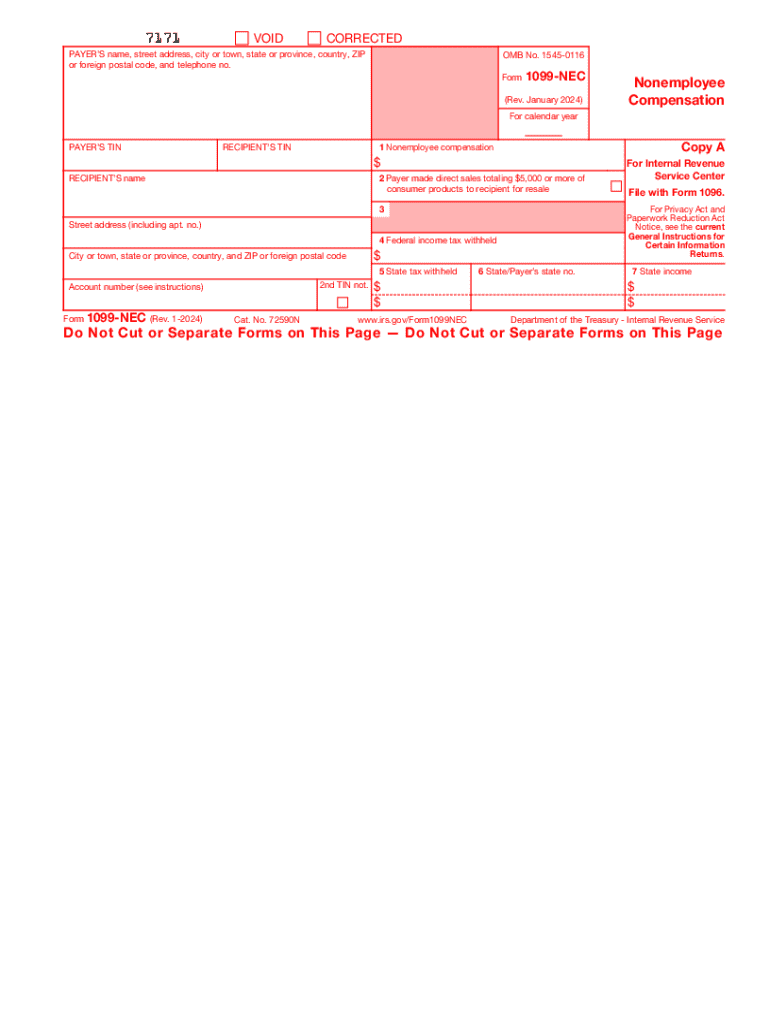

The Form 1099 NEC (Nonemployee Compensation) is a tax document used in the United States to report payments made to non-employees, such as independent contractors and freelancers. This form is essential for businesses that have paid $600 or more to a non-employee for services rendered during the tax year. The 2024 revision of this form includes updated guidelines to ensure compliance with IRS regulations.

Understanding the purpose of the 1099 NEC is crucial for accurate tax reporting. It helps the IRS track income that may not be reported through traditional payroll systems, ensuring that all income is accounted for during tax season.

How to use the Form 1099 NEC Rev January 2024 Nonemployee Compensation

Using the Form 1099 NEC involves several key steps. First, businesses must gather the necessary information about the non-employee, including their name, address, and taxpayer identification number (TIN). This information is essential for accurately completing the form.

Next, businesses should report the total amount paid to the non-employee in Box 1 of the form. It is important to ensure that this amount reflects all payments made for services throughout the year. Once completed, the form must be distributed to the non-employee and filed with the IRS by the specified deadline.

Steps to complete the Form 1099 NEC Rev January 2024 Nonemployee Compensation

Completing the Form 1099 NEC involves a systematic approach:

- Gather necessary information: Collect the non-employee's name, address, and TIN.

- Fill out the form: Enter the total compensation paid in Box 1 and complete other relevant sections.

- Review the form: Double-check all entries for accuracy to avoid penalties.

- Distribute copies: Provide a copy to the non-employee and retain one for your records.

- File with the IRS: Submit the form by the deadline, either electronically or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 NEC are critical for compliance. For the 2024 tax year, the deadline to provide the form to non-employees is typically January 31. Additionally, the IRS must receive the filed forms by the same date if submitting electronically or by mail. Missing these deadlines can result in penalties, so it is important to stay organized and proactive.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 1099 NEC. These guidelines include instructions on who must file, how to report payments, and the necessary information required on the form. It is important to refer to the IRS instructions for the most current information, as regulations may change from year to year.

Businesses should also be aware of the penalties for failing to file or for filing incorrect information. Staying informed about IRS guidelines helps ensure compliance and avoid unnecessary fines.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 1099 NEC can lead to significant penalties. The IRS imposes fines for late filings, ranging from $50 to $550 per form, depending on how late the form is submitted. Additionally, if the form is intentionally disregarded or if false information is provided, the penalties can be even more severe.

To avoid these penalties, it is essential for businesses to understand their obligations and ensure timely and accurate filing of all required forms.

Quick guide on how to complete form 1099 nec rev january 2024 nonemployee compensation

Complete Form 1099 NEC Rev January 2024 Nonemployee Compensation seamlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Form 1099 NEC Rev January 2024 Nonemployee Compensation from any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Form 1099 NEC Rev January 2024 Nonemployee Compensation effortlessly

- Find Form 1099 NEC Rev January 2024 Nonemployee Compensation and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 1099 NEC Rev January 2024 Nonemployee Compensation and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 nec rev january 2024 nonemployee compensation

Create this form in 5 minutes!

How to create an eSignature for the form 1099 nec rev january 2024 nonemployee compensation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 1099 preparation software and how does it work?

1099 preparation software is a tool designed to streamline the process of generating, filing, and managing 1099 forms for independent contractors and freelancers. This software automates calculations and ensures compliance with IRS regulations, making the 1099 filing process more efficient. With airSlate SignNow's 1099 preparation software, businesses can easily manage documents and acquire necessary eSignatures.

-

What features should I look for in 1099 preparation software?

When selecting 1099 preparation software, look for features such as automated form generation, eSignature capabilities, and easy document management. Additionally, ensure it offers secure cloud access and real-time tracking of prepared forms. airSlate SignNow provides all these features, enabling businesses to simplify their 1099 preparation process.

-

Is your 1099 preparation software user-friendly?

Yes, airSlate SignNow's 1099 preparation software is designed to be intuitive and user-friendly. The platform offers a straightforward interface that even non-technical users can easily navigate. This ensures that businesses can focus on their core operations without being bogged down by complicated software.

-

How does your 1099 preparation software ensure compliance with IRS regulations?

airSlate SignNow's 1099 preparation software stays updated with the latest IRS regulations and requirements for 1099 forms. This ensures that all generated forms are compliant and accurate. Our platform also offers error-checking features to minimize mistakes before filing, providing peace of mind for businesses.

-

What is the cost of using your 1099 preparation software?

The pricing for airSlate SignNow's 1099 preparation software varies depending on the specific needs of your business. We offer flexible pricing plans designed for both small businesses and larger enterprises. To get a precise quote, you can visit our website or contact our sales team directly.

-

Can I integrate your 1099 preparation software with other tools?

Absolutely! airSlate SignNow's 1099 preparation software can seamlessly integrate with various accounting and payroll systems. This integration ensures a smooth flow of data, which reduces the need for manual data entry and enhances overall efficiency for your business.

-

What are the benefits of using 1099 preparation software?

Using 1099 preparation software like airSlate SignNow offers multiple benefits, including time savings, accuracy, and compliance. Automation eliminates tedious manual processes and reduces the risk of human error. Furthermore, eSignature capabilities allow for quick document approvals, accelerating your overall business workflows.

Get more for Form 1099 NEC Rev January 2024 Nonemployee Compensation

Find out other Form 1099 NEC Rev January 2024 Nonemployee Compensation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation