What is 706 Tax Return 2022

What is the 706 Tax Return?

The 706 tax return, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a federal form used to report the estate tax liability of a deceased individual. This form is essential for the executor of the estate to determine whether the estate exceeds the federal estate tax exemption threshold. The 706 is particularly relevant for estates with a gross value exceeding the applicable exemption limit, which can vary from year to year. It includes detailed information about the decedent's assets, liabilities, and any deductions that may apply.

Steps to Complete the 706 Tax Return

Completing the 706 tax return involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including property deeds, bank statements, and investment records.

- Determine the gross estate value: Assess the total value of all assets owned by the decedent at the time of death.

- Calculate deductions: Identify any allowable deductions, such as debts, funeral expenses, and charitable contributions.

- Complete the form: Fill out the 706 form accurately, ensuring all information is complete and correct.

- Review and file: Double-check all entries for accuracy before submitting the form to the IRS by the due date.

Filing Deadlines / Important Dates

The 706 tax return must be filed within nine months of the decedent's date of death. If additional time is needed, the executor can request a six-month extension, but this must be submitted before the original due date. It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Required Documents

To complete the 706 tax return, several documents are necessary:

- Death certificate of the decedent

- List of all assets and their valuations

- Documentation of debts and liabilities

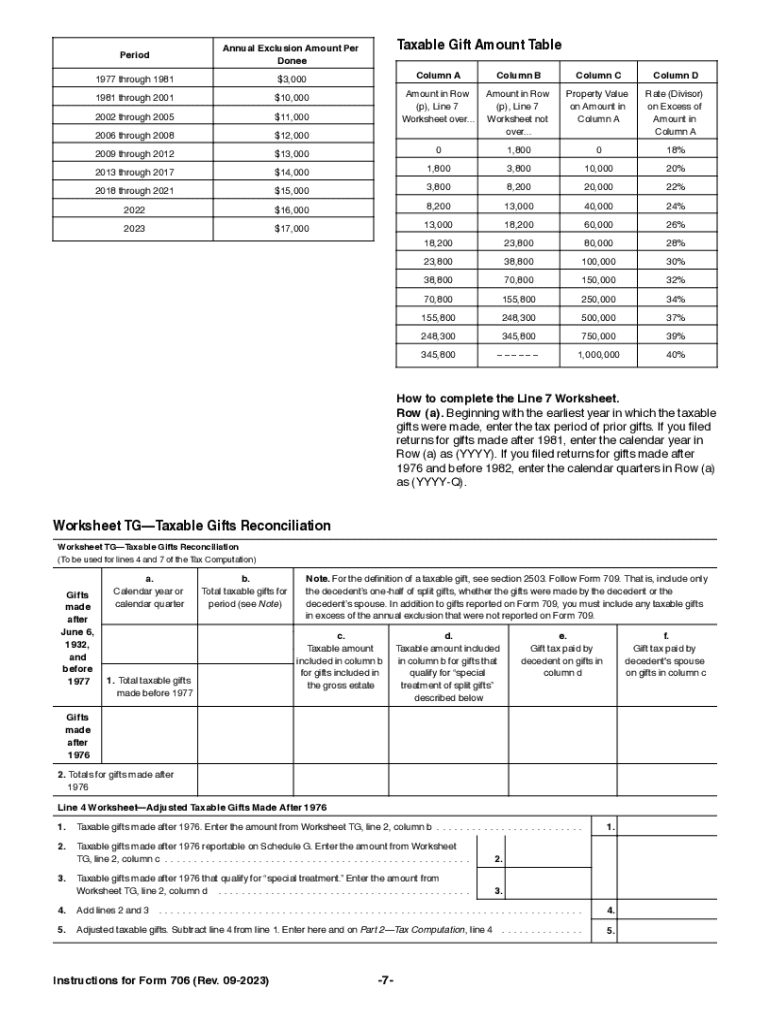

- Records of any prior gifts that may affect the estate tax calculation

- Any relevant tax returns from previous years

IRS Guidelines

The IRS provides specific guidelines for filing the 706 tax return, including instructions on how to value assets and calculate tax liabilities. It is important to refer to the most recent IRS instructions for Form 706 to ensure compliance with current tax laws and regulations. These guidelines outline the necessary steps and documentation required to accurately complete the form.

Penalties for Non-Compliance

Failure to file the 706 tax return on time or inaccuracies in the information provided can result in significant penalties. The IRS may impose a penalty for late filing, which can be a percentage of the unpaid tax amount. Additionally, interest may accrue on any unpaid taxes. It is advisable to ensure timely and accurate filing to avoid these financial repercussions.

Quick guide on how to complete what is 706 tax return

Facilitate What Is 706 Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the right template and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage What Is 706 Tax Return on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign What Is 706 Tax Return with ease

- Obtain What Is 706 Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign What Is 706 Tax Return and guarantee superb communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is 706 tax return

Create this form in 5 minutes!

How to create an eSignature for the what is 706 tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the aoc e 201 and how does it work?

The aoc e 201 is a comprehensive electronic signature solution provided by airSlate SignNow. It enables businesses to easily send, receive, and sign documents online, streamlining the signing process while ensuring legal compliance. With user-friendly features, the aoc e 201 allows you to manage your documents efficiently and securely.

-

What are the pricing options for the aoc e 201?

airSlate SignNow offers competitive pricing for the aoc e 201, ensuring it remains accessible for businesses of all sizes. Various plans are available, allowing you to choose one that fits your needs and budget. Additionally, a free trial may be available to help you evaluate the aoc e 201 before making a commitment.

-

What features does the aoc e 201 provide?

The aoc e 201 comes equipped with robust features, including customizable templates, real-time notifications, and secure cloud storage. Users can leverage advanced tools such as document editing, workflow automation, and team collaboration. These features enable businesses to enhance productivity and efficiency during the signing process.

-

How can the aoc e 201 benefit my business?

Implementing the aoc e 201 in your business can signNowly reduce the time and cost associated with manual document signing. It not only accelerates the signing process but also improves the overall customer experience. By adopting the aoc e 201, you can streamline operations and focus on more critical aspects of your business.

-

Is the aoc e 201 secure for sensitive documents?

Yes, the aoc e 201 is designed with security in mind, employing industry-standard encryption and compliance with regulations such as GDPR and HIPAA. These features ensure that your sensitive documents are protected during the signing process. With the aoc e 201, you can confidently manage your documents without compromising security.

-

Can I integrate the aoc e 201 with other applications?

Absolutely! The aoc e 201 offers seamless integrations with numerous applications, enhancing its versatility. Whether you use CRM systems, cloud storage solutions, or project management tools, the aoc e 201 can easily fit into your existing workflow, making document management and signing simpler.

-

What support options are available for aoc e 201 users?

airSlate SignNow provides comprehensive support for aoc e 201 users through various channels, including email, chat, and a detailed knowledge base. This ensures you receive assistance whenever you encounter issues or have questions. The commitment to customer service means the aoc e 201 is backed by a team ready to help you succeed.

Get more for What Is 706 Tax Return

- Cube that is fillable form

- Certificate of real estate value sdcl 7 9 74 minnehahacounty form

- Form ct 245 iinstructions for form ct 245 maintenance fee tax ny

- Mvms physical education department monthly exercise log form

- Biometric exception form

- Phone number for the dav form

- Arkansas confidential information sheet

- Initiating application family court form

Find out other What Is 706 Tax Return

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will