Form it 209 Claim for Noncustodial Parent New York State 2021

What is the Form IT 209 Claim For Noncustodial Parent New York State

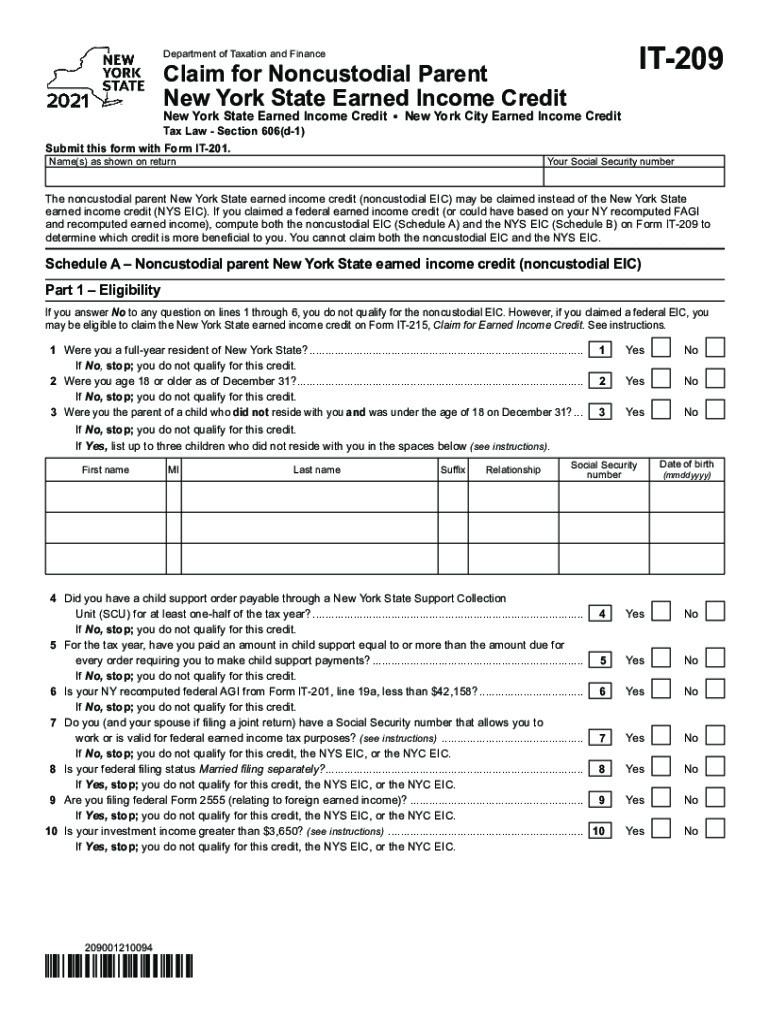

The Form IT 209 is a tax document specifically designed for noncustodial parents in New York State. This form allows eligible parents to claim a credit for child support payments made, which can significantly impact their tax liability. It is essential for noncustodial parents to understand the purpose of this form, as it directly relates to their financial responsibilities and rights regarding child support. By filing the IT 209, parents can ensure that they receive appropriate tax benefits associated with their support obligations.

Steps to complete the Form IT 209 Claim For Noncustodial Parent New York State

Completing the Form IT 209 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of child support payments and personal identification information. Next, fill out the form by providing your details, including your name, Social Security number, and the child's information. It is crucial to accurately report the amount of child support paid during the tax year. After completing the form, review all entries for accuracy before submitting it to the New York State Department of Taxation and Finance.

Eligibility Criteria

To qualify for the IT 209, certain eligibility criteria must be met. Primarily, the individual must be a noncustodial parent who has made child support payments for a dependent child. The child must reside with the custodial parent, and the noncustodial parent must have a legal obligation to provide support as mandated by a court order. Additionally, the noncustodial parent should not have any outstanding tax liabilities or issues that could affect their ability to claim the credit. Understanding these criteria is vital for ensuring a successful claim.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 209 can be submitted through various methods to accommodate different preferences. Parents can file the form online through the New York State Department of Taxation and Finance website, which offers a streamlined process for electronic submissions. Alternatively, the completed form can be mailed to the appropriate address provided by the state. For those who prefer in-person assistance, visiting a local tax office may be an option. It is essential to choose a submission method that aligns with your comfort level and ensures timely processing.

Required Documents

When preparing to submit the Form IT 209, certain documents are required to support your claim. These typically include proof of child support payments, such as bank statements or payment receipts, and a copy of the court order outlining your child support obligations. Additionally, personal identification information, such as your Social Security number and the child's details, is necessary. Having these documents ready will facilitate a smoother filing process and help avoid delays.

Legal use of the Form IT 209 Claim For Noncustodial Parent New York State

The legal use of the Form IT 209 is governed by New York State tax laws, which outline the parameters for claiming credits related to child support. This form serves as an official declaration of the noncustodial parent's financial contributions toward their child's upbringing. Properly completing and submitting the IT 209 ensures compliance with state regulations and helps protect the rights of the noncustodial parent. Understanding the legal framework surrounding this form is crucial for maximizing its benefits while adhering to the law.

Quick guide on how to complete form it 209 claim for noncustodial parent new york state

Manage Form IT 209 Claim For Noncustodial Parent New York State effortlessly on any device

Digital document management has surged in popularity among companies and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Form IT 209 Claim For Noncustodial Parent New York State across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign Form IT 209 Claim For Noncustodial Parent New York State with ease

- Locate Form IT 209 Claim For Noncustodial Parent New York State and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and press the Done button to save your changes.

- Choose your preferred method for delivering your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form IT 209 Claim For Noncustodial Parent New York State and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 209 claim for noncustodial parent new york state

Create this form in 5 minutes!

How to create an eSignature for the form it 209 claim for noncustodial parent new york state

The way to make an e-signature for a PDF online

The way to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The way to make an e-signature straight from your smartphone

The way to make an e-signature for a PDF on iOS

The way to make an e-signature for a PDF document on Android

People also ask

-

What is the pricing structure for airSlate SignNow with it 209?

The pricing for airSlate SignNow with it 209 is designed to be affordable, offering various plans to suit different business needs. Whether you are a small startup or a large enterprise, you can find a pricing plan that works for you. Additionally, you can take advantage of a free trial to explore its features before committing.

-

What features does airSlate SignNow offer in relation to it 209?

airSlate SignNow provides a wide range of features with it 209, including unlimited document signing, templates, and collaboration tools. You can easily customize your workflows and automate repetitive tasks to save time. The platform is user-friendly, making it easy for teams to adopt quickly.

-

How can airSlate SignNow with it 209 benefit my business?

Using airSlate SignNow with it 209 can signNowly enhance your business operations by streamlining the document signing process. This efficient solution reduces turnaround times, minimizes paperwork, and improves overall productivity. By integrating it into your workflows, you can provide a better experience for your clients.

-

Does airSlate SignNow integrate with other tools using it 209?

Yes, airSlate SignNow seamlessly integrates with various tools and applications using it 209, making it versatile for different business environments. Integrations with platforms like Google Drive, Salesforce, and Dropbox allow you to work efficiently without switching between systems. This helps maintain consistency and ease of access.

-

Is it possible to track document statuses within airSlate SignNow and it 209?

Absolutely! airSlate SignNow provides robust tracking features with it 209 that allow you to monitor document statuses in real time. You can see when documents are sent, viewed, and signed, providing peace of mind and improving accountability. This visibility is key for effective document management.

-

Can airSlate SignNow with it 209 accommodate large volumes of documents?

Yes, airSlate SignNow with it 209 is designed to handle a large volume of documents efficiently. The platform supports bulk sending capabilities, allowing you to send multiple documents at once without compromising on speed or security. This feature is especially beneficial for businesses that require high-volume signing.

-

What security measures does airSlate SignNow implement with it 209?

Security is a top priority for airSlate SignNow with it 209. The platform employs advanced encryption and complies with industry standards to safeguard your documents. You can be confident that your sensitive information is protected throughout the signing process.

Get more for Form IT 209 Claim For Noncustodial Parent New York State

Find out other Form IT 209 Claim For Noncustodial Parent New York State

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement