FORM 8879 California E File Signature Authorization for Individuals FORM 8879 California E File Signature Authorization for Indi 2023-2026

Understanding Form 8879 California E-file Signature Authorization

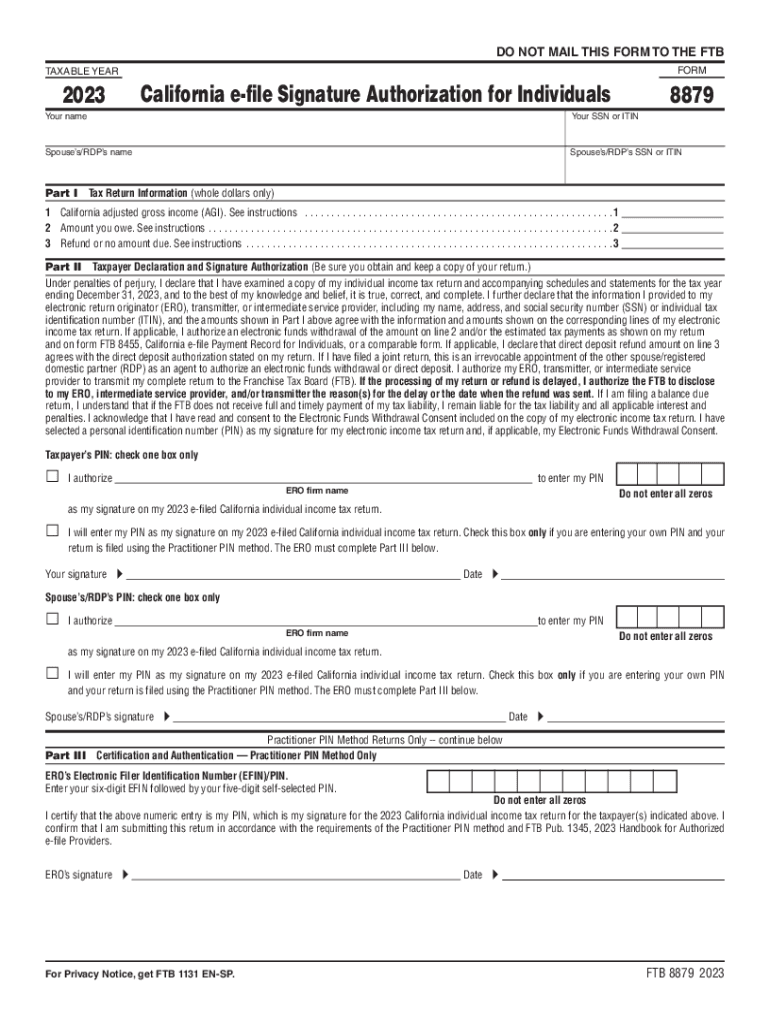

Form 8879, also known as the California E-file Signature Authorization, is a critical document for individuals filing their taxes electronically in California. This form serves as a declaration that the taxpayer has reviewed their tax return and authorizes the electronic filing of their return. It ensures that the taxpayer's signature is legally recognized for e-filing purposes, streamlining the process while maintaining compliance with IRS regulations.

Steps to Complete Form 8879 California

Completing Form 8879 involves several straightforward steps. First, gather all necessary tax documents, including your completed tax return. Next, fill out the form by entering your personal information, such as your name, Social Security number, and the tax year. After that, review the information for accuracy. Finally, sign and date the form to authorize the electronic submission of your tax return. It is essential to ensure that all details match those on your tax return to avoid any issues during filing.

Obtaining Form 8879 California

Form 8879 can be obtained from the California Franchise Tax Board's website or through tax preparation software that supports e-filing. Many tax professionals also provide this form as part of their services. Ensure that you are using the most current version of the form to comply with the latest tax regulations. If you are working with a tax preparer, they will typically provide the form as part of the e-filing process.

Legal Use of Form 8879 California

The legal use of Form 8879 is crucial for ensuring that the electronic filing of your tax return is valid. By signing this form, you are affirming that you have reviewed your tax return and that the information provided is accurate to the best of your knowledge. This authorization is necessary for the IRS to accept your e-filed return. Failure to properly complete and sign this form may result in delays or rejections of your tax filing.

Key Elements of Form 8879 California

Key elements of Form 8879 include taxpayer identification information, the tax preparer's information (if applicable), and the taxpayer's signature and date. The form also includes a section for the tax preparer to indicate their credentials and confirm their role in the filing process. Understanding these elements is important for ensuring that all required information is accurately provided, facilitating a smooth e-filing experience.

Filing Deadlines for Form 8879 California

Filing deadlines for Form 8879 align with the general tax filing deadlines established by the IRS. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to submit Form 8879 promptly to ensure that your e-filed return is processed in a timely manner, avoiding potential penalties or interest on late filings.

Examples of Using Form 8879 California

Form 8879 is commonly used by individual taxpayers who choose to file their taxes electronically, especially those who work with tax professionals. For instance, a self-employed individual may use this form to authorize their tax preparer to file their return electronically. Similarly, retirees or students filing their taxes can also utilize this form to ensure their returns are submitted efficiently. Understanding these scenarios can help taxpayers recognize the importance of Form 8879 in the e-filing process.

Create this form in 5 minutes or less

Find and fill out the correct form 8879 california e file signature authorization for individuals form 8879 california e file signature authorization for

Create this form in 5 minutes!

How to create an eSignature for the form 8879 california e file signature authorization for individuals form 8879 california e file signature authorization for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8879 California?

Form 8879 California is an e-signature authorization form that allows taxpayers to electronically sign their California tax returns. This form is essential for ensuring that your e-filed return is valid and accepted by the California Franchise Tax Board.

-

How can airSlate SignNow help with Form 8879 California?

airSlate SignNow provides a seamless platform for electronically signing Form 8879 California. With our user-friendly interface, you can quickly fill out and eSign the form, ensuring compliance and efficiency in your tax filing process.

-

Is there a cost associated with using airSlate SignNow for Form 8879 California?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage and eSign Form 8879 California without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for Form 8879 California?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for Form 8879 California. These features enhance your document management process, making it easier to handle tax forms efficiently.

-

Can I integrate airSlate SignNow with other software for Form 8879 California?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to streamline your workflow when handling Form 8879 California. This integration helps reduce manual data entry and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for Form 8879 California?

Using airSlate SignNow for Form 8879 California offers numerous benefits, including faster processing times, enhanced security, and improved accuracy. Our platform ensures that your tax documents are handled efficiently, giving you peace of mind during tax season.

-

Is airSlate SignNow secure for signing Form 8879 California?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form 8879 California is signed in a safe environment. We utilize advanced encryption and authentication measures to protect your sensitive information throughout the signing process.

Get more for FORM 8879 California E file Signature Authorization For Individuals FORM 8879 California E file Signature Authorization For Indi

Find out other FORM 8879 California E file Signature Authorization For Individuals FORM 8879 California E file Signature Authorization For Indi

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document