K 40PT Property Tax Relief Claim for Low Income Seniors 2022

What is the K-40PT Property Tax Relief Claim For Low Income Seniors

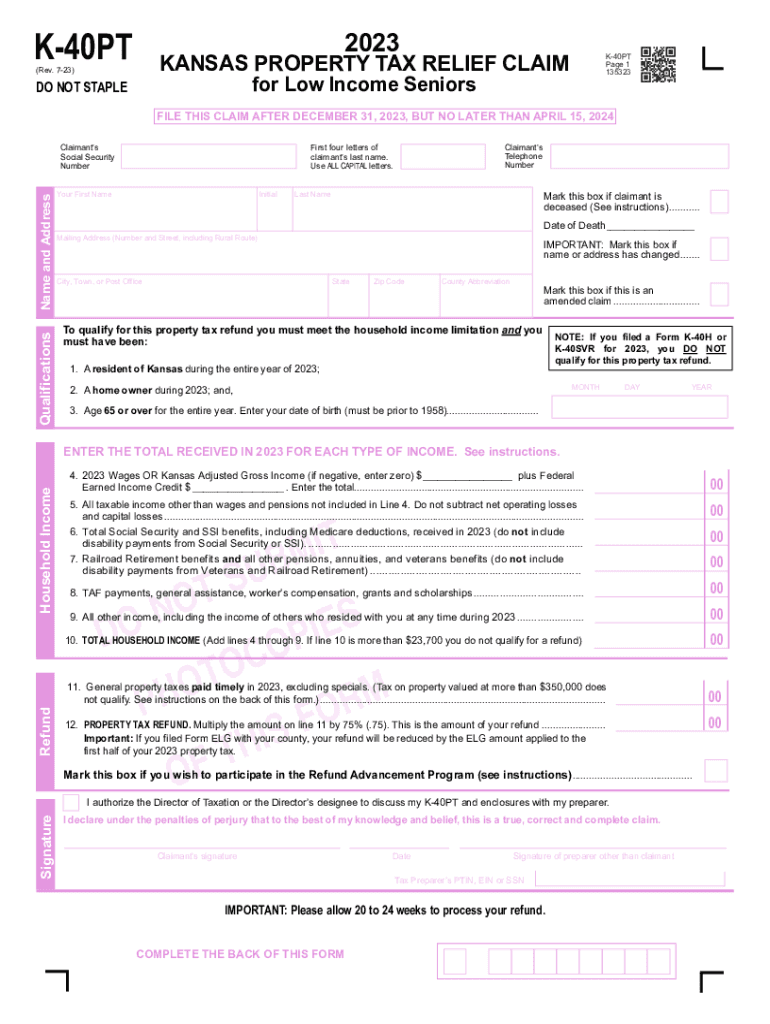

The K-40PT Property Tax Relief Claim For Low Income Seniors is a specific tax relief program designed to assist senior citizens with limited income in managing their property tax obligations. This form allows eligible seniors to apply for a reduction in their property taxes, making it easier for them to maintain home ownership and financial stability. The program aims to alleviate the financial burden on low-income seniors, ensuring they can afford to stay in their homes without the stress of overwhelming tax payments.

Eligibility Criteria

To qualify for the K-40PT Property Tax Relief Claim, applicants must meet certain criteria. Generally, seniors must be at least sixty-five years old and have a total household income that falls below a specified threshold. Additionally, applicants must own and occupy the property for which they are seeking tax relief. It is important for seniors to review the specific income limits and other requirements set by their state to ensure they meet all eligibility guidelines.

Steps to Complete the K-40PT Property Tax Relief Claim For Low Income Seniors

Completing the K-40PT Property Tax Relief Claim involves several key steps:

- Gather necessary documentation, including proof of age, income statements, and property ownership records.

- Obtain the K-40PT form from your local tax authority or download it from the appropriate state website.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Attach any required supporting documents to the completed form.

- Submit the form by the designated deadline, either online, by mail, or in person, depending on state guidelines.

Required Documents

When applying for the K-40PT Property Tax Relief Claim, applicants must provide specific documentation to verify their eligibility. Required documents typically include:

- Proof of age, such as a birth certificate or government-issued ID.

- Income verification, which may include tax returns, Social Security statements, or other income documentation.

- Property ownership evidence, such as a deed or mortgage statement.

Ensuring all documents are accurate and up-to-date will facilitate a smoother application process.

