Virginia Form 502 2018

What is the Virginia Form 502

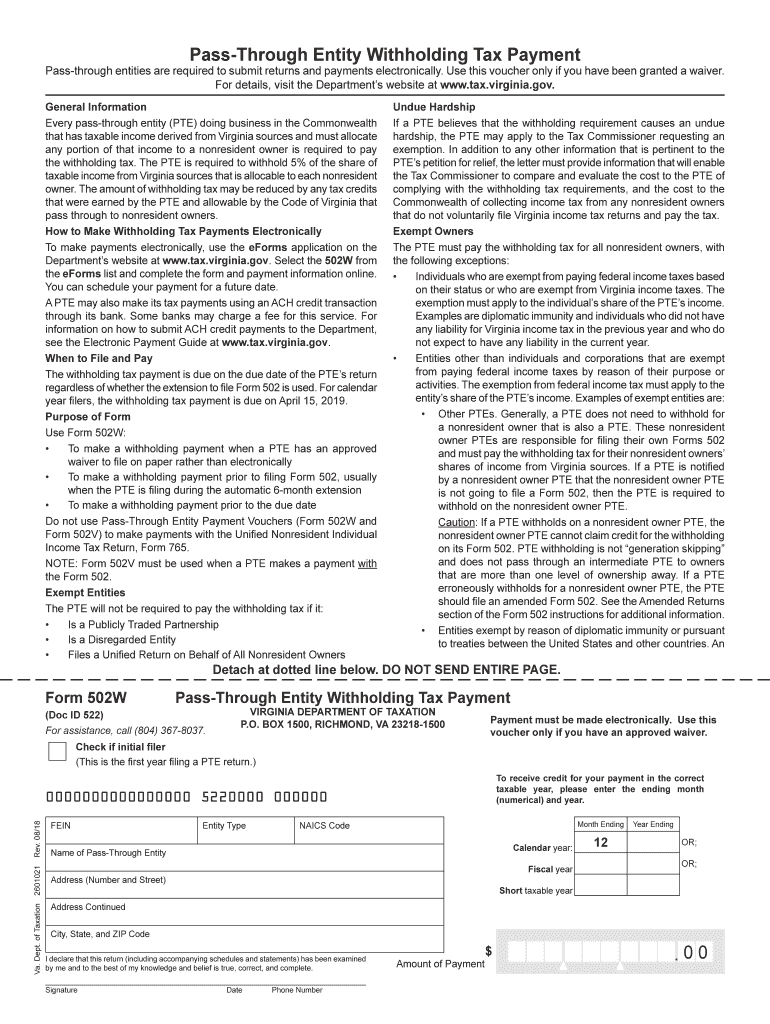

The Virginia Form 502 is a state tax document used by businesses to report income and calculate tax liabilities. This form is specifically designed for pass-through entities, such as partnerships and S corporations, allowing them to report income that is passed through to individual owners or shareholders. The information provided on this form is essential for the Virginia Department of Taxation to assess the tax obligations of the entity and its owners accurately.

Steps to complete the Virginia Form 502

Completing the Virginia Form 502 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by entering the required information in the designated fields, such as total income, deductions, and credits. It is essential to double-check all entries for accuracy before signing the form. After completing the form, ensure it is submitted by the appropriate deadline to avoid penalties.

Legal use of the Virginia Form 502

The Virginia Form 502 must be used in accordance with state tax laws and regulations. It is legally binding once signed and submitted, meaning that the information provided must be truthful and accurate. Misrepresentation or errors can lead to penalties, including fines or additional taxes owed. Understanding the legal implications of this form is crucial for compliance and to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Virginia Form 502 are typically aligned with the federal tax deadlines. Generally, the form must be filed by May 1 of the year following the tax year being reported. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to keep track of these dates to ensure timely submission and avoid late fees.

Form Submission Methods

The Virginia Form 502 can be submitted through various methods, including online filing, mailing a paper form, or delivering it in person to a local tax office. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. If mailing the form, ensure it is sent well before the deadline to account for any postal delays.

Key elements of the Virginia Form 502

Key elements of the Virginia Form 502 include sections for reporting total income, deductions, and credits. The form also requires information about the business entity, including its name, address, and federal identification number. Additionally, it includes a section for signatures from authorized representatives, affirming that the information provided is accurate and complete.

Examples of using the Virginia Form 502

Examples of using the Virginia Form 502 include partnerships that need to report income distributed to partners or S corporations that pass income through to shareholders. For instance, a partnership with multiple partners would complete the form to report their collective income and allocate the appropriate amounts to each partner, ensuring compliance with state tax obligations.

Quick guide on how to complete what is a 502w 2018 2019 form

Your assistance manual on how to prepare your Virginia Form 502

If you wish to understand how to complete and submit your Virginia Form 502, here are a few concise instructions on how to simplify tax submission.

To start, you just need to create your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to edit, draft, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify responses as necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your Virginia Form 502 in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; explore variations and schedules.

- Click Obtain form to open your Virginia Form 502 in our editor.

- Complete the necessary fillable sections with your information (text, numbers, checkmarks).

- Utilize the Signature Tool to insert your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Preserve changes, print your copy, submit it to your recipient, and save it to your device.

Make the most of this manual to file your taxes electronically with airSlate SignNow. Please remember that paper filing can lead to increased return errors and delayed refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct what is a 502w 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

-

What is the procedure to fill out a form for more than one post in AAI 2018?

Hello dear AAI JOB aspirantFill up different posts of present recruitment 02/2018 by using different email IDs but phone number can be same.

-

What is the process to fill out the CISF recruitment 2018 application form?

Central Industrial Security Force (CISF) Job Notification:Central Industrial Security Force (CISF) invited applications for the 519 posts of Assistant Sub-Inspector post. The eligible candidates can apply to the post through the prescribed format on or before 15 December 2018.Important Date:Last date of receipt of application by the Unit Commanders: 12 December 2018Last date of receipt of application by respective Zonal DIsG: 22 December 2018Written examination: 24 February 2019

-

What is the last date to fill out the ICAR 2018 exam form?

Hii,The last date to fill out the ICAR 2018 exam form is in May 2018. Specific date is not yet released by the officials. But if you want to apply for the entrance exam then you can apply for it as soon as possible.Click here: ICAR application formYou can also fill your respective application form by visiting the official website.Or else you can click on the above mentioned link and get it filled easily.The application fee for the form is mentioned in the below attached picture.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the what is a 502w 2018 2019 form

How to create an eSignature for the What Is A 502w 2018 2019 Form in the online mode

How to make an electronic signature for your What Is A 502w 2018 2019 Form in Google Chrome

How to generate an electronic signature for putting it on the What Is A 502w 2018 2019 Form in Gmail

How to generate an eSignature for the What Is A 502w 2018 2019 Form straight from your smartphone

How to create an electronic signature for the What Is A 502w 2018 2019 Form on iOS

How to create an eSignature for the What Is A 502w 2018 2019 Form on Android devices

People also ask

-

What is a 502w form, and why is it important?

The 502w form is a crucial document used for tax withholding purposes, particularly for employees and employers. Understanding how to properly complete and submit the 502w form is vital to ensure accurate tax reporting and compliance. airSlate SignNow streamlines this process, facilitating quick electronic signing and distribution.

-

How can I use airSlate SignNow to manage my 502w form?

With airSlate SignNow, you can easily upload, edit, and send your 502w form for electronic signatures. The platform allows multiple recipients to sign the document seamlessly, ensuring that all necessary parties can access and complete the 502w form quickly and efficiently. Plus, you can track the signing process in real-time.

-

What pricing plans are available for using the 502w form in airSlate SignNow?

airSlate SignNow offers a variety of pricing plans that can accommodate both individuals and businesses. Each plan allows you to manage documents like the 502w form with various levels of features tailored to meet your needs. You can start with a free trial to explore how the platform can enhance your document management.

-

What features does airSlate SignNow offer for the 502w form?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure cloud storage for your 502w form. The platform also includes advanced authentication options to ensure that only authorized users can sign the document. This combination of features simplifies the signing process while maintaining security.

-

Can I integrate airSlate SignNow with other software for the 502w form?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to incorporate your workflow for the 502w form. This includes CRMs, accounting software, and file storage systems, which helps streamline the process of managing your documents. These integrations enhance productivity and reduce manual tasks.

-

What benefits can I expect from using airSlate SignNow for the 502w form?

Using airSlate SignNow for your 502w form offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy in document handling. With electronic signature capabilities, you can eliminate the hassle of printing and mailing, saving time and resources. Moreover, the audit trail feature ensures compliance and accountability.

-

Is airSlate SignNow secure for handling my 502w form?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your 502w form and other documents. With encryption, secure cloud storage, and compliance with regulations, you can trust that your sensitive information is kept safe throughout the signing process. This commitment to security allows you to focus on your business without worry.

Get more for Virginia Form 502

- Springfield t delaware springfield s d lst holly neff local tax form

- Idx form

- Great depression bell ringer form

- In the fairfax county general district court form

- Inquiryclaim form trs trs virginia

- Code of virginia code article 3 procedure in civil cases form

- Protective orders what does the new legislation mean form

- In the court of county tennessee motherfather form

Find out other Virginia Form 502

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF