Pass through Entity Withholding FAQMaine Revenue Services 2020

Understanding the Virginia Pass Through Entity Withholding

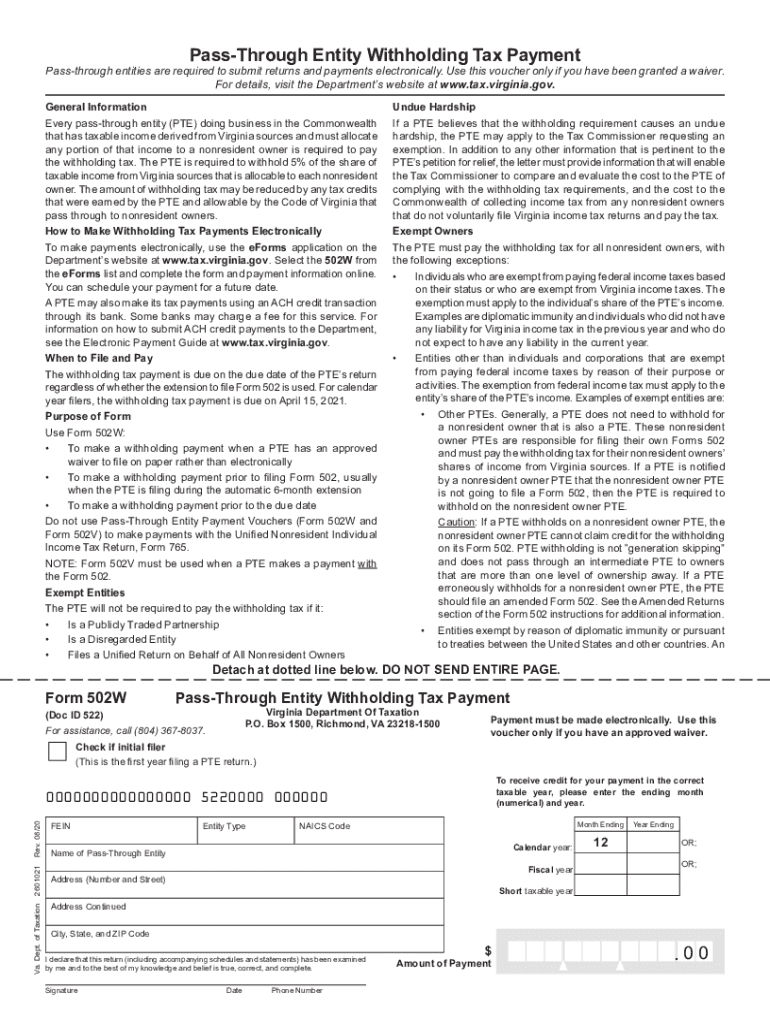

The Virginia pass-through entity withholding tax applies to certain business entities, such as partnerships and limited liability companies (LLCs), that pass income to their owners. This tax ensures that the state collects revenue from entities that may not have a physical presence in Virginia but generate income from Virginia sources. Understanding this tax is crucial for compliance and for avoiding potential penalties.

Steps to Complete the Virginia Form 502

Filling out the Virginia Form 502 requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary information about the entity, including its legal name, federal employer identification number (EIN), and address.

- Determine the total income generated from Virginia sources.

- Calculate the withholding amount based on the applicable rates for the income earned.

- Complete the form by entering the required information in the designated fields.

- Review the completed form for accuracy before submission.

Filing Deadlines and Important Dates

Timely filing of the Virginia Form 502 is essential to avoid penalties. The form is typically due on the fifteenth day of the fourth month following the close of the entity's tax year. For entities operating on a calendar year, this means the form is due by April 15. It is advisable to check for any changes to deadlines or additional requirements each tax year.

Penalties for Non-Compliance

Failure to file the Virginia Form 502 or to remit the appropriate withholding tax can result in significant penalties. These may include fines and interest on unpaid amounts. Entities should ensure compliance to avoid these financial repercussions and maintain good standing with the Virginia Department of Taxation.

Digital vs. Paper Version of Form 502

Entities have the option to file the Virginia Form 502 either digitally or via paper. The digital version offers advantages such as faster processing times and reduced risk of errors. However, some entities may prefer the paper version for record-keeping purposes. Understanding the benefits and requirements of each method can help entities choose the best option for their needs.

Eligibility Criteria for Pass Through Withholding

Not all entities are subject to Virginia's pass-through entity withholding tax. Generally, eligibility is determined by the type of entity and the nature of its income. Entities that generate income from Virginia sources and pass that income to their owners are typically required to withhold tax. It is important for entities to assess their eligibility to ensure compliance with state tax laws.

Required Documents for Filing

When completing the Virginia Form 502, certain documents may be required to support the information provided. These may include financial statements, records of income earned from Virginia sources, and documentation of any credits or deductions claimed. Having these documents readily available can facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete pass through entity withholding faqmaine revenue services

Effortlessly Prepare Pass through Entity Withholding FAQMaine Revenue Services on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the right forms and securely keep them online. airSlate SignNow provides all the tools necessary to swiftly create, edit, and eSign your documents without delays. Handle Pass through Entity Withholding FAQMaine Revenue Services on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and eSign Pass through Entity Withholding FAQMaine Revenue Services with Ease

- Locate Pass through Entity Withholding FAQMaine Revenue Services and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Alter and eSign Pass through Entity Withholding FAQMaine Revenue Services to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pass through entity withholding faqmaine revenue services

Create this form in 5 minutes!

How to create an eSignature for the pass through entity withholding faqmaine revenue services

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is Form 502 for VA State and how is it used?

Form 502 for VA State is a tax form used by individuals and businesses to report Virginia income tax. It is essential for fulfilling state tax obligations and ensuring compliance with state regulations. Utilizing airSlate SignNow can streamline the signing and submission process for Form 502, making it easier for users.

-

How does airSlate SignNow facilitate the completion of Form 502 for VA State?

airSlate SignNow provides an intuitive platform to create, edit, and eSign Form 502 for VA State efficiently. Users can easily input their data, ensure all necessary fields are filled, and send the form securely to other parties for signatures. This simplifies the entire process, allowing for quick submission to the Virginia Department of Taxation.

-

What are the pricing options for using airSlate SignNow for Form 502 for VA State?

airSlate SignNow offers a range of pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, there is an affordable plan that allows you to use the platform for managing documents like Form 502 for VA State. Visit our pricing page for detailed information about each plan.

-

Can I integrate airSlate SignNow with other applications to manage Form 502 for VA State?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing document management for Form 502 for VA State. You can connect our platform with tools like Google Drive, Salesforce, and other productivity applications. This allows for a more comprehensive workflow for your business.

-

What benefits does airSlate SignNow provide for signing Form 502 for VA State?

One of the key benefits of using airSlate SignNow is the ease of signing Form 502 for VA State electronically, which saves time and reduces the need for printing documents. Our platform ensures the integrity and security of your documents, providing a legal eSignature that is compliant with state laws. This enhances trust and efficiency in the signing process.

-

Is there customer support available for questions regarding Form 502 for VA State?

Absolutely! airSlate SignNow offers dedicated customer support for any inquiries related to Form 502 for VA State. Whether you need assistance with the platform or have specific questions about the form itself, our support team is available to provide the help you need.

-

How secure is the signing process for Form 502 for VA State with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Form 502 for VA State. Our platform employs advanced encryption methods and complies with industry standards to ensure that your documents are safe and secure from unauthorized access during the signing process.

Get more for Pass through Entity Withholding FAQMaine Revenue Services

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497429177 form

- Wa odometer disclosure statement form

- Wa odometer 497429179 form

- Promissory note in connection with sale of vehicle or automobile washington form

- Bill of sale for watercraft or boat washington form

- Bill of sale of automobile and odometer statement for as is sale washington form

- Construction contract cost plus or fixed fee washington form

- Painting contract for contractor washington form

Find out other Pass through Entity Withholding FAQMaine Revenue Services

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document