Form 502W Pass through Entity Withholding Tax Payment Form 502W Pass through Entity Withholding Tax Payment 2021

Understanding the VA Entity Withholding Form

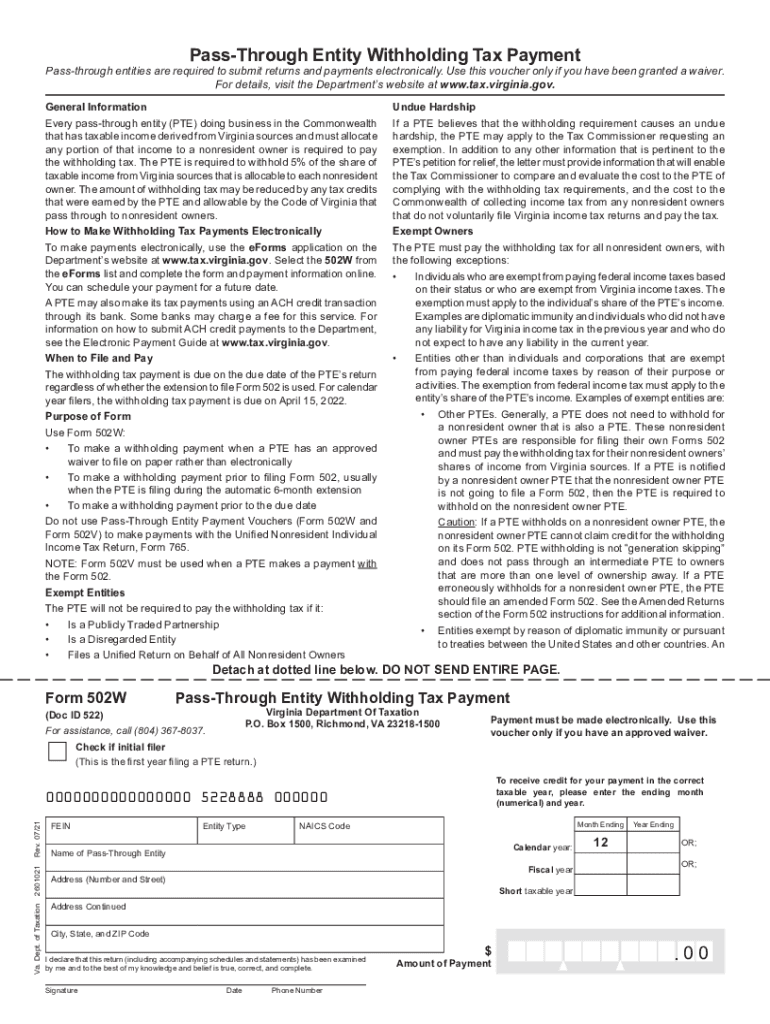

The VA Entity Withholding Form, also known as the Virginia 502W, is a crucial document for businesses operating as pass-through entities in Virginia. This form is used to report and remit withholding tax on income that is allocated to non-resident partners or members. It ensures compliance with Virginia tax laws and facilitates the correct payment of taxes owed by the entity on behalf of its non-resident stakeholders.

Steps to Complete the VA Entity Withholding Form

Completing the Virginia 502W involves several key steps to ensure accuracy and compliance:

- Gather necessary information about the entity and its members or partners.

- Calculate the total amount of income subject to withholding.

- Determine the appropriate withholding rate as per Virginia tax regulations.

- Fill out the form with accurate details, including the entity's name, address, and federal identification number.

- Report the total withholding amount and provide details for each non-resident member or partner.

- Review the completed form for any errors before submission.

Legal Use of the VA Entity Withholding Form

The Virginia 502W is legally binding when completed accurately and submitted on time. It serves as a formal declaration of the entity's withholding obligations and must adhere to the guidelines set forth by the Virginia Department of Taxation. Proper use of this form helps prevent penalties and ensures that the entity meets its tax responsibilities under state law.

Filing Deadlines and Important Dates

Timely filing of the Virginia 502W is essential to avoid penalties. The form is typically due on the 15th day of the fourth month following the end of the entity's tax year. For calendar year filers, this means the form is due by April 15. Entities should also be aware of any specific deadlines for estimated payments, which may vary based on their tax situation.

Obtaining the VA Entity Withholding Form

The Virginia 502W can be easily obtained from the Virginia Department of Taxation's website. It is available in a downloadable format, allowing businesses to print and complete the form as needed. Additionally, electronic filing options may be available, which can streamline the submission process and enhance efficiency.

Key Elements of the VA Entity Withholding Form

When filling out the Virginia 502W, several key elements must be included:

- Entity identification information, including name and federal tax identification number.

- Details of each non-resident partner or member, including their share of income.

- The total amount withheld for each individual and the overall total.

- Signature of an authorized representative of the entity to validate the form.

Quick guide on how to complete 2021 form 502w pass through entity withholding tax payment form 502w 2021 pass through entity withholding tax payment

Prepare Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the features you need to create, modify, and eSign your documents quickly without delays. Manage Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment on any device with airSlate SignNow Android or iOS applications and simplify any document-related operation today.

The most efficient way to modify and eSign Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment with ease

- Locate Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment and ensure effective communication at any point during the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 502w pass through entity withholding tax payment form 502w 2021 pass through entity withholding tax payment

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 502w pass through entity withholding tax payment form 502w 2021 pass through entity withholding tax payment

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an e-signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the VA entity withholding form?

The VA entity withholding form is a document required by Virginia tax authorities to report and withhold taxes on certain payments made to out-of-state entities. This form ensures that businesses comply with state tax regulations. Understanding how to fill it out correctly is essential for avoiding penalties.

-

How can airSlate SignNow help with the VA entity withholding form?

airSlate SignNow streamlines the process of preparing and signing the VA entity withholding form, making it easy for businesses to handle their tax documentation. With our user-friendly platform, you can quickly fill out, eSign, and send the form securely. This saves time and reduces the chances of errors.

-

Are there any fees associated with using airSlate SignNow for the VA entity withholding form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including those who frequently manage the VA entity withholding form. The pricing is competitive and provides access to additional features that enhance productivity. Choosing the right plan can offer cost-effective solutions for your document signing needs.

-

What features does airSlate SignNow include for managing the VA entity withholding form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure document storage for managing the VA entity withholding form efficiently. Users can also benefit from bulk sending options, allowing multiple forms to be sent at once. These features enhance workflow and improve document management.

-

Can I integrate airSlate SignNow with other software to manage the VA entity withholding form?

Absolutely! airSlate SignNow offers integrations with a variety of software, including CRM systems and accounting tools, which can help facilitate the management of the VA entity withholding form. This interoperability supports seamless business operations, allowing for efficient data transfer and document handling.

-

Is there customer support for help with the VA entity withholding form?

Yes, airSlate SignNow provides dedicated customer support to assist with any questions regarding the VA entity withholding form or overall platform usage. Our support team can guide you through the features and help troubleshoot issues. This ensures that you have a smooth experience when utilizing our solution.

-

What benefits can I expect from using airSlate SignNow for the VA entity withholding form?

Using airSlate SignNow for the VA entity withholding form offers numerous benefits, including increased efficiency, enhanced security, and compliance with state regulations. The platform simplifies document handling, reducing turnaround times and improving accuracy. This leads to a more effective business operation overall.

Get more for Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment

- Option to purchase addendum to residential lease lease or rent to own arizona form

- Arizona prenuptial premarital agreement with financial statements arizona form

- Arizona prenuptial premarital agreement without financial statements arizona form

- Az prenuptial form

- Financial statements only in connection with prenuptial premarital agreement arizona form

- Revocation of premarital or prenuptial agreement arizona form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children arizona form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497296871 form

Find out other Form 502W Pass Through Entity Withholding Tax Payment Form 502W Pass Through Entity Withholding Tax Payment

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word