Fillable Kansas Department of Revenue Application to 2022

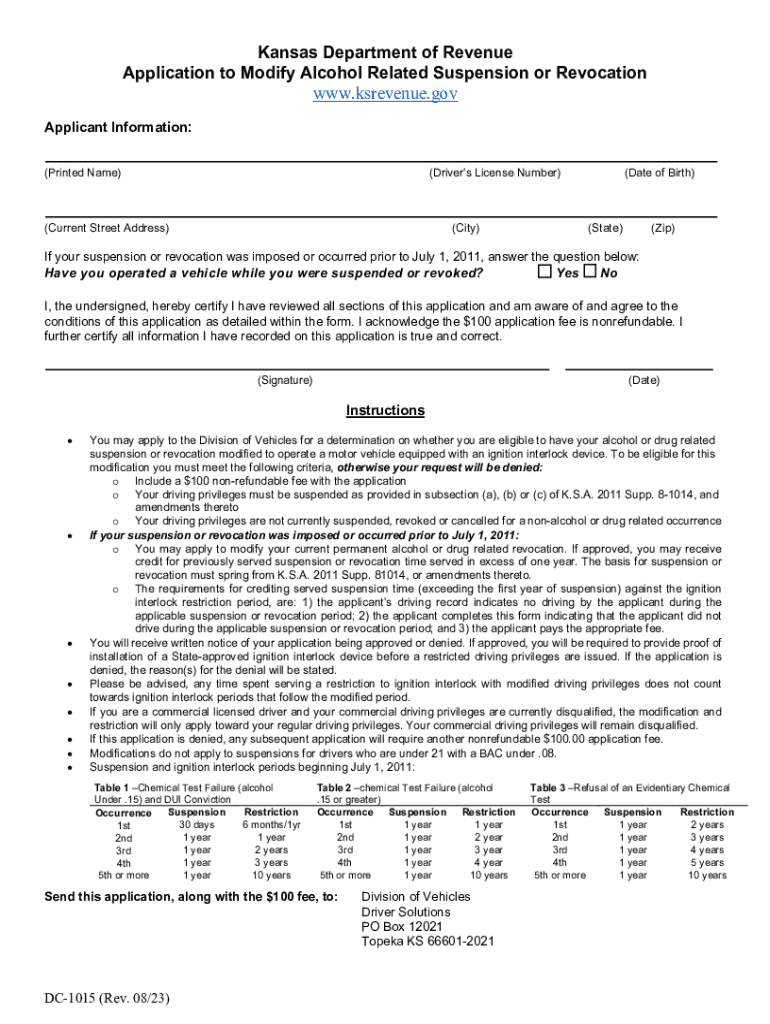

What is the Fillable Kansas Department Of Revenue Application To

The Fillable Kansas Department Of Revenue Application To is an official form used by residents of Kansas to apply for various tax-related purposes. This application serves multiple functions, including but not limited to, requesting tax exemptions, applying for refunds, or initiating specific tax processes outlined by the Kansas Department of Revenue. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations.

How to use the Fillable Kansas Department Of Revenue Application To

Using the Fillable Kansas Department Of Revenue Application To is straightforward. Begin by downloading the form from the Kansas Department of Revenue website. Once you have the form, fill in the required fields accurately. Ensure that you provide all necessary information, such as your personal details, tax identification number, and any relevant financial data. After completing the form, you can print it for submission or utilize a digital signing solution for a more efficient process.

Steps to complete the Fillable Kansas Department Of Revenue Application To

Completing the Fillable Kansas Department Of Revenue Application To involves several key steps:

- Download the form from the Kansas Department of Revenue website.

- Read the instructions carefully to understand what information is required.

- Fill in your personal details, including your name, address, and tax identification number.

- Provide any necessary financial information or documentation as specified.

- Review the completed application for accuracy.

- Sign the form electronically or manually, depending on your submission method.

- Submit the form according to the instructions provided, either online, by mail, or in person.

Required Documents

When completing the Fillable Kansas Department Of Revenue Application To, certain documents may be required to support your application. These can include:

- Proof of identity, such as a driver's license or state ID.

- Tax identification number documentation.

