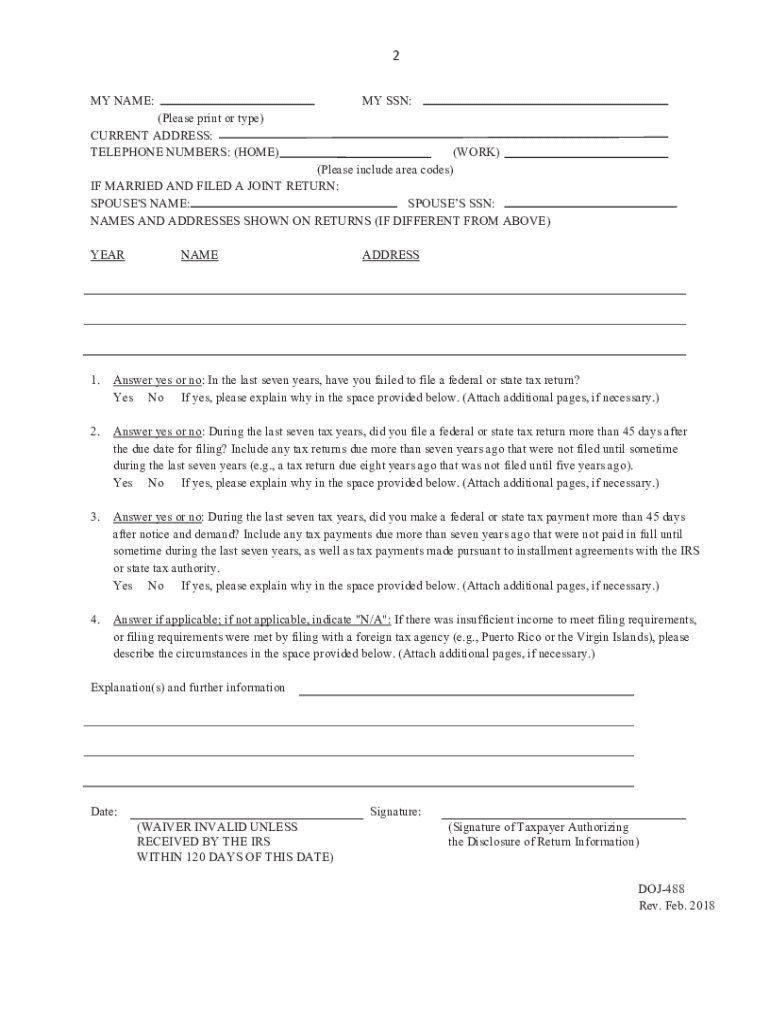

DOJ 488 Tax Waiver Form

What is the DOJ 488 Tax Waiver Form

The DOJ 488 Tax Waiver Form is a specific document used to request a waiver for certain tax obligations under the jurisdiction of the Department of Justice. This form is typically utilized by individuals or entities seeking relief from tax liabilities that may hinder their ability to fulfill other legal obligations. It is crucial for applicants to understand the purpose of this form, as it serves as a formal request for consideration of their unique circumstances regarding tax liabilities.

How to use the DOJ 488 Tax Waiver Form

Using the DOJ 488 Tax Waiver Form involves several steps to ensure that the application is completed accurately and submitted correctly. First, applicants should gather all necessary documentation that supports their request for a waiver. This may include financial statements, tax returns, and any relevant correspondence with tax authorities. Once the form is completed, it should be reviewed for accuracy before submission. Depending on the specific requirements, the form may need to be submitted online, by mail, or in person to the appropriate department.

Steps to complete the DOJ 488 Tax Waiver Form

Completing the DOJ 488 Tax Waiver Form requires careful attention to detail. The following steps can guide applicants through the process:

- Obtain the latest version of the DOJ 488 Tax Waiver Form from the appropriate source.

- Fill out the form with accurate personal and financial information.

- Attach any supporting documents that substantiate the request for a waiver.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, ensuring that it is sent to the correct address or online portal.

