Form it 209 Claim for Noncustodial Parent New York State Earned Income 2022

What is the Form IT 209 Claim For Noncustodial Parent New York State Earned Income

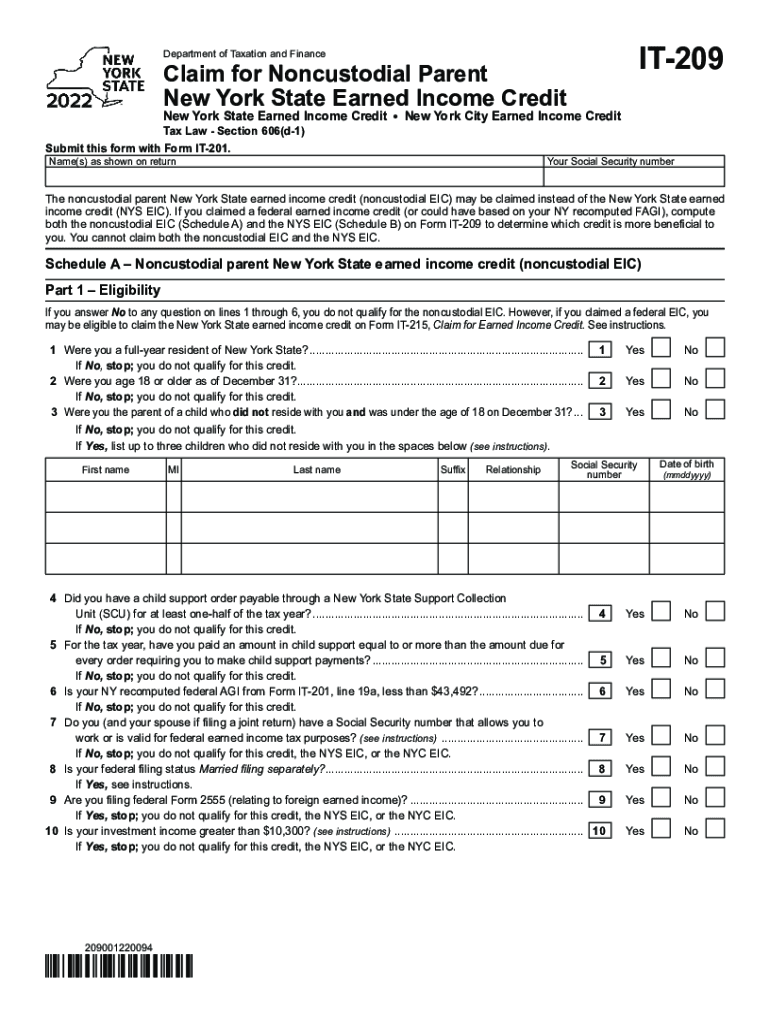

The Form IT 209 is a tax document used by noncustodial parents in New York State to claim the Earned Income Tax Credit (EITC). This form allows eligible parents to receive a tax benefit that can significantly reduce their tax liability. The EITC is designed to assist low to moderate-income workers, and noncustodial parents who meet specific criteria can benefit from this credit. Understanding the purpose of the IT 209 is crucial for maximizing available tax benefits.

Steps to complete the Form IT 209 Claim For Noncustodial Parent New York State Earned Income

Completing the Form IT 209 involves several key steps to ensure accuracy and compliance with tax regulations. First, gather all necessary documents, including your income statements and any relevant information about your dependents. Next, fill out the personal information section, ensuring that all details are correct. Follow this by providing your income details and calculating your eligibility for the Earned Income Tax Credit. Finally, review the form for any errors before submitting it to the appropriate state tax authority.

Eligibility Criteria

To qualify for the Earned Income Tax Credit using Form IT 209, certain eligibility criteria must be met. Applicants must be noncustodial parents who have a qualifying child living with the custodial parent. Additionally, your income must fall within the specified limits set by the IRS for the tax year in question. It is essential to check the most current income thresholds and other requirements to ensure that you qualify for the credit.

Required Documents

When preparing to fill out the Form IT 209, specific documents will be necessary to support your claim. These typically include:

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation of any qualifying children, including Social Security numbers.

- Previous year’s tax return, if applicable.

Having these documents ready will streamline the process and help ensure that your application is complete.

Form Submission Methods

The Form IT 209 can be submitted through various methods, providing flexibility for users. You can choose to file the form online using approved tax software, which often simplifies the process. Alternatively, you may print the completed form and mail it directly to the New York State Department of Taxation and Finance. In some cases, in-person submissions may be accepted at designated tax offices. Always check the latest guidelines for the most efficient submission method.

Filing Deadlines / Important Dates

Awareness of filing deadlines is essential to avoid penalties and ensure timely processing of your claim. The deadline for submitting the Form IT 209 typically aligns with the federal tax filing deadline, which is usually April fifteenth. However, it is advisable to verify specific dates for the current tax year, as they may vary. Marking these dates on your calendar can help you stay organized and compliant.

Quick guide on how to complete form it 209 claim for noncustodial parent new york state earned income

Effortlessly Prepare Form IT 209 Claim For Noncustodial Parent New York State Earned Income on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Form IT 209 Claim For Noncustodial Parent New York State Earned Income on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Form IT 209 Claim For Noncustodial Parent New York State Earned Income with Ease

- Locate Form IT 209 Claim For Noncustodial Parent New York State Earned Income and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on Done to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Form IT 209 Claim For Noncustodial Parent New York State Earned Income to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 209 claim for noncustodial parent new york state earned income

Create this form in 5 minutes!

People also ask

-

What are the form it 209 instructions?

The form it 209 instructions provide detailed steps for completing and submitting the form correctly. This guidance is crucial for ensuring compliance and avoiding common mistakes. Our platform simplifies this process, allowing users to navigate the instructions efficiently.

-

How can airSlate SignNow help with form it 209 instructions?

airSlate SignNow streamlines the process of filling out form it 209 instructions by providing an intuitive interface for document signing and editing. Users can easily access instructions and relevant fields directly within the platform, making the overall process faster and simpler.

-

Are there any costs associated with using airSlate SignNow for form it 209 instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that enhance the experience of handling form it 209 instructions, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for handling document instructions?

airSlate SignNow includes features such as real-time collaboration, customizable templates, and secure eSignature capabilities designed to assist in managing form it 209 instructions. This comprehensive set of tools ensures that users can efficiently manage their documentation without hassle.

-

Is there mobile access for form it 209 instructions in airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile-friendly platform, allowing you to access form it 209 instructions on the go. Whether you’re using a smartphone or tablet, you can fill out and send documents wherever you are, ensuring flexibility and convenience.

-

Can form it 209 instructions be easily shared with team members?

Yes, with airSlate SignNow, sharing form it 209 instructions with team members is seamless. Users can send documents directly through the platform, enabling collaborative efforts while ensuring everyone accesses the latest version of the instructions at all times.

-

What integrations does airSlate SignNow support to enhance form it 209 instructions usage?

airSlate SignNow integrates with various popular applications, making it easier to incorporate form it 209 instructions into your existing workflows. This flexibility allows users to streamline their processes and enhance productivity by connecting with tools they already use.

Get more for Form IT 209 Claim For Noncustodial Parent New York State Earned Income

Find out other Form IT 209 Claim For Noncustodial Parent New York State Earned Income

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online