Form 8879 California E File Signature Authorization for 2019

What is the Form 8879 California E file Signature Authorization For

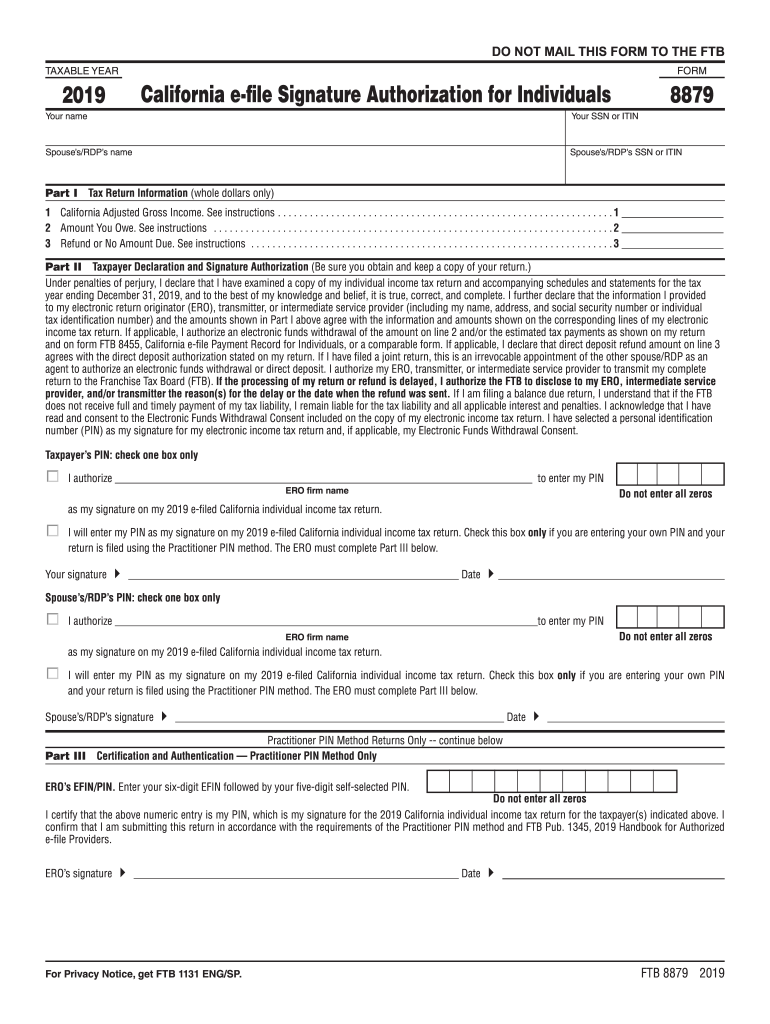

The Form 8879, also known as the California E file Signature Authorization, is a crucial document used by taxpayers in California to authorize the electronic filing of their tax returns. This form serves as a declaration that the taxpayer has reviewed their return and agrees to its submission. It is particularly important for tax professionals who file on behalf of clients, ensuring that the process remains compliant with state regulations.

How to use the Form 8879 California E file Signature Authorization

Using the Form 8879 involves several steps. First, the taxpayer must complete their tax return, ensuring all information is accurate. Next, the tax professional will prepare the Form 8879, which includes details such as the taxpayer's name, Social Security number, and the tax year. After reviewing the return, the taxpayer must sign the form, either electronically or by hand, depending on the method of filing. Once signed, the form is submitted alongside the e-filed tax return to the California Franchise Tax Board.

Steps to complete the Form 8879 California E file Signature Authorization

Completing the Form 8879 involves a series of straightforward steps:

- Gather necessary information, including your tax return and identification details.

- Fill out the taxpayer information section, ensuring accuracy.

- Review the completed tax return with your tax professional.

- Sign the Form 8879 to authorize the e-filing of your return.

- Submit the signed form along with your e-filed tax return to the California Franchise Tax Board.

Key elements of the Form 8879 California E file Signature Authorization

The Form 8879 contains several key elements that are essential for its validity. These include:

- Taxpayer Information: Name, address, and Social Security number.

- Tax Professional Information: Details of the tax preparer, including their identification number.

- Signature Section: A designated area for the taxpayer's signature, indicating consent for e-filing.

- Tax Year: The specific tax year for which the authorization is being granted.

Legal use of the Form 8879 California E file Signature Authorization

The legal use of the Form 8879 is governed by various regulations that ensure electronic signatures are valid. Under the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA), electronic signatures have the same legal standing as traditional handwritten signatures. This means that once the Form 8879 is signed electronically, it is legally binding and can be used in the event of disputes or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8879 align with the overall tax filing deadlines set by the IRS and the California Franchise Tax Board. Typically, individual tax returns are due by April 15, unless an extension is filed. It is essential to complete and submit the Form 8879 before the tax return deadline to ensure timely processing and avoid penalties. Taxpayers should also be aware of any changes in deadlines that may occur due to holidays or other factors.

Quick guide on how to complete 2019 form 8879 california e file signature authorization for

Complete Form 8879 California E file Signature Authorization For effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Form 8879 California E file Signature Authorization For on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest way to alter and eSign Form 8879 California E file Signature Authorization For without hassle

- Obtain Form 8879 California E file Signature Authorization For and then click Get Form to commence.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document versions. airSlate SignNow takes care of all your document management needs in just a few clicks from any chosen device. Edit and eSign Form 8879 California E file Signature Authorization For and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 8879 california e file signature authorization for

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8879 california e file signature authorization for

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is a California e file form?

A California e file form is a digital document submitted online to the California tax authorities for filing taxes. This method allows users to easily and securely e-file their tax documents, ensuring compliance with state regulations. AirSlate SignNow streamlines this process by providing tools for document preparation and e-signatures.

-

How does airSlate SignNow support California e file forms?

AirSlate SignNow offers a user-friendly platform that simplifies the creation