Eligibility Criteria

Eligibility for the DOJ 488 Tax Waiver Form varies depending on individual circumstances. Generally, applicants must demonstrate a legitimate need for the waiver due to financial hardship or other compelling reasons. It is essential to provide sufficient evidence that supports the claim for relief from tax obligations. Each case is reviewed on its merits, and meeting the eligibility criteria does not guarantee approval.

Required Documents

When applying for the DOJ 488 Tax Waiver Form, certain documents are typically required to support the application. These may include:

- Recent tax returns to provide a clear picture of financial status.

- Financial statements that outline income, expenses, and assets.

- Any correspondence with tax authorities related to the tax obligations in question.

- Proof of financial hardship, such as unemployment letters or medical bills.

Form Submission Methods

The DOJ 488 Tax Waiver Form can be submitted through various methods, depending on the guidelines provided by the Department of Justice. Common submission methods include:

- Online submission via the official portal, if available.

- Mailing the completed form to the designated address.

- In-person delivery to the appropriate office, if required.

Quick guide on how to complete doj 488 tax waiver form

Effortlessly Prepare DOJ 488 Tax Waiver Form on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and eSign your documents without complications. Manage DOJ 488 Tax Waiver Form on any device through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and eSign DOJ 488 Tax Waiver Form with Ease

- Find DOJ 488 Tax Waiver Form and click on Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the features that airSlate SignNow has specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign DOJ 488 Tax Waiver Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the doj 488 tax waiver form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax check waiver?

A tax check waiver is a legal document signNowing that a taxpayer is exempt from certain tax liabilities. By obtaining a tax check waiver, businesses can streamline their financial processes, ensuring compliance while minimizing tax obligations. Utilizing a service like airSlate SignNow simplifies the process of obtaining and managing tax check waivers efficiently.

-

How can airSlate SignNow help with tax check waivers?

airSlate SignNow provides a user-friendly platform for creating, sending, and signing documents, including tax check waivers. Our solution enables businesses to easily manage their waiver requests and maintain compliance with tax regulations. With advanced features like templates and automated reminders, airSlate SignNow simplifies the tax check waiver process.

-

What are the costs associated with airSlate SignNow for tax check waivers?

Pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for businesses of all sizes. Our plans offer diverse features, including unlimited document signing, which can be particularly beneficial for managing tax check waivers. To find the best option for your needs, we recommend checking our pricing page for detailed information.

-

Are there any integrations available for managing tax check waivers?

Yes, airSlate SignNow integrates with various platforms such as Google Drive, Salesforce, and Microsoft Office, making it easy to manage tax check waivers alongside your other business documents. These integrations allow for seamless workflow and data synchronization, helping to ensure that all relevant information is readily accessible. This enhances efficiency in handling tax-related processes.

-

What security measures are in place for tax check waivers in airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including tax check waivers, by using industry-standard encryption technologies. Our platform ensures that your data is protected at all times, empowering you to manage sensitive documents with confidence. With secure cloud storage and access control features, your tax-related information remains safe.

-

What benefits does eSigning tax check waivers offer?

eSigning tax check waivers through airSlate SignNow offers numerous benefits, such as faster processing times and reduced paperwork. Our platform allows users to sign documents from anywhere, on any device, speeding up the approval process signNowly. This enhances overall productivity for businesses navigating tax compliance.

-

Can I track the status of my tax check waiver documents?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your tax check waiver documents in real time. You will receive notifications when your documents are viewed, signed, or completed, ensuring you stay informed throughout the process. This feature helps you manage your tax check waivers effectively.

Get more for DOJ 488 Tax Waiver Form

- Name of common law spousessn form

- W2 upload south carolina department of revenue scgov form

- 67715 17 accident claimindd form

- 9500 euclid avenue q1 3 form

- Initial disability claim form speedy template

- Texas fishing forumtffthe best place in texas to talk form

- Po box 975 new york ny 10108 0975 646 473 8666 outside nyc 800 575 7771 www form

- Molecular laboratory form

Find out other DOJ 488 Tax Waiver Form

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement