Dasny Certified Payroll Form Excel 2012-2026

What is the Dasny Certified Payroll Form Excel

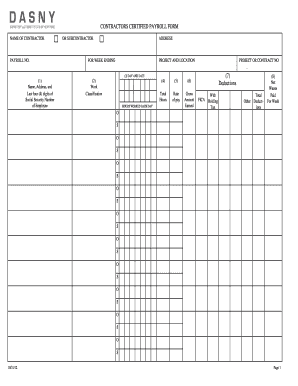

The Dasny Certified Payroll Form Excel is a specialized document used by contractors and subcontractors working on public works projects in New York State. This form is essential for reporting wages paid to laborers and ensuring compliance with prevailing wage laws. The form includes detailed information about the project, the workers employed, their job classifications, and the hours worked. It serves as a critical tool for maintaining transparency and accountability in public contracting.

Steps to Complete the Dasny Certified Payroll Form Excel

Completing the Dasny Certified Payroll Form Excel involves several key steps:

- Download the Form: Obtain the latest version of the Dasny Certified Payroll Form Excel from a reliable source.

- Enter Project Information: Fill in the project name, location, and contract number at the top of the form.

- List Employee Details: For each employee, provide their name, social security number, job classification, and the hours worked during the pay period.

- Report Wage Information: Include the gross wages paid to each employee, along with any deductions made.

- Sign and Date: Ensure that the form is signed by an authorized representative of the contractor, certifying the accuracy of the information provided.

Legal Use of the Dasny Certified Payroll Form Excel

The legal use of the Dasny Certified Payroll Form Excel is governed by New York State labor laws, which require contractors on public works projects to submit certified payroll records. These records must accurately reflect the wages and hours worked by employees to ensure compliance with the prevailing wage laws. Failure to submit accurate forms can result in penalties, including fines and potential disqualification from future contracts.

Key Elements of the Dasny Certified Payroll Form Excel

Understanding the key elements of the Dasny Certified Payroll Form Excel is crucial for accurate completion:

- Employee Information: Names, social security numbers, and job classifications must be clearly listed.

- Hours Worked: Total hours worked by each employee during the reporting period should be documented.

- Wage Rates: Include the applicable wage rates for each job classification as per the prevailing wage schedule.

- Certifications: The form must be certified by an authorized representative, affirming the truthfulness of the information provided.

Filing Deadlines / Important Dates

It is important to adhere to specific filing deadlines when submitting the Dasny Certified Payroll Form Excel. Generally, these forms must be submitted weekly for ongoing projects, with the deadline typically set for the end of the week. Contractors should be aware of any additional deadlines that may be specified in their contract or by the contracting agency to avoid penalties.

Form Submission Methods

The Dasny Certified Payroll Form Excel can be submitted through various methods, ensuring convenience for contractors:

- Online Submission: Many agencies allow for electronic submission of certified payroll forms through their online portals.

- Mail: Completed forms can be mailed to the designated agency address as specified in the contract.

- In-Person Submission: Contractors may also choose to deliver the forms in person to the appropriate agency office.

Quick guide on how to complete contractors certified payroll form 7 deductions dasny

Handle Dasny Certified Payroll Form Excel anytime, anywhere

Your routine business operations may need extra focus when managing state-specific documents. Reclaim your working hours and reduce paper expenses linked to document-focused workflows with airSlate SignNow. airSlate SignNow provides a wide array of pre-made business documents, including Dasny Certified Payroll Form Excel, which you can utilize and distribute to your business associates. Handle your Dasny Certified Payroll Form Excel seamlessly with robust editing and eSignature features and send it directly to your recipients.

How to acquire Dasny Certified Payroll Form Excel in a few easy steps:

- Select a document appropriate for your state.

- Click Learn More to view the document and ensure its accuracy.

- Choose Get Form to start working on it.

- Dasny Certified Payroll Form Excel will open instantly in the editor. No further steps are needed.

- Utilize airSlate SignNow’s powerful editing options to complete or modify the document.

- Click the Sign tool to generate your signature and eSign your document.

- When ready, click Done, save changes, and access your document.

- Send the document via email or text, or use a link-to-fill option with your partners or allow them to download the document.

airSlate SignNow signNowly saves your time managing Dasny Certified Payroll Form Excel and allows you to find necessary documents in one place. A comprehensive collection of forms is organized and designed to facilitate key business processes required for your organization. The advanced editor reduces the likelihood of mistakes, enabling you to easily correct errors and review your documents on any device before sending them out. Start your free trial now to explore all the advantages of airSlate SignNow for your daily business operations.

Create this form in 5 minutes or less

Find and fill out the correct contractors certified payroll form 7 deductions dasny

FAQs

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the contractors certified payroll form 7 deductions dasny

How to generate an electronic signature for the Contractors Certified Payroll Form 7 Deductions Dasny online

How to generate an electronic signature for your Contractors Certified Payroll Form 7 Deductions Dasny in Chrome

How to make an electronic signature for signing the Contractors Certified Payroll Form 7 Deductions Dasny in Gmail

How to generate an eSignature for the Contractors Certified Payroll Form 7 Deductions Dasny from your smart phone

How to make an electronic signature for the Contractors Certified Payroll Form 7 Deductions Dasny on iOS

How to generate an eSignature for the Contractors Certified Payroll Form 7 Deductions Dasny on Android

People also ask

-

What does a certified payroll report look like?

Your certified payroll report should include the name and address of your business, the government project you're completing, the address of the project, and the project's identifying number. Include the date the work week ended and your payroll number.

-

What is a statement of compliance?

A Statement of Compliance from ABS demonstrates that a manufacturer's product has been inspected or reviewed by ABS and meets the specified requirements of their selected industry standard or testing procedure.

-

What is a statement of compliance for certified payroll?

A payroll is not considered to be certified unless accompanied by the statement of compliance. By signing the form, the contractor or subcontractor declares under penalty of perjury that the information submitted in the payroll reports is true and correct to the best of their knowledge.

-

What is the difference between payroll and certified payroll?

Certified Payroll is a detailed payroll report on a federal form, also called WH-347. A Certified Payroll report is a special payroll report that contractors working on government-funded construction projects or public works must submit weekly.

-

How do you ensure payroll compliance?

How do you ensure accuracy in payroll? Classify workers correctly. Keep meticulous employee and payroll records. Stay informed of the latest payroll regulations. Automate payroll with software programs. Integrate payroll with timekeeping and benefits administration. Audit payroll processes regularly.

Get more for Dasny Certified Payroll Form Excel

Find out other Dasny Certified Payroll Form Excel

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation