it 209 2020

What is the IT 209?

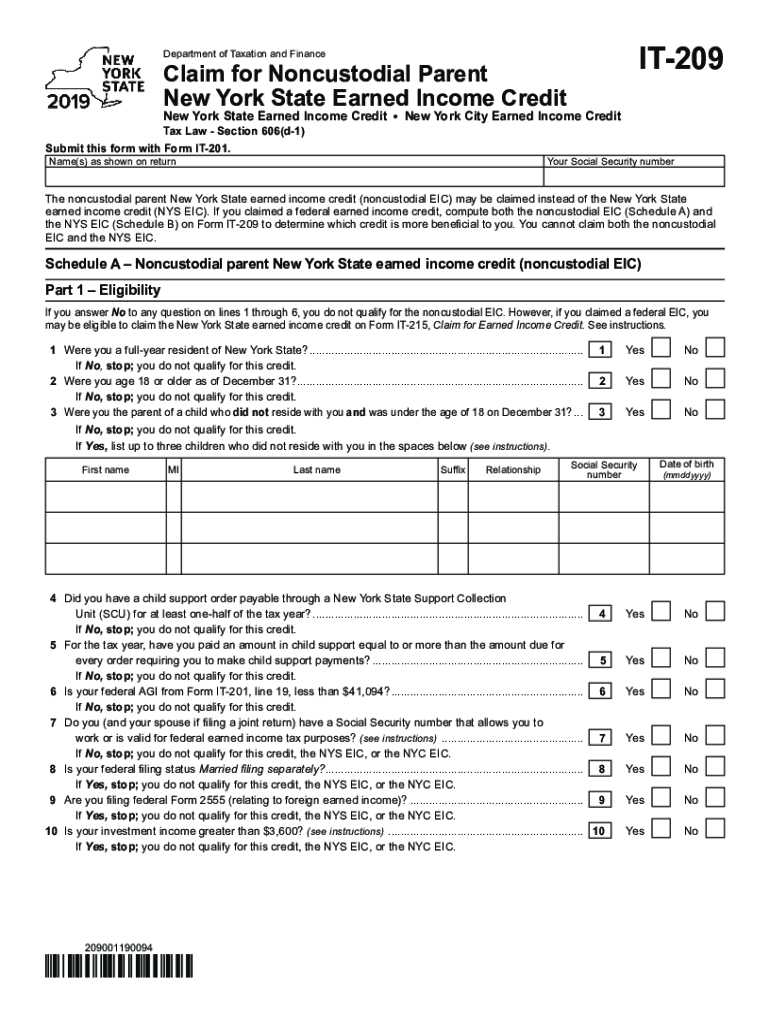

The IT 209 form is a tax document used in New York State, primarily for individuals and businesses to report specific tax information. This form is essential for ensuring compliance with state tax regulations. It serves various purposes, including reporting income, deductions, and credits. Understanding the IT 209 is crucial for accurate tax reporting and avoiding potential penalties.

How to use the IT 209

Using the IT 209 form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and deduction records. Next, carefully fill out the form, ensuring all information is accurate and complete. Once completed, review the form for any errors before submission. Utilizing digital tools can streamline this process, allowing for easy edits and secure submission.

Steps to complete the IT 209

Completing the IT 209 form requires a systematic approach:

- Collect all relevant financial documents.

- Fill in your personal information, including name, address, and Social Security number.

- Report your total income and any applicable deductions.

- Calculate your tax liability based on the information provided.

- Review the form for accuracy and completeness.

- Submit the form electronically or via mail, adhering to the submission guidelines.

Legal use of the IT 209

The IT 209 form is legally binding when completed correctly and submitted on time. It must comply with all state regulations regarding tax reporting. Using a reliable eSignature solution can enhance the legal validity of the form, ensuring that all signatures are authenticated and that the document meets the necessary legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the IT 209 form are crucial for compliance. Typically, the form must be submitted by April fifteenth for individual taxpayers. Businesses may have different deadlines based on their fiscal year. It is essential to stay informed about any changes to these dates to avoid penalties and interest on late submissions.

Who Issues the Form

The IT 209 form is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax compliance and ensuring that taxpayers fulfill their obligations. Understanding the role of this agency can help taxpayers navigate the complexities of tax reporting and compliance in New York.

Quick guide on how to complete it 209

Complete It 209 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documentation, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without delays. Handle It 209 on any device using airSlate SignNow’s apps for Android or iOS and simplify any document-related process today.

The easiest method to edit and electronically sign It 209

- Locate It 209 and click Get Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information, then click the Done button to save your adjustments.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign It 209 while ensuring clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 209

Create this form in 5 minutes!

People also ask

-

What is the it 209 feature in airSlate SignNow?

The it 209 feature in airSlate SignNow allows users to efficiently manage and automate document workflows. This feature streamlines the eSigning process, making it easy to send and track documents, ensuring a smoother experience for all parties involved.

-

How does airSlate SignNow pricing work for the it 209 tool?

airSlate SignNow offers competitive pricing plans that include access to the it 209 capabilities. Users can choose from different subscription tiers based on their business size and signing needs, ensuring they get the best value for their investment.

-

What are the main benefits of using it 209 in airSlate SignNow?

The benefits of using it 209 in airSlate SignNow include enhanced efficiency, improved workflow automation, and reduced turnaround times for document signing. By leveraging this feature, businesses can experience signNow time savings and increased productivity.

-

Can I integrate it 209 with other software solutions?

Yes, airSlate SignNow's it 209 is designed for seamless integration with various software applications. This allows you to enhance productivity by connecting eSigning with your existing tools, such as CRM and document management systems.

-

Is it 209 secure for my sensitive documents?

Absolutely! The it 209 feature in airSlate SignNow prioritizes security with advanced encryption and compliance measures. This ensures that all your sensitive documents are protected during the eSigning process, providing peace of mind for your business.

-

How easy is it to use the it 209 functionality?

Using the it 209 functionality in airSlate SignNow is incredibly user-friendly. With an intuitive interface, even those with minimal tech experience can quickly learn to send and sign documents effortlessly, making it accessible for everyone on your team.

-

Are there any mobile options for it 209?

Yes, airSlate SignNow offers a mobile app that supports the it 209 feature, enabling users to send and sign documents on-the-go. This flexibility helps businesses maintain productivity regardless of their physical location.

Get more for It 209

- Ssc board application form pdf

- University of education lahore degree verification challan form 448426977

- Reading explorer 3 answer key form

- Reading explorer 5 answer key form

- Akhuwat loan online application form

- Onet interest profiler short form

- Job board department of corrections and rehabilitation form

- Sample form x3 soldering procedure specification sps

Find out other It 209

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template