Form Submission Methods

Applicants can submit the K-40PT Property Tax Relief Claim through various methods, depending on their state’s regulations. Common submission methods include:

- Online submission via the state tax authority's website, if available.

- Mailing the completed form and supporting documents to the appropriate tax office.

- In-person submission at designated local tax offices or community centers.

It is advisable to confirm the preferred submission method with local tax authorities to ensure compliance with state requirements.

Filing Deadlines / Important Dates

Filing deadlines for the K-40PT Property Tax Relief Claim can vary by state. Generally, applications must be submitted by a specific date each year to qualify for the current tax year. It is crucial for applicants to be aware of these deadlines to avoid missing out on potential tax relief. Checking with local tax authorities for the exact filing dates is recommended to ensure timely submission.

Quick guide on how to complete k 40pt property tax relief claim for low income seniors

Complete K 40PT Property Tax Relief Claim For Low Income Seniors effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Handle K 40PT Property Tax Relief Claim For Low Income Seniors on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to edit and electronically sign K 40PT Property Tax Relief Claim For Low Income Seniors without breaking a sweat

- Find K 40PT Property Tax Relief Claim For Low Income Seniors and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of sharing your form—through email, text message (SMS), invite link, or download it onto your PC.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign K 40PT Property Tax Relief Claim For Low Income Seniors and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 40pt property tax relief claim for low income seniors

Create this form in 5 minutes!

How to create an eSignature for the k 40pt property tax relief claim for low income seniors

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the K 40PT Property Tax Relief Claim For Low Income Seniors?

The K 40PT Property Tax Relief Claim For Low Income Seniors is a program that provides property tax relief to eligible low-income seniors. This claim can signNowly reduce the tax burden for seniors, allowing them to keep more of their hard-earned money. Understanding the details of this program is essential for qualifying seniors to take advantage of the benefits.

-

How can airSlate SignNow help with the K 40PT Property Tax Relief Claim For Low Income Seniors?

airSlate SignNow offers an easy-to-use platform for preparing and signing documents related to the K 40PT Property Tax Relief Claim For Low Income Seniors. With our eSignature capabilities, seniors can quickly and securely complete their applications from the comfort of their homes. This streamlines the process, making it simpler for those who may struggle with traditional methods.

-

Is there a cost associated with using airSlate SignNow for the K 40PT Property Tax Relief Claim For Low Income Seniors?

airSlate SignNow provides a cost-effective solution for processing documents related to the K 40PT Property Tax Relief Claim For Low Income Seniors. Our pricing plans are designed to accommodate various budgets, ensuring that even those on fixed incomes can access the necessary tools to submit their claims. Check our website for specific details on pricing and packages.

-

What features does airSlate SignNow offer for managing the K 40PT Property Tax Relief Claim For Low Income Seniors?

airSlate SignNow includes a range of features tailored to managing the K 40PT Property Tax Relief Claim For Low Income Seniors. Key features include secure document storage, customizable templates, and automated reminders for important deadlines. These tools enhance the user experience, making claim submissions more efficient.

-

Can I access airSlate SignNow from any device for my K 40PT Property Tax Relief Claim For Low Income Seniors?

Yes, you can access airSlate SignNow from any device, including desktops, tablets, and smartphones. This flexibility allows seniors to manage their K 40PT Property Tax Relief Claim For Low Income Seniors on the go, ensuring they can work on their claims whenever it is convenient for them. Our cloud-based platform guarantees seamless access anytime, anywhere.

-

Are there integrations available that can assist with the K 40PT Property Tax Relief Claim For Low Income Seniors?

airSlate SignNow offers various integrations that can assist with the K 40PT Property Tax Relief Claim For Low Income Seniors. By integrating with popular tools such as Google Drive, Dropbox, and CRM systems, users can streamline their document management process and ensure that their claims are handled efficiently. These integrations create a more cohesive workflow for seniors navigating their property tax relief applications.

-

What is the benefit of using airSlate SignNow for the K 40PT Property Tax Relief Claim For Low Income Seniors?

Using airSlate SignNow for the K 40PT Property Tax Relief Claim For Low Income Seniors offers signNow benefits, including time savings and enhanced convenience. Our digital solution eliminates the need for in-person meetings and paper documents, making the process faster and more user-friendly. Seniors can enjoy peace of mind knowing their claims are handled securely and efficiently.

Get more for K 40PT Property Tax Relief Claim For Low Income Seniors

Find out other K 40PT Property Tax Relief Claim For Low Income Seniors

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template