California E File Authorization 2018

What is the California E File Authorization?

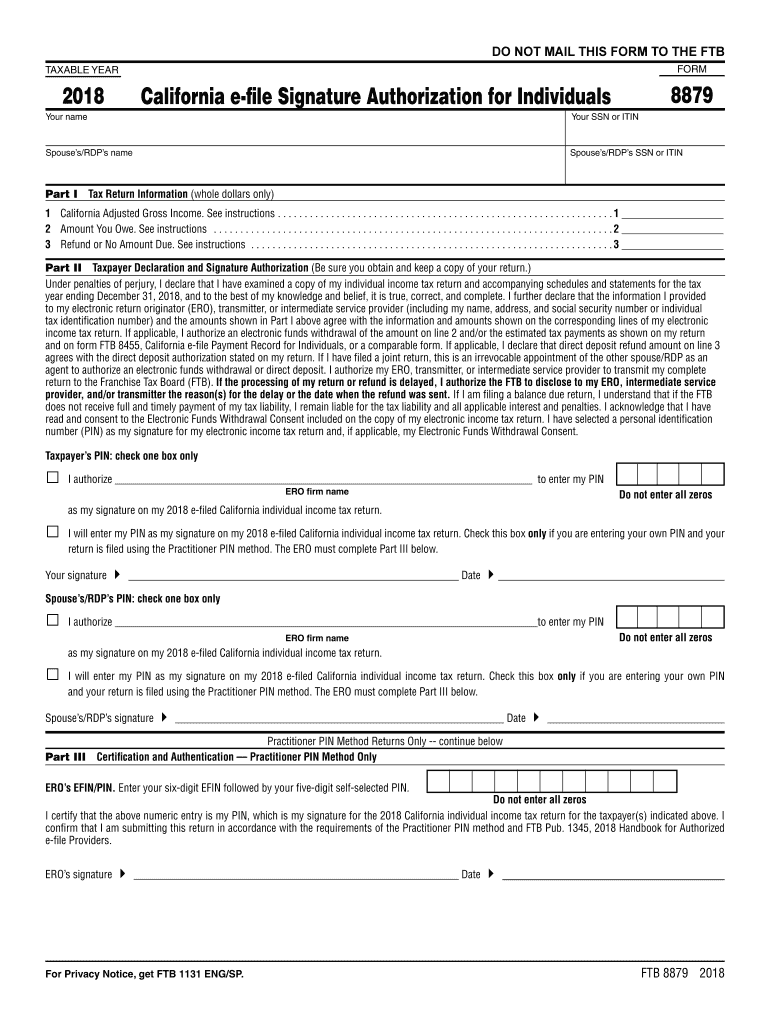

The California E File Authorization is a crucial document that allows taxpayers to electronically file their tax returns with the California Franchise Tax Board (FTB). This authorization streamlines the filing process by enabling tax professionals to submit returns on behalf of their clients, ensuring compliance with state regulations. The authorization is particularly beneficial for those who prefer the convenience of e-filing over traditional paper submissions.

How to Use the California E File Authorization

To effectively use the California E File Authorization, taxpayers must first complete the appropriate form, often referred to as the CA e file authorization form. This form typically requires personal information, including the taxpayer's name, Social Security number, and details about the tax preparer. Once completed, the form must be signed by the taxpayer, granting permission for their tax preparer to file electronically. It is essential to keep a copy of the authorization for personal records.

Steps to Complete the California E File Authorization

Completing the California E File Authorization involves several key steps:

- Gather necessary personal information, including your Social Security number and tax details.

- Obtain the CA e file authorization form from the California Franchise Tax Board website or your tax preparer.

- Fill out the form accurately, ensuring all required fields are completed.

- Sign the form to provide your consent for electronic filing.

- Submit the completed form to your tax preparer or directly to the FTB, as required.

Legal Use of the California E File Authorization

The California E File Authorization is legally binding, provided it is completed in accordance with state regulations. This authorization ensures that the taxpayer has granted explicit permission for their tax preparer to file on their behalf. It is important for both taxpayers and tax preparers to understand their responsibilities under California tax law, as improper use of the authorization can lead to penalties or delays in processing returns.

Required Documents

When completing the California E File Authorization, certain documents may be necessary to support the information provided on the form. These documents typically include:

- Personal identification, such as a driver's license or state ID.

- Previous year’s tax return for reference.

- Any relevant income statements, such as W-2s or 1099s.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the California E File Authorization. Generally, the deadline for submitting state income tax returns aligns with the federal deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the California Franchise Tax Board's website for any updates or changes to these important dates.

Quick guide on how to complete california tax form 8879 2018 2019

Your assistance manual on how to prepare your California E File Authorization

If you’re interested in understanding how to finalize and dispatch your California E File Authorization, here are some brief instructions on how to simplify tax submission.

To begin, you simply need to create your airSlate SignNow account to revolutionize how you manage documentation online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax files with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures, and revisit to amend responses when necessary. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your California E File Authorization in just a few minutes:

- Set up your account and start processing PDFs in no time.

- Access our library to obtain any IRS tax form; browse through editions and schedules.

- Select Get form to open your California E File Authorization in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and rectify any errors.

- Save modifications, print your document, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper may lead to increased errors and delays in refunds. Undoubtedly, before electronically filing your taxes, visit the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct california tax form 8879 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

I started teaching piano lessons this year, how do I pay quarterly taxes in California? What form should I fill out?

Go to https://www.irs.gov/pub/irs-pdf/... You will file a form 1040ES each quarter. The website will tell you the due dates for each quarterly payment. Get a similar form from your state tax board website if you pay state taxes.Note: If this is your first year filing, ever, then you can get away without sending in estimated payments because you owe the LESSER of what you owe this year or last year. Having been self-employed most of my life, I always filed quarterly estimated taxes, using the amount I had owed the year before, because I had to to avoid fines, and because I didn't want to get to April of the next year and not have the money. As for the amount you should pay to the IRS and your state, you might be able to figure this out using worksheets available on the IRS and state websites. If you chose to deal in cash and not report it, that's your business. Your students are not going to send you a 1099 at the end of the year. But if you teach at an institution which pays you more than a few thousand dollars a year, they WILL file a 1099 stating how much they paid you in miscellaneous income, with the IRS and state.

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the california tax form 8879 2018 2019

How to make an electronic signature for the California Tax Form 8879 2018 2019 in the online mode

How to generate an electronic signature for the California Tax Form 8879 2018 2019 in Chrome

How to make an electronic signature for putting it on the California Tax Form 8879 2018 2019 in Gmail

How to make an eSignature for the California Tax Form 8879 2018 2019 right from your smart phone

How to create an eSignature for the California Tax Form 8879 2018 2019 on iOS

How to make an eSignature for the California Tax Form 8879 2018 2019 on Android OS

People also ask

-

What is a CA e file signature?

A CA e file signature is a secure, electronic signature used to validate documents in compliance with Canadian regulations. It provides authenticity and integrity, ensuring that the signed document cannot be altered. airSlate SignNow supports CA e file signatures, making it easy for businesses to sign documents digitally.

-

How does airSlate SignNow support CA e file signatures?

airSlate SignNow integrates seamlessly with CA e file signature solutions, allowing users to sign documents securely online. Our platform enables the creation, sending, and receiving of documents with a CA e file signature directly from your workspace. This streamlines the signing process and enhances document security.

-

Is there a cost associated with using CA e file signatures on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for CA e file signatures, depending on your subscription plan. We offer various pricing tiers to meet the needs of different businesses, including a free trial to explore essential features. This ensures you can find a solution that fits your budget while utilizing CA e file signatures.

-

What are the key features of airSlate SignNow related to CA e file signatures?

AirSlate SignNow provides essential features such as document templates, automated reminders, and real-time tracking for CA e file signatures. The platform also offers secure storage and compliance with legal standards, ensuring that all signatures are valid and enforceable. These features help businesses manage documents efficiently.

-

What are the benefits of using CA e file signatures with airSlate SignNow?

Using CA e file signatures with airSlate SignNow enhances security, reduces paper waste, and speeds up the document signing process. This digital solution simplifies the workflow and ensures compliance with Canadian regulations, giving your business a competitive edge. Additionally, it improves the overall customer experience by providing quick access to signed documents.

-

Can I integrate airSlate SignNow with other software for CA e file signatures?

Yes, airSlate SignNow offers flexible integrations with various CRM, accounting, and document management software, facilitating the use of CA e file signatures within your existing workflow. This allows businesses to enhance productivity by automating document processes. Our API also provides additional customization options for seamless integration.

-

Is my data secure when using CA e file signatures with airSlate SignNow?

Absolutely! AirSlate SignNow takes data security seriously, ensuring that all information related to CA e file signatures is encrypted and stored securely. Our platform complies with industry standards and regulations, providing businesses with peace of mind regarding data protection. Your documents are safe, and your signatures remain legally binding.

Get more for California E File Authorization

- Ri 71 3 remittance form

- Garrettland form

- Colorado uniform employee application small group health

- Caq application form

- Thickened fluids winnipeg regional health authority form

- Relates to the following request types form

- First home new home exemption or concession from duty application form and lodgement guide

- Cr 112jv 792 s judicial council form

Find out other California E File Authorization

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template