Commercial Rent Return Form 2016

What is the Commercial Rent Return Form

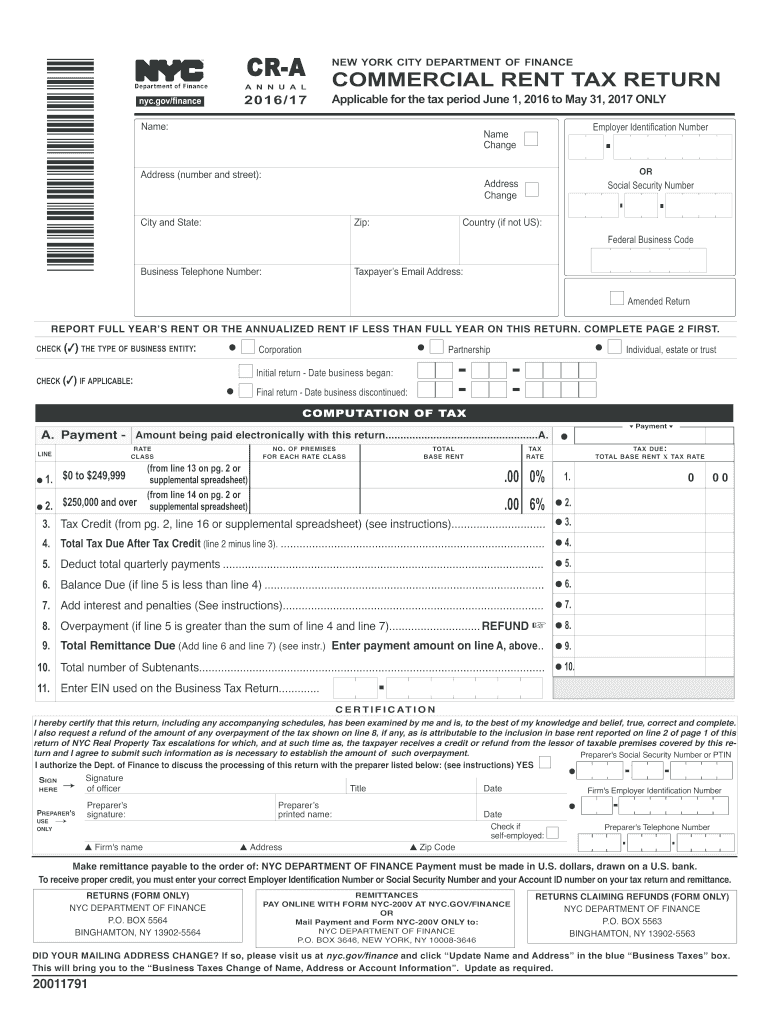

The Commercial Rent Return Form is a tax document used by businesses to report rental income and expenses to the Internal Revenue Service (IRS). This form is essential for landlords and property owners who generate income from commercial properties. By accurately completing this form, taxpayers ensure compliance with federal tax regulations while also calculating their taxable income from rental activities.

How to use the Commercial Rent Return Form

Using the Commercial Rent Return Form involves several key steps. First, gather all necessary financial documents related to your rental properties, including income statements and expense receipts. Next, fill out the form by providing details such as property addresses, rental income received, and any deductible expenses incurred during the tax year. Finally, review the completed form for accuracy before submitting it to the IRS, either electronically or via mail.

Steps to complete the Commercial Rent Return Form

Completing the Commercial Rent Return Form requires a systematic approach:

- Collect all relevant financial documentation related to your commercial rental properties.

- Enter your personal and property information accurately on the form.

- Detail all rental income received throughout the tax year.

- List any allowable expenses, such as maintenance costs, property management fees, and utilities.

- Calculate your total taxable income from rental activities.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the Commercial Rent Return Form

The Commercial Rent Return Form must be used in accordance with IRS guidelines to ensure its legal validity. This includes accurately reporting all income and expenses and adhering to filing deadlines. Failure to comply with these regulations can result in penalties or audits. It is crucial to maintain proper documentation and records to support the information reported on the form.

Filing Deadlines / Important Dates

Timely submission of the Commercial Rent Return Form is essential to avoid penalties. The standard deadline for filing is typically April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any potential extensions they may apply for, which can provide additional time to file the form without incurring penalties.

Form Submission Methods (Online / Mail / In-Person)

The Commercial Rent Return Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to eFile their forms using IRS-approved software, which simplifies the process and provides immediate confirmation of receipt.

- Mail: Taxpayers can print the completed form and send it to the appropriate IRS address based on their location and filing status.

- In-Person: Some individuals may opt to deliver their forms directly to local IRS offices, although this method is less common.

Quick guide on how to complete commercial rent return 2016 form

Your assistance manual on preparing your Commercial Rent Return Form

If you’re curious about how to finish and submit your Commercial Rent Return Form, here are some concise recommendations to simplify tax filing.

To begin, all you need to do is set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and efficient document solution that enables you to edit, create, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and easily return to modify any information as needed. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing capabilities.

Follow the instructions below to complete your Commercial Rent Return Form in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Obtain form to open your Commercial Rent Return Form in our editor.

- Insert the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Signature Tool to add your legally-recognized eSignature (if required).

- Examine your document and fix any inaccuracies.

- Save your changes, print your copy, send it to your addressee, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in physical form may lead to more return errors and delay refunds. Of course, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct commercial rent return 2016 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

What is the official website to fill out the GST return form?

https://www.gst.gov.in/

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How do I file an income tax return online from Form 16?

Greeting Friends !!!If you are going to file it yourself, then following is the procedure:-Before you start the process, keep your bank statements, Form 16 issued by your employer and a copy of last year's return at hand. Next, log on to http://incometaxindiaefiling.gov...Follow these steps:Step 1: Register yourself on the website. Your Permanent Account Number (PAN) will be your user ID.Step 2: View your tax credit statement — Form 26AS — for the financial year 2015–16 . The statement will reflect the taxes deducted by your employer actually deposited with the I-T department. The TDS as per your Form 16 must tally with the figures in Form 26AS. If you file the return despite discrepancies, if any, you could get a notice from the I-T department later.Step 3: Under the 'Download' menu, click on Income Tax Return Forms and choose AY 2016–17 (for financial year 2015–16 ). Download the Income Tax Return (ITR) form applicable to you.Which Income Tax Return Form Require to file or applicable F.Y. 2015–16 by Hetal M Kukadiya on Tax Knowledge Bank - IndiaStep 4: Open the downloaded Return Preparation Software (excel or Java utility) and complete the form by entering all the details , using your all documentsStep 5: Ascertain the tax payable by clicking the 'Calculate Tax' tab. Pay tax (if applicable) and enter the challan details in the tax return.Step 6: Confirm all the information in the worksheet by clicking the 'Validate' tab.Step 7: Proceed to generate an XML file and save it on your computer.Step 8: Go to 'Upload Return' on the portal's left panel and upload the saved XML file after selecting 'AY 2016-2017 ' and the relevant form. You will be asked whether you wish to digitally sign the file. If you have obtained a DS (digital signature), select Yes. Or, choose 'No'.Step 9: Once the website flashes the message about successful e-filing on your screen, you can consider the process to be complete. The acknowledgment form — ITR—Verification (ITR-V ) will be generated and you can download it.Step 10: you can Verify online with EVC Pin or Take a printout of the form ITR-V , sign it preferably in blue ink, and send it only by ordinary or Speed post to the Income-Tax Department-CPC , Post Bag No-1 , Electronic City Post Office, Bangalore - 560 100, Karnataka, within 120 days of filing your return online.Its Advisable to go with CA help for filling Tax return. There are lots of amendment come in every year, to file accurate return and Tax planning benefit etc so Prefer to go with expert like CA, Tax Preparer etc…Be Peaceful !!!

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

Create this form in 5 minutes!

How to create an eSignature for the commercial rent return 2016 form

How to generate an eSignature for your Commercial Rent Return 2016 Form in the online mode

How to make an electronic signature for the Commercial Rent Return 2016 Form in Google Chrome

How to make an eSignature for signing the Commercial Rent Return 2016 Form in Gmail

How to create an electronic signature for the Commercial Rent Return 2016 Form right from your mobile device

How to generate an eSignature for the Commercial Rent Return 2016 Form on iOS

How to make an eSignature for the Commercial Rent Return 2016 Form on Android OS

People also ask

-

What is a Commercial Rent Return Form?

The Commercial Rent Return Form is a crucial document used by landlords to report rental income to tax authorities. It helps streamline the process of declaring rental income, ensuring compliance with relevant tax regulations. Using this form can simplify your tax reporting procedures, providing clarity and documentation for both landlords and tenants.

-

How can airSlate SignNow help with the Commercial Rent Return Form?

airSlate SignNow offers a seamless platform for sending and eSigning the Commercial Rent Return Form electronically. This eliminates the need for paper-based processes, making it faster and more efficient to handle rental agreements. Additionally, our platform allows for secure storage and easy access to important documents.

-

Is there a cost associated with using airSlate SignNow for the Commercial Rent Return Form?

Yes, airSlate SignNow offers a range of pricing plans to accommodate different business needs when managing the Commercial Rent Return Form. Our pricing is designed to be cost-effective, ensuring that you get the best value for electronic document management. You can choose a plan that aligns with your business size and frequency of use.

-

Can I integrate airSlate SignNow with other applications for managing the Commercial Rent Return Form?

Absolutely! airSlate SignNow supports integrations with various third-party applications, enhancing your workflow when dealing with the Commercial Rent Return Form. Whether you're using accounting software or property management tools, our platform can streamline processes, ensuring that all necessary documents are easily managed from a single interface.

-

What features does airSlate SignNow offer for eSigning the Commercial Rent Return Form?

airSlate SignNow includes a variety of features designed to maximize efficiency when eSigning the Commercial Rent Return Form. Key features include customizable templates, a user-friendly interface, and real-time tracking of document status. These functionalities ensure that you can quickly and securely handle all your signing needs.

-

How does airSlate SignNow ensure the security of the Commercial Rent Return Form?

Security is a top priority at airSlate SignNow, especially regarding sensitive documents like the Commercial Rent Return Form. We employ industry-standard encryption and secure servers to protect your data. Additionally, features such as authentication protocols ensure that only authorized users can access and sign your documents.

-

Can I save time by using airSlate SignNow for the Commercial Rent Return Form?

Using airSlate SignNow for the Commercial Rent Return Form can signNowly reduce the time spent on document management. Our platform allows you to prepare, send, and eSign documents in minutes rather than hours or days. This efficiency frees up valuable time for landlords and property managers to focus on other important tasks.

Get more for Commercial Rent Return Form

- Get the fl401 jordan publishing fillable form

- Form 2465 medicaid

- Reggie braziel sermons 432865981 form

- Those applicants requiring accommodations to the application andor interview process should notify a representative of the form

- Pc 205b form

- Celebrate recovery sponsor training form

- Ncll sample church bylaws noondayba form

- Important things about programs and services mdhhs pub 1010 form

Find out other Commercial Rent Return Form

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document