- Any relevant financial statements or tax returns.

- Additional forms that may be specified in the application instructions.

Form Submission Methods

The Fillable Kansas Department Of Revenue Application To can be submitted through various methods to accommodate different preferences:

- Online: If available, you can submit the form electronically through the Kansas Department of Revenue's online portal.

- By Mail: Print the completed form and send it to the designated address provided in the application instructions.

- In-Person: You may also choose to deliver the form directly to a local Kansas Department of Revenue office.

Eligibility Criteria

Eligibility for using the Fillable Kansas Department Of Revenue Application To varies based on the specific purpose of the application. Generally, applicants must be residents of Kansas or have business operations within the state. Additionally, certain qualifications may apply depending on the type of tax exemption or refund being requested. It is essential to review the eligibility criteria outlined in the application instructions to ensure compliance.

Quick guide on how to complete fillable kansas department of revenue application to

Complete Fillable Kansas Department Of Revenue Application To effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the proper form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Fillable Kansas Department Of Revenue Application To on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Fillable Kansas Department Of Revenue Application To effortlessly

- Obtain Fillable Kansas Department Of Revenue Application To and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Select pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Erase concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and electronically sign Fillable Kansas Department Of Revenue Application To to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable kansas department of revenue application to

Create this form in 5 minutes!

How to create an eSignature for the fillable kansas department of revenue application to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fillable Kansas Department Of Revenue Application To?

The Fillable Kansas Department Of Revenue Application To is an electronic form that allows users to easily input their information and submit applications to the Kansas Department of Revenue. This fillable application simplifies the process for individuals and businesses, making data entry quicker and more efficient.

-

How can I create a Fillable Kansas Department Of Revenue Application To using airSlate SignNow?

To create a Fillable Kansas Department Of Revenue Application To with airSlate SignNow, simply access our platform and choose the document template you need. You can customize the fields to fit your specific requirements, ensuring that you gather all the necessary information for your application.

-

What are the benefits of using airSlate SignNow for the Fillable Kansas Department Of Revenue Application To?

Using airSlate SignNow for the Fillable Kansas Department Of Revenue Application To offers several benefits, including a streamlined submission process, reduced paperwork, and improved accuracy. Our platform is designed to simplify the workflow, allowing users to complete applications faster and with fewer errors.

-

Is there a cost associated with using the Fillable Kansas Department Of Revenue Application To on airSlate SignNow?

Yes, there is a cost associated with using the Fillable Kansas Department Of Revenue Application To on airSlate SignNow. However, we offer various pricing plans that cater to different business needs, ensuring that you receive the best value for an efficient and effective e-signature solution.

-

Can I integrate airSlate SignNow with other software to streamline my Fillable Kansas Department Of Revenue Application To process?

Absolutely! airSlate SignNow provides integration options with various software and applications, enhancing your ability to manage the Fillable Kansas Department Of Revenue Application To seamlessly. This flexibility allows for better data management and improved efficiency in your workflow.

-

How secure is my information when using the Fillable Kansas Department Of Revenue Application To on airSlate SignNow?

Your information is highly secure when using the Fillable Kansas Department Of Revenue Application To on airSlate SignNow. We implement advanced security measures, including data encryption and secure storage, to ensure that your personal and financial information remains protected throughout the filing process.

-

What features does airSlate SignNow offer for managing the Fillable Kansas Department Of Revenue Application To?

airSlate SignNow offers several key features for managing the Fillable Kansas Department Of Revenue Application To, including customizable templates, e-signatures, and real-time tracking. These features help facilitate a smooth application process and enable users to manage their submissions more effectively.

Get more for Fillable Kansas Department Of Revenue Application To

- A guide to writing club by laws uinta county form

- Preschool program 4 year olds 2019 2020 registration form

- Caps form umresearch umd

- Fully completed and signed applications must be submitted electronically to cemenova form

- Professors in the united states wikipedia form

- Clla staff scholarship form texas aampampm university

- Intake form supporting student gender identity mcps form 560 80

- Jv 210 application to commence juvenile court proceedings and decision of social worker judicial council forms

Find out other Fillable Kansas Department Of Revenue Application To

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document