CT 10U Consumers Compensating Use Tax Returns and Instructions Rev 1 23 2021

What is the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23

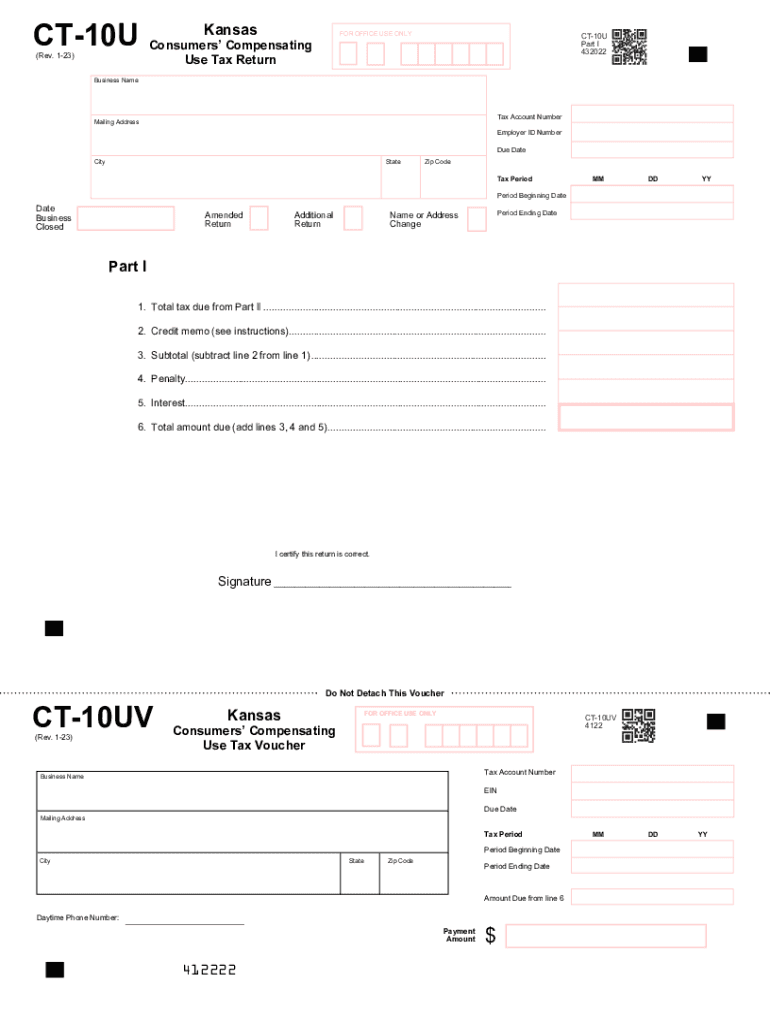

The CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23 is a tax form used by consumers in Connecticut to report and pay compensating use tax on taxable purchases made outside the state. This form is essential for individuals and businesses that acquire goods or services that are subject to use tax but were not taxed at the point of sale. The compensating use tax ensures that consumers contribute to the state’s revenue, similar to sales tax, for items purchased from out-of-state vendors.

How to use the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23

To effectively use the CT 10U form, taxpayers must first gather all relevant information regarding their purchases. This includes details about the items acquired, the purchase price, and the date of purchase. Once this information is collected, individuals can fill out the form by entering the required data into the designated fields. It is crucial to ensure accuracy to avoid potential penalties. After completing the form, taxpayers can submit it either online or via mail, depending on their preference and compliance requirements.

Steps to complete the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23

Completing the CT 10U form involves several key steps:

- Gather all receipts and documentation for taxable purchases made outside Connecticut.

- Fill in your personal information, including name, address, and taxpayer identification number.

- List each item purchased along with its purchase price and date of purchase.

- Calculate the total compensating use tax owed based on the applicable tax rate.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline to avoid penalties.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the CT 10U form. Generally, the form must be submitted annually, with specific deadlines that may vary each year. Taxpayers should check the Connecticut Department of Revenue Services website or consult tax professionals for the most current deadlines to ensure timely submission and compliance.

Required Documents

When completing the CT 10U form, taxpayers should have the following documents ready:

- Receipts or invoices for all out-of-state purchases.

- Previous tax returns, if applicable, to reference any prior compensating use tax payments.

- Any relevant correspondence from the Connecticut Department of Revenue Services.

Penalties for Non-Compliance

Failure to file the CT 10U form or pay the compensating use tax owed can result in penalties. These may include fines, interest on unpaid taxes, and potential legal actions. It is advisable for taxpayers to adhere to filing requirements and deadlines to avoid these consequences. Understanding the implications of non-compliance can help individuals and businesses maintain good standing with state tax authorities.

Quick guide on how to complete ct 10u consumers compensating use tax returns and instructions rev 1 23

Complete CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a sustainable alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23 on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23 without hassle

- Find CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23 and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from a device of your preference. Modify and eSign CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 10u consumers compensating use tax returns and instructions rev 1 23

Create this form in 5 minutes!

How to create an eSignature for the ct 10u consumers compensating use tax returns and instructions rev 1 23

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23?

The CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23 is a document required by businesses in Connecticut for reporting compensating use taxes. It provides detailed guidelines on how to accurately complete the return, ensuring compliance with state tax laws. Understanding this document is essential for maintaining good tax standing as it simplifies the reporting process.

-

How can airSlate SignNow assist with the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23?

airSlate SignNow offers an efficient platform for completing and eSigning the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23. Our tool ensures that you can easily fill out the required information and securely sign the document for submission. This simplifies the overall tax return process and enhances compliance.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow provides various pricing plans tailored to suit different business needs when handling documents like the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23. Our plans are designed to be cost-effective, ensuring you get value for what you pay. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, cloud storage, and team collaboration tools that allow for effective document management. When dealing with the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23, these features ensure that you can easily edit, save, and share vital tax documents securely. This enhances productivity and organization.

-

Can I integrate airSlate SignNow with other software for my tax processes?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software to enhance your workflow for the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23. This interoperability allows you to import, export, and manage information across multiple platforms efficiently. Simplifying your tax processes has never been easier.

-

Is there customer support available for help with the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23?

Absolutely! airSlate SignNow provides excellent customer support to assist users with any queries related to the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23. Our support team is available via chat, email, or phone to ensure you have the resources you need to complete your tax returns successfully.

-

What are the benefits of eSigning the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23?

eSigning the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23 using airSlate SignNow offers numerous benefits, including increased security, reduced turnaround time, and improved organization. It eliminates the need for physical paperwork and helps keep your documents easily accessible. Enjoy the convenience of signing from anywhere at any time.

Get more for CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23

- Internship timesheet form

- August 20 1998 western oregon university wou form

- Slcc in lafayette louisiana1098 t forms

- The date for disciple now at deermeadows baptist church form

- Albert james bert shoosmith scholarship application vnla vnla form

- Fax check authorization form

- Iowa state diploma form

- Llu financial aid forms 2005indd loma linda university llu

Find out other CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 1 23

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy