Form 8879 California E File Signature Authorization for Individuals 2022

What is the Form 8879 California E file Signature Authorization For Individuals

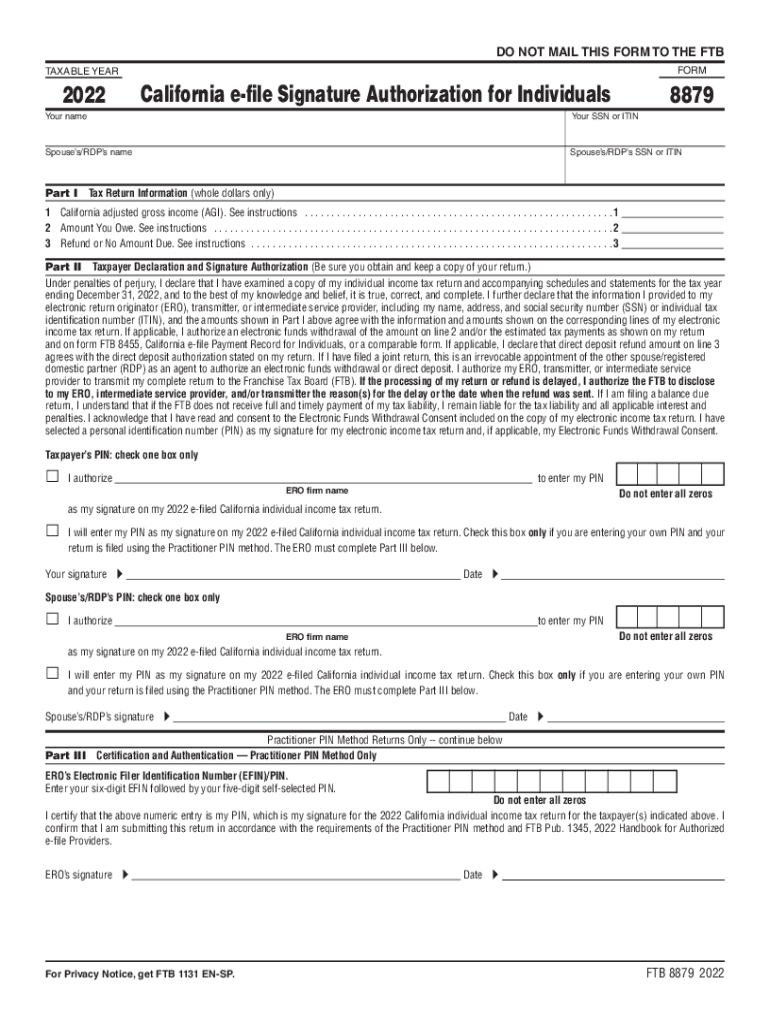

The Form 8879 California E file Signature Authorization is a crucial document that allows individuals to electronically file their tax returns. This form serves as an authorization for the tax preparer to submit the taxpayer's return to the California Franchise Tax Board (FTB) electronically. By signing this form, taxpayers confirm that they have reviewed their tax return and authorize the e-filing process. This form is particularly important for ensuring compliance with state regulations regarding electronic submissions.

How to use the Form 8879 California E file Signature Authorization For Individuals

Using the Form 8879 involves a straightforward process. First, taxpayers must complete their tax return using tax preparation software or through a tax professional. Once the return is finalized, the taxpayer will fill out the Form 8879, providing necessary information such as their name, Social Security number, and the tax year. After completing the form, the taxpayer must sign it, either electronically or by hand, depending on the method of submission. The signed form is then submitted to the tax preparer, who will use it to e-file the tax return with the FTB.

Steps to complete the Form 8879 California E file Signature Authorization For Individuals

Completing the Form 8879 requires careful attention to detail. Here are the steps to follow:

- Gather your tax return information, including income, deductions, and credits.

- Access the Form 8879 through your tax preparation software or request it from your tax professional.

- Fill in your personal details, including your name, Social Security number, and the tax year.

- Review your tax return to ensure all information is accurate and complete.

- Sign the form, confirming your authorization for e-filing.

- Submit the signed Form 8879 to your tax preparer.

Legal use of the Form 8879 California E file Signature Authorization For Individuals

The legal use of the Form 8879 is governed by federal and state regulations regarding electronic signatures and tax filing. When properly completed and signed, the form is considered legally binding. It complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA), which establish the validity of electronic signatures. Taxpayers must ensure that they follow all guidelines to maintain the legal integrity of their e-filing process.

Key elements of the Form 8879 California E file Signature Authorization For Individuals

Several key elements must be included in the Form 8879 to ensure its validity:

- Taxpayer Information: Full name, Social Security number, and address.

- Tax Preparer Information: Name and identification number of the tax preparer.

- Tax Year: The year for which the tax return is being filed.

- Signature: The taxpayer's signature, which can be electronic or handwritten.

- Date: The date the form is signed by the taxpayer.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8879 align with the general tax filing deadlines set by the IRS and the California FTB. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential for taxpayers to be aware of these deadlines to avoid penalties and ensure timely submission of their tax returns.

Quick guide on how to complete 2022 form 8879 california e file signature authorization for individuals

Complete Form 8879 California E file Signature Authorization For Individuals effortlessly on any gadget

Internet-based document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can access the appropriate form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Form 8879 California E file Signature Authorization For Individuals on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Form 8879 California E file Signature Authorization For Individuals with ease

- Locate Form 8879 California E file Signature Authorization For Individuals and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal value as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about missing or lost documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your device of choice. Edit and eSign Form 8879 California E file Signature Authorization For Individuals and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 8879 california e file signature authorization for individuals

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 8879 california e file signature authorization for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Form 8879?

California Form 8879 is an essential document that authorizes an e-filed tax return to be filed electronically. It is often required by taxpayers to confirm the accuracy of their tax return details. Utilizing airSlate SignNow, you can easily eSign California Form 8879 securely and efficiently.

-

How does airSlate SignNow facilitate signing California Form 8879?

airSlate SignNow streamlines the signing process for California Form 8879 by providing a user-friendly platform where you can electronically sign documents. You can upload your Form 8879, add your signature, and send it to relevant parties swiftly. This eliminates the hassle of printing and scanning.

-

Is airSlate SignNow cost-effective for using California Form 8879?

Yes, airSlate SignNow offers a cost-effective solution for managing California Form 8879 and other documents. The pricing tiers are designed to cater to various user needs while ensuring that you receive the best value for your investment. With airSlate SignNow, you can save time and resources.

-

What features does airSlate SignNow offer for managing California Form 8879?

airSlate SignNow includes features like template creation, document sharing, and real-time tracking specifically tailored for California Form 8879. These features allow you to manage the signing process efficiently and stay organized throughout your tax filing. Enhancing your workflow is simple with airSlate SignNow.

-

Can I integrate airSlate SignNow with other platforms while handling California Form 8879?

Absolutely! airSlate SignNow provides seamless integrations with various platforms, making it easy to manage California Form 8879 alongside your existing apps and systems. This interoperability allows for a more streamlined workflow and enhances your overall productivity.

-

Is airSlate SignNow suitable for small businesses needing California Form 8879?

Definitely! airSlate SignNow is designed to accommodate businesses of all sizes, including small enterprises. It offers features that simplify the process of obtaining eSignatures on California Form 8879, ensuring you can manage tax responsibilities without unnecessary complications.

-

What are the benefits of using airSlate SignNow for California Form 8879?

Using airSlate SignNow for California Form 8879 brings numerous benefits, including enhanced security for your documents and signNow time savings. By allowing digital signatures, you can accelerate the filing process and reduce the need for physical paperwork. Moreover, its user-friendly interface ensures a hassle-free experience.

Get more for Form 8879 California E file Signature Authorization For Individuals

- Sheetrock drywall contract for contractor south dakota form

- Flooring contract for contractor south dakota form

- Sd deed form

- Notice of intent to enforce forfeiture provisions of contact for deed south dakota form

- Final notice of forfeiture and request to vacate property under contract for deed south dakota form

- Buyers request for accounting from seller under contract for deed south dakota form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed south dakota form

- General notice of default for contract for deed south dakota form

Find out other Form 8879 California E file Signature Authorization For Individuals

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request