Form 502W Pass through Entity Withholding Tax Payment Form 502W Pass through Entity Withholding Tax Payment 2021

What is the Form 502W?

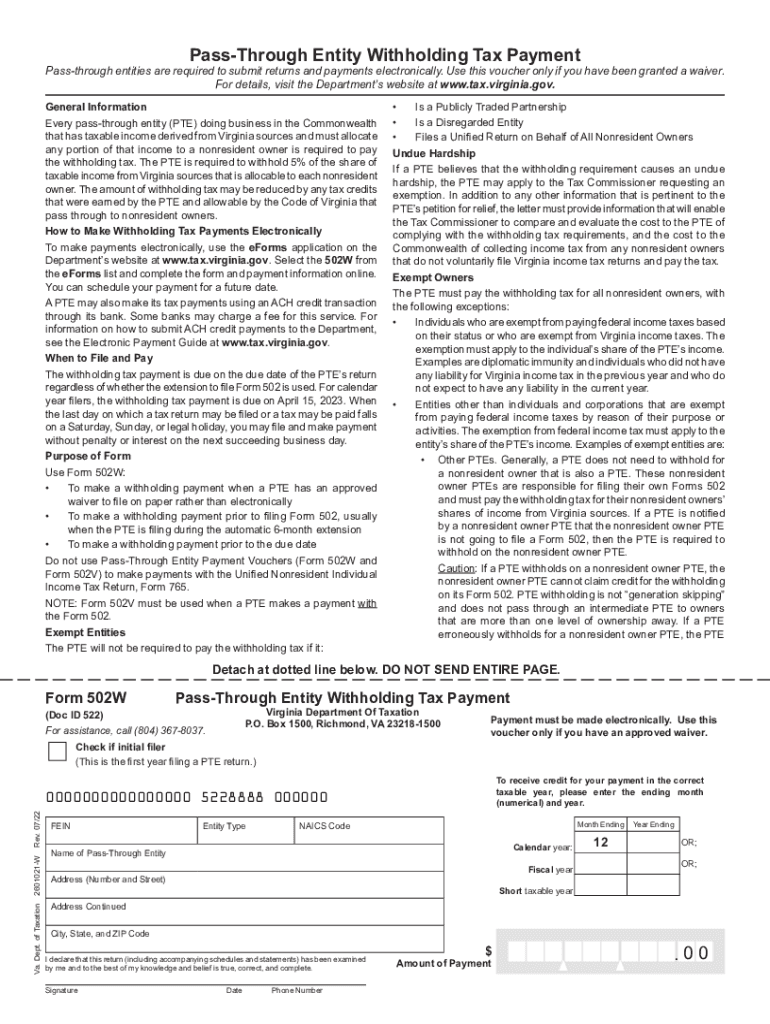

The Form 502W, also known as the Pass Through Entity Withholding Tax Payment form, is a crucial document for businesses operating in Virginia that are classified as pass-through entities. This includes partnerships, limited liability companies (LLCs), and S corporations. The form is used to report and remit withholding tax on income that is passed through to the owners or shareholders. Understanding this form is essential for compliance with Virginia tax regulations and ensuring that the correct amount of tax is withheld from distributions made to owners.

Steps to Complete the Form 502W

Completing the Form 502W involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information about the entity, including its name, address, and federal employer identification number (EIN). Next, calculate the total taxable revenue that will be subject to withholding. This includes income that is distributed to the owners. Once the amounts are determined, fill out the form by entering the appropriate figures in the designated fields. Finally, review the completed form for accuracy before submission.

Filing Deadlines and Important Dates

Timely filing of the Form 502W is essential to avoid penalties. The form must be submitted to the Virginia Department of Taxation by the due date, which typically aligns with the entity's tax return filing deadline. For most entities, this is the 15th day of the fourth month following the end of the tax year. It is important to keep track of these deadlines to ensure compliance and avoid interest or penalties for late payments.

Key Elements of the Form 502W

Understanding the key elements of the Form 502W is vital for accurate completion. The form requires details such as the entity's legal name, address, and EIN. Additionally, it includes sections for reporting the total amount of income subject to withholding and the corresponding tax amount. It is also important to include the payment method, whether by check or electronic payment, to ensure proper processing by the Virginia Department of Taxation.

Legal Use of the Form 502W

The Form 502W serves a legal purpose in the context of Virginia tax law. It is used to comply with state requirements for withholding taxes on income distributed by pass-through entities. Failure to properly complete and submit this form can result in penalties and interest charges. Therefore, understanding the legal implications of this form is essential for business owners and tax professionals alike.

Who Issues the Form 502W?

The Form 502W is issued by the Virginia Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating in Virginia. It is important for entities to stay informed about any updates or changes to the form or related regulations, as these can impact filing requirements and procedures.

Examples of Using the Form 502W

Using the Form 502W is common among various types of pass-through entities. For instance, a partnership distributing profits to its partners must complete this form to report the withholding tax. Similarly, an S corporation making distributions to its shareholders would also use the Form 502W to ensure compliance with state tax laws. Understanding these examples helps clarify the practical application of the form in real-world scenarios.

Quick guide on how to complete form 502w pass through entity withholding tax payment form 502w pass through entity withholding tax payment

Prepare Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment with ease on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to generate, edit, and eSign your documents swiftly without delays. Manage Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment on any device via the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The simplest way to edit and eSign Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment effortlessly

- Obtain Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Underline pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Modify and eSign Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 502w pass through entity withholding tax payment form 502w pass through entity withholding tax payment

Create this form in 5 minutes!

How to create an eSignature for the form 502w pass through entity withholding tax payment form 502w pass through entity withholding tax payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Virginia entity withholding?

Virginia entity withholding refers to the tax withholding process required for certain entities operating within the state. It mandates that businesses withhold a portion of income for tax purposes, ensuring compliance with Virginia tax regulations. Understanding this process is essential for businesses to avoid penalties and maintain good standing.

-

How can airSlate SignNow help with Virginia entity withholding?

airSlate SignNow streamlines the document signing process, making it easier for businesses to manage compliance related to Virginia entity withholding. With our eSignature feature, you can quickly send tax-related documents for signature, ensuring timely submissions. This helps eliminate delays and supports accurate tax reporting.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing tailored to suit the needs of businesses managing Virginia entity withholding. We provide various subscription plans that provide access to our eSigning capabilities and other features. Additionally, our cost-effective solutions help businesses save money while complying with tax obligations.

-

What features does airSlate SignNow provide for tax compliance?

airSlate SignNow includes features like template creation, automated workflows, and comprehensive audit trails. These tools facilitate easier management of documents associated with Virginia entity withholding. By utilizing these features, businesses can enhance their compliance processes and maintain records effortlessly.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes the security of your documents, including those related to Virginia entity withholding. Our platform is equipped with advanced encryption and security protocols to safeguard sensitive information. You can send and eSign documents with confidence, knowing your data is protected.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely, airSlate SignNow seamlessly integrates with popular accounting software to enhance the process of managing Virginia entity withholding. This integration allows for easy synchronization of tax-related documents and information. By using our integrations, businesses can streamline their workflow and improve overall efficiency.

-

What benefits can businesses expect from using airSlate SignNow for their document needs?

Using airSlate SignNow offers numerous benefits, particularly for managing Virginia entity withholding. These benefits include increased efficiency, reduced turnaround times, and improved accuracy in tax documentation. Our user-friendly platform empowers businesses to focus on growth while ensuring compliance.

Get more for Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment

- 5113 1 354 in the district court of judicial council kansasjudicialcouncil form

- 5113 213 in the district court of county kansas in the interest of name year of birth a male female case no form

- 5113 1 133 in the district court of kansas judicial council kansasjudicialcouncil form

- Protective orders and the importance of tcic reporting texas kansasjudicialcouncil form

- Petition promissory form

- Kansasjudicialcouncil 6969217 form

- 5113 200 in the district court of county kansas in the interest of name year of birth a male female case no form

- 5113 315 in the district court of county kansas in the matter of name juvenile year of birth a male female case no form

Find out other Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History