CR a 20 Commercial Rent Tax Annual Return 2020

What is the CR A 20 Commercial Rent Tax Annual Return

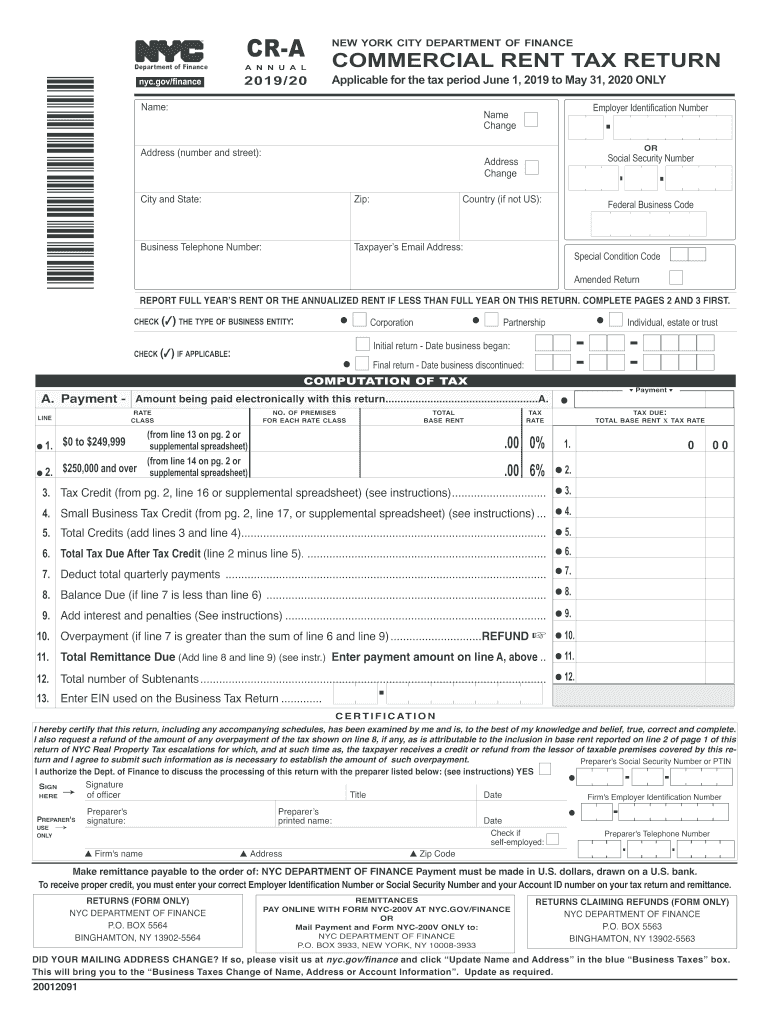

The CR A 20 Commercial Rent Tax Annual Return is a crucial document for businesses operating in New York City that are subject to the commercial rent tax. This return is used to report the total rent paid for commercial premises during the tax year. It is essential for ensuring compliance with local tax regulations and for determining the amount of tax owed. The form captures various details about the rental agreements, including the property address, the total rent paid, and the duration of the lease. Understanding this form is vital for business owners to fulfill their tax obligations accurately.

Steps to complete the CR A 20 Commercial Rent Tax Annual Return

Completing the CR A 20 Commercial Rent Tax Annual Return involves several key steps:

- Gather all relevant rental agreements and documentation for the tax year.

- Calculate the total rent paid, ensuring to include all applicable charges.

- Fill out the CR A 20 form, providing accurate information about the business and rental details.

- Review the completed form for accuracy and completeness.

- Submit the form either online, by mail, or in person, depending on your preference.

Following these steps can help ensure that the return is filed correctly and on time, minimizing the risk of penalties.

Legal use of the CR A 20 Commercial Rent Tax Annual Return

The CR A 20 Commercial Rent Tax Annual Return must be completed in accordance with New York City tax laws. Legal use of this form requires accurate reporting of all rental payments and adherence to submission deadlines. Failing to comply with these regulations can lead to penalties, including fines and interest on unpaid taxes. It is important for businesses to be aware of their obligations under the law and to maintain proper records to support the information reported on the return.

Filing Deadlines / Important Dates

Timely filing of the CR A 20 Commercial Rent Tax Annual Return is essential to avoid penalties. The filing deadline typically falls on the last day of the month following the end of the tax year. For example, if the tax year ends on December 31, the return must be filed by January 31 of the following year. It is advisable for businesses to mark their calendars and prepare their documentation in advance to ensure compliance with these important dates.

Required Documents

To complete the CR A 20 Commercial Rent Tax Annual Return, businesses will need to gather several key documents:

- Rental agreements for the reporting period.

- Records of total rent paid, including any additional charges.

- Proof of payment, such as bank statements or receipts.

- Any correspondence with the New York City Department of Finance regarding commercial rent tax.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Penalties for Non-Compliance

Businesses that fail to file the CR A 20 Commercial Rent Tax Annual Return on time or inaccurately report their rental payments may face significant penalties. These can include late fees, interest on unpaid taxes, and potential legal action by the city. It is crucial for business owners to understand the importance of compliance and to take proactive steps to meet their filing obligations. Regularly reviewing rental agreements and maintaining accurate records can help mitigate the risk of non-compliance.

Quick guide on how to complete cr a 2019 20 commercial rent tax annual return

Easily Prepare CR A 20 Commercial Rent Tax Annual Return on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the features you require to create, modify, and eSign your documents promptly without delays. Manage CR A 20 Commercial Rent Tax Annual Return on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

Effortlessly Modify and eSign CR A 20 Commercial Rent Tax Annual Return

- Locate CR A 20 Commercial Rent Tax Annual Return and click Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize essential sections of your documents or obscure sensitive information with specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign CR A 20 Commercial Rent Tax Annual Return to ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cr a 2019 20 commercial rent tax annual return

Create this form in 5 minutes!

How to create an eSignature for the cr a 2019 20 commercial rent tax annual return

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the naeyc 72 hour report and why is it important?

The naeyc 72 hour report is a crucial document that outlines compliance with NAEYC accreditation standards within 72 hours of an incident. It ensures that early childhood programs maintain quality and transparency. Understanding this report is essential for educators and administrators aiming to achieve or retain their NAEYC accreditation.

-

How can airSlate SignNow assist with the naeyc 72 hour report?

airSlate SignNow simplifies the creation, signing, and storage of the naeyc 72 hour report through its user-friendly platform. With electronic signatures and secure document management, you can streamline your reporting processes and ensure compliance efficiently. This enables institutions to focus more on their educational objectives rather than administrative hurdles.

-

Is there a cost associated with using airSlate SignNow for the naeyc 72 hour report?

Yes, airSlate SignNow offers various pricing plans designed to meet the needs of different organizations. These plans are cost-effective and provide comprehensive features to facilitate the eSigning process for important documents like the naeyc 72 hour report. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the naeyc 72 hour report?

airSlate SignNow provides features such as customizable templates, in-app document editing, and advanced security measures for handling the naeyc 72 hour report. Additionally, you can track document status and send reminders for signatures, ensuring timely compliance with any reporting deadlines. These features help you stay organized and efficient.

-

Can I integrate airSlate SignNow with other software for managing the naeyc 72 hour report?

Absolutely! airSlate SignNow offers integration capabilities with various applications, enabling you to manage the naeyc 72 hour report within your existing workflow. This includes tools for document management, customer relationship management (CRM), and more, enhancing overall productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the naeyc 72 hour report?

Using airSlate SignNow for the naeyc 72 hour report allows for quicker document turnaround, improved compliance tracking, and enhanced security for sensitive information. It also minimizes paperwork and administrative burdens, making it an excellent choice for educational institutions focused on quality and efficiency. These benefits can greatly contribute to a seamless reporting process.

-

Who can benefit from using the naeyc 72 hour report feature in airSlate SignNow?

Administrators, educators, and compliance officers in early childhood education programs can greatly benefit from using the naeyc 72 hour report feature in airSlate SignNow. By leveraging this tool, they can ensure timely reporting and adherence to NAEYC standards, ultimately fostering a better learning environment for children. It's an essential asset for maintaining program integrity.

Get more for CR A 20 Commercial Rent Tax Annual Return

Find out other CR A 20 Commercial Rent Tax Annual Return

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed