Business & Excise Tax Forms 2023

Understanding the Business and Excise Tax Forms

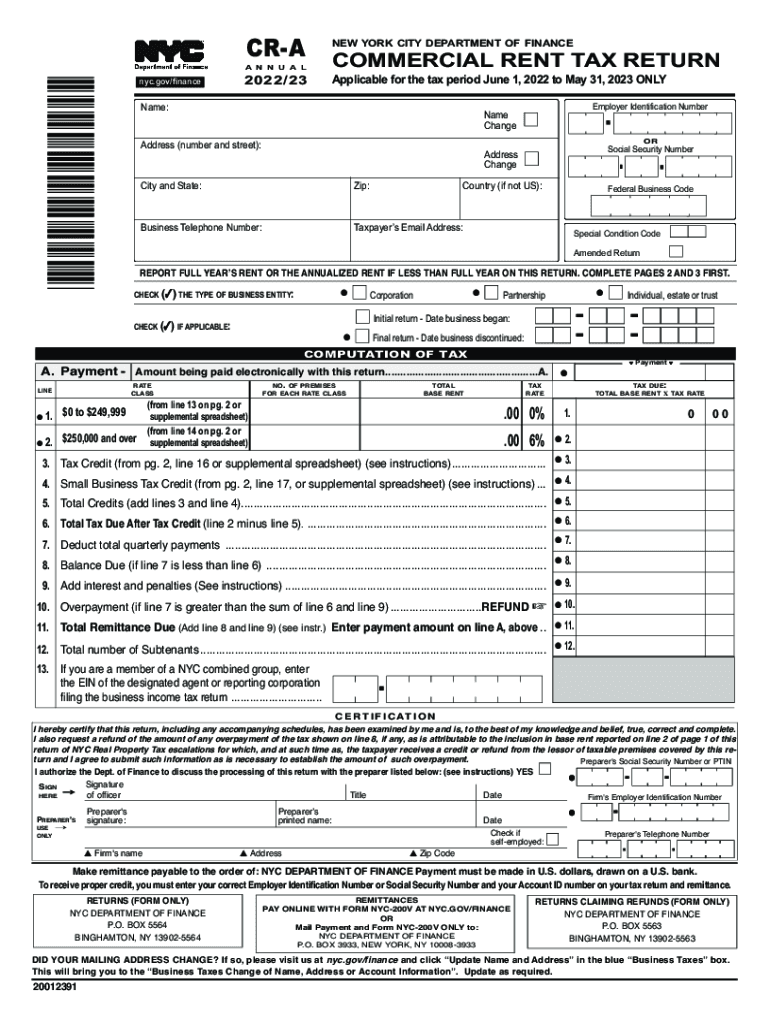

The Business and Excise Tax Forms are essential documents required for businesses operating in New York City. These forms facilitate the reporting and payment of various taxes, including the commercial rent tax. Understanding these forms is crucial for compliance and accurate tax reporting. Each form serves a specific purpose and must be filled out according to the guidelines provided by the New York City Department of Finance.

Steps to Complete the Business and Excise Tax Forms

Completing the Business and Excise Tax Forms requires careful attention to detail. Here are the general steps to follow:

- Gather all necessary financial documents, including rental agreements and income statements.

- Obtain the appropriate form, such as the NYC Commercial Rent Tax Form, from the Department of Finance.

- Fill out the form with accurate and complete information, ensuring all required fields are addressed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the Business and Excise Tax Forms to avoid late fees and penalties. The deadlines may vary based on the specific tax type and the fiscal year. Typically, the NYC Commercial Rent Tax Return must be filed annually, with specific dates set by the Department of Finance. Keeping a calendar of these important dates can help ensure timely compliance.

Required Documents for Filing

When filing the Business and Excise Tax Forms, several documents are typically required to support your submission. These may include:

- Rental agreements or leases that detail the terms of the commercial space.

- Financial statements that provide an overview of income and expenses.

- Any prior year tax returns that may be relevant to the current filing.

- Proof of payment for any previous taxes owed.

Form Submission Methods

There are multiple methods available for submitting the Business and Excise Tax Forms. Businesses can choose to file online through the NYC Department of Finance website, which often provides a streamlined process. Alternatively, forms can be mailed to the appropriate address or submitted in person at designated locations. Each method has its own advantages, so selecting the one that best fits your needs is important.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Business and Excise Tax Forms can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to stay informed about their tax obligations and ensure timely submissions to avoid these consequences.

Quick guide on how to complete business ampamp excise tax forms

Effortlessly Prepare Business & Excise Tax Forms on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent sustainable alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely keep them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Business & Excise Tax Forms on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

The Easiest Way to Modify and Electronically Sign Business & Excise Tax Forms

- Obtain Business & Excise Tax Forms and click on Get Form to commence.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Business & Excise Tax Forms while maintaining excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business ampamp excise tax forms

Create this form in 5 minutes!

How to create an eSignature for the business ampamp excise tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the NYC commercial rent tax instructions for 2024?

The NYC commercial rent tax instructions for 2024 provide detailed guidelines for businesses subject to this tax. These instructions outline the calculation methods, filing deadlines, and eligibility criteria, ensuring compliance with local regulations. It's essential for landlords and tenants to familiarize themselves with these instructions to avoid penalties.

-

How can airSlate SignNow help with managing NYC commercial rent tax documents?

AirSlate SignNow simplifies the management of NYC commercial rent tax documents by offering an eSigning solution that allows users to quickly sign, send, and store relevant files. By using airSlate SignNow, businesses can ensure timely submissions and maintain organized records, particularly when adhering to the NYC commercial rent tax instructions for 2024.

-

Is there a cost associated with using airSlate SignNow for NYC commercial rent tax filing?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to essential eSigning features that can streamline your document management process, including the NYC commercial rent tax instructions for 2024. Visit our pricing page to find a plan that fits your budget.

-

What features does airSlate SignNow offer that are relevant to NYC commercial rent tax?

AirSlate SignNow provides features such as customizable templates, secure storage, and audit trails, which are vital for handling NYC commercial rent tax documents. These features enhance the efficiency of completing tax-related tasks and ensure compliance with the NYC commercial rent tax instructions for 2024.

-

Can airSlate SignNow integrate with other accounting software for tax purposes?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, making it easy to collaborate and manage NYC commercial rent tax records. These integrations facilitate a smooth flow of information, helping businesses comply with the NYC commercial rent tax instructions for 2024 more effectively.

-

How does eSigning help in meeting NYC commercial rent tax deadlines?

eSigning with airSlate SignNow speeds up the process of signing important tax documents, ensuring they are submitted on time. By leveraging the efficiency of eSignatures, businesses can adhere to the NYC commercial rent tax instructions for 2024, avoiding late fees and maintaining good standing with tax authorities.

-

What benefits does airSlate SignNow provide for NYC commercial renters?

AirSlate SignNow offers signNow benefits for NYC commercial renters, including reduced paperwork, faster transactions, and greater compliance with NYC commercial rent tax instructions for 2024. By streamlining the signing process, businesses can focus on their operations rather than administrative tasks.

Get more for Business & Excise Tax Forms

- 5113 1 303 in the district court of kansas judicial council kansasjudicialcouncil form

- 08302016 1 1702 in the district court of kansasjudicialcouncil 6969390 form

- Kansasjudicialcouncil 6969216 form

- Title wakulla news all issues citation thumbnails kansasjudicialcouncil 6969383 form

- 5113 375 in the district court of county kansas in the matter of name juvenile year of birth a male female case no form

- 5113 1 396 in the district court of county kansas in kansasjudicialcouncil form

- Suggestion record form

- 5113 352 in the district court of county kansas in the matter of name juvenile year of birth a male female case no form

Find out other Business & Excise Tax Forms

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online