Www Gayco Comnyc Commercial Rent Tax ExtensionNyc Commercial Rent Tax Extension GayCo 2022

Understanding the NYC Commercial Rent Tax Extension

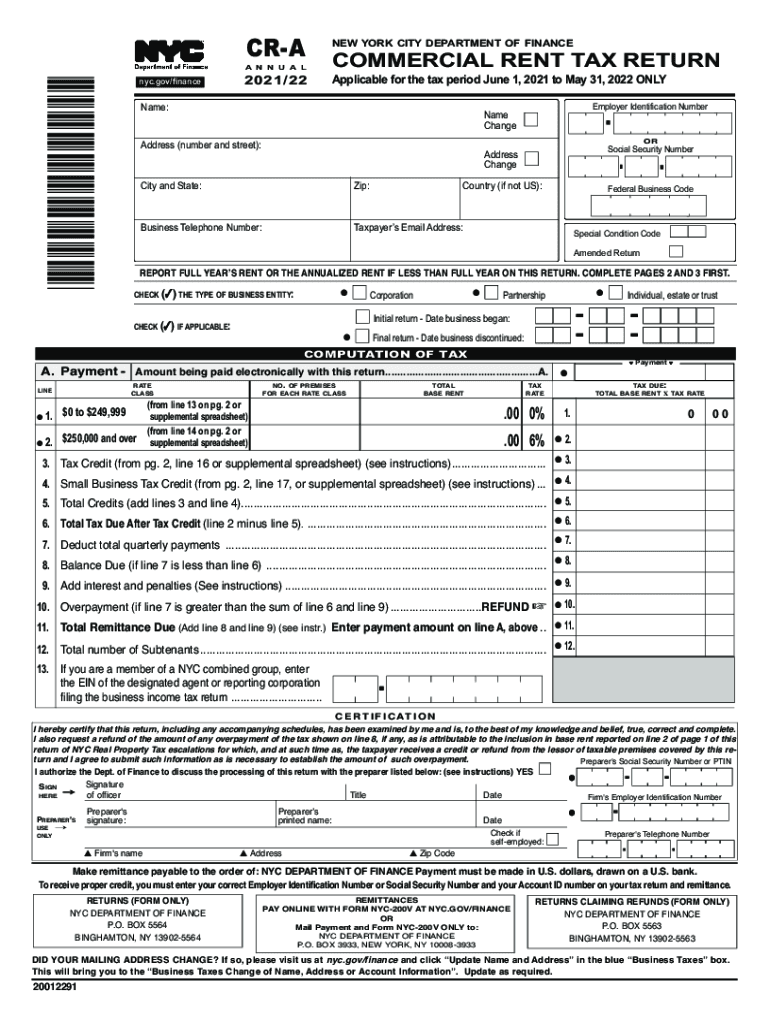

The NYC commercial rent tax extension is a provision allowing businesses to extend their filing deadline for the commercial rent tax. This tax applies to businesses renting commercial space in New York City and is calculated based on the rent paid. Understanding this extension can help businesses avoid late penalties and ensure compliance with local tax laws.

Steps to Complete the NYC Commercial Rent Tax Extension

To successfully complete the NYC commercial rent tax extension, follow these steps:

- Gather all necessary documents, including your lease agreement and previous tax filings.

- Fill out the extension form accurately, ensuring all information is current and correct.

- Submit the completed form to the appropriate city agency before the deadline.

- Keep a copy of the submitted form for your records.

Filing Deadlines for the NYC Commercial Rent Tax Extension

It is crucial to be aware of the filing deadlines associated with the NYC commercial rent tax extension. Typically, the extension must be filed before the original due date of the commercial rent tax return. Missing this deadline can result in penalties and interest on unpaid taxes.

Required Documents for the NYC Commercial Rent Tax Extension

When applying for the NYC commercial rent tax extension, you will need to provide several key documents:

- Your current lease agreement.

- Previous tax returns related to commercial rent tax.

- Any correspondence from the NYC Department of Finance regarding your tax status.

Penalties for Non-Compliance with the NYC Commercial Rent Tax

Failure to comply with the NYC commercial rent tax regulations can lead to significant penalties. These may include:

- Late filing penalties, which can increase the total tax owed.

- Interest on unpaid taxes, accruing from the original due date.

- Potential legal action for continued non-compliance.

Eligibility Criteria for the NYC Commercial Rent Tax Extension

To qualify for the NYC commercial rent tax extension, businesses must meet specific eligibility criteria. Generally, this includes being a registered business operating within New York City and having a valid commercial lease. It is essential to review these criteria thoroughly to ensure compliance.

Quick guide on how to complete wwwgaycocomnyc commercial rent tax extensionnyc commercial rent tax extension gayco

Complete Www gayco comnyc commercial rent tax extensionNyc Commercial Rent Tax Extension GayCo effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any delays. Manage Www gayco comnyc commercial rent tax extensionNyc Commercial Rent Tax Extension GayCo across any platform with the airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

The simplest method to edit and electronically sign Www gayco comnyc commercial rent tax extensionNyc Commercial Rent Tax Extension GayCo effortlessly

- Find Www gayco comnyc commercial rent tax extensionNyc Commercial Rent Tax Extension GayCo and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method to submit your form, either via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Www gayco comnyc commercial rent tax extensionNyc Commercial Rent Tax Extension GayCo to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwgaycocomnyc commercial rent tax extensionnyc commercial rent tax extension gayco

Create this form in 5 minutes!

People also ask

-

What is the 'nyc 200v' feature in airSlate SignNow?

The 'nyc 200v' feature in airSlate SignNow allows users to electronically sign and manage documents seamlessly. This feature ensures quick and efficient document workflows, making it ideal for businesses operating in high-paced environments like NYC.

-

How does airSlate SignNow compare in pricing for the 'nyc 200v' plan?

AirSlate SignNow offers competitive pricing for the 'nyc 200v' plan, making it a cost-effective choice for businesses. The pricing tiers are designed to accommodate various business sizes, ensuring you get maximum value for your eSigning needs in New York City.

-

What benefits does the 'nyc 200v' integration provide?

The 'nyc 200v' integration with airSlate SignNow streamlines document signing processes, boosting efficiency. Users benefit from real-time collaboration and automated workflows, which help to reduce delays and improve overall productivity.

-

Is the 'nyc 200v' feature compatible with other software?

Yes, the 'nyc 200v' feature in airSlate SignNow is designed to integrate smoothly with various software platforms. Popular CRM and project management tools can be linked easily, making it a flexible choice for businesses in New York City.

-

Can I access airSlate SignNow's 'nyc 200v' feature on mobile devices?

Absolutely! The 'nyc 200v' feature is fully accessible on mobile devices, allowing you to send and sign documents on the go. This flexibility is essential for busy professionals in NYC who need to manage paperwork from anywhere.

-

What type of support does airSlate SignNow offer for the 'nyc 200v' feature?

AirSlate SignNow provides robust customer support for the 'nyc 200v' feature. Users can access a variety of resources, including live chat, email support, and comprehensive tutorials, ensuring you get the help you need when you need it.

-

How secure is the 'nyc 200v' process for signing documents?

The 'nyc 200v' process for signing documents in airSlate SignNow is extremely secure. With industry-standard encryption and compliance with legal requirements, your documents are protected, giving you peace of mind while conducting business.

Get more for Www gayco comnyc commercial rent tax extensionNyc Commercial Rent Tax Extension GayCo

- Ne corporation form

- Nebraska pre incorporation agreement shareholders agreement and confidentiality agreement nebraska form

- Nebraska domestic form

- Nebraska bylaws for corporation nebraska form

- Corporate records maintenance package for existing corporations nebraska form

- Nebraska articles of incorporation for professional corporation nebraska form

- Nebraska incorporation document form

- Ne llc form

Find out other Www gayco comnyc commercial rent tax extensionNyc Commercial Rent Tax Extension GayCo

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation