ACH Transfer Vs Wire Transfer What is the Difference? 2022-2026

Understanding ACH Transfers and Wire Transfers

ACH transfers and wire transfers are two common methods for moving money electronically. The Automated Clearing House (ACH) system is primarily used for direct deposits, payroll, and recurring payments. It processes transactions in batches, which makes it cost-effective but slower compared to wire transfers. Wire transfers, on the other hand, are typically used for larger amounts and provide immediate transfer of funds between banks. Understanding these differences can help you choose the right method for your financial needs.

Steps to Complete an ACH Transfer

To initiate an ACH transfer, follow these steps:

- Gather necessary information, including the recipient's name, bank account number, and routing number.

- Log into your bank's online banking platform or mobile app.

- Navigate to the section for making payments or transfers.

- Select ACH transfer as your payment method.

- Enter the recipient's details and the amount you wish to transfer.

- Review the information for accuracy and confirm the transaction.

Keep in mind that ACH transfers may take one to three business days to process.

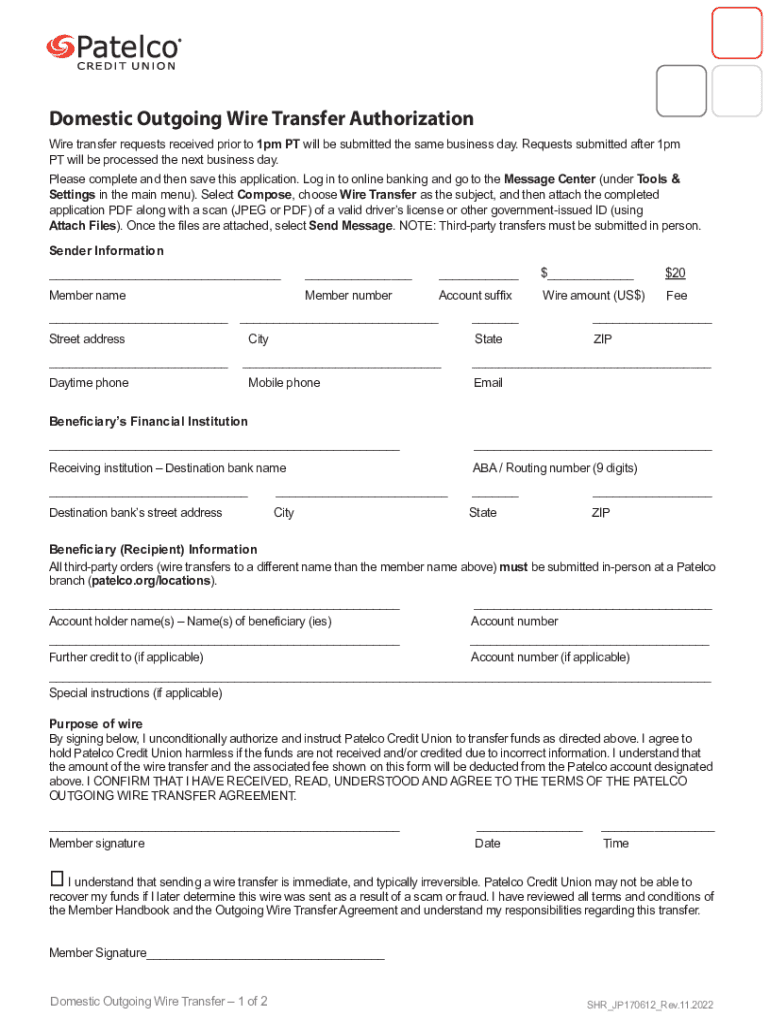

Key Elements of Wire Transfers

Wire transfers involve several key elements that ensure secure and efficient transactions:

- Sender's Information: The sender must provide their bank account details and identification.

- Recipient's Information: Accurate details, including the recipient's name, account number, and bank's routing number, are essential.

- Transfer Fees: Most banks charge a fee for wire transfers, which can vary based on the amount and destination.

- Processing Time: Wire transfers are typically completed within hours, making them ideal for urgent transactions.

Examples of Using ACH Transfers and Wire Transfers

ACH transfers are commonly used for payroll deposits, utility bill payments, and subscription services. For example, if you receive your paycheck directly deposited into your bank account, that is an ACH transfer. Wire transfers are often used for real estate transactions, international payments, or sending large sums of money quickly. For instance, when purchasing a home, the buyer may use a wire transfer to send the down payment to the seller's bank.

Legal Use of ACH Transfers and Wire Transfers

Both ACH and wire transfers are governed by federal regulations in the United States, including the Electronic Fund Transfer Act (EFTA). This act provides consumer protections for electronic payments, ensuring that users are informed of their rights and responsibilities. It is essential for individuals and businesses to comply with these regulations to avoid penalties and ensure secure transactions.

Quick guide on how to complete ach transfer vs wire transfer what is the difference

Execute ACH Transfer Vs Wire Transfer What Is The Difference? effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents swiftly and without delays. Manage ACH Transfer Vs Wire Transfer What Is The Difference? on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and eSign ACH Transfer Vs Wire Transfer What Is The Difference? without hassle

- Locate ACH Transfer Vs Wire Transfer What Is The Difference? and click Get Form to initiate.

- Utilize the features we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for such purposes.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device of your preference. Modify and eSign ACH Transfer Vs Wire Transfer What Is The Difference? and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ach transfer vs wire transfer what is the difference

Create this form in 5 minutes!

How to create an eSignature for the ach transfer vs wire transfer what is the difference

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the patelco routing number?

The Patelco routing number is a unique nine-digit code used to identify Patelco Credit Union for electronic transactions. This number is essential for processing transfers, direct deposits, and bill payments effectively. Make sure to use the correct patelco routing number to avoid any issues with your transactions.

-

How can I find my patelco routing number?

You can find your Patelco routing number on the bottom left corner of your checks. Alternatively, you can log into your Patelco online banking account or contact customer support for assistance. Knowing your patelco routing number is crucial for setting up direct deposits and making electronic transfers.

-

What are the benefits of using airSlate SignNow with my Patelco routing number?

Using airSlate SignNow with your Patelco routing number allows you to streamline your document signing process seamlessly. You can send and eSign documents quickly, enhancing your business's efficiency. The integration with your Patelco account further simplifies transactions related to any agreements or contracts.

-

Are there any fees associated with using my patelco routing number for transactions?

Typically, there are no fees directly associated with using your patelco routing number for standard transactions such as direct deposits and bill payments. However, it's always best to check with Patelco Credit Union for any specific terms that may apply. Using airSlate SignNow can also help you keep costs low while handling electronic documents.

-

Can I integrate airSlate SignNow with my Patelco Credit Union accounts?

Yes, you can easily integrate airSlate SignNow with your Patelco Credit Union accounts to manage document signing and transactions. This integration enables you to utilize your patelco routing number efficiently while ensuring secure document handling. The platform is designed to enhance productivity in your business operations.

-

What features does airSlate SignNow offer that are beneficial with my patelco routing number?

AirSlate SignNow offers numerous features such as electronic signature capabilities, document tracking, and secure cloud storage. Utilizing these features along with your patelco routing number allows for an efficient transaction process. This combination simplifies document management and ensures compliance with necessary regulations.

-

Is airSlate SignNow suitable for small businesses using a patelco routing number?

Absolutely! AirSlate SignNow is a cost-effective solution perfect for small businesses leveraging their patelco routing number for transactions. It simplifies the process of sending, signing, and managing documents, allowing small businesses to operate efficiently and effectively as they grow.

Get more for ACH Transfer Vs Wire Transfer What Is The Difference?

- Filled form of accord130

- Texas w 3 form

- Rental application pdf from coldwell banker chicago form

- Fictitious business name filing ventura county form fill 2013

- Irs form n 848pdffillercom 2012

- D 400 fillable form 2012

- Florida department of corrections supplemental application form

- Form m660 26nr 2010 rediform

Find out other ACH Transfer Vs Wire Transfer What Is The Difference?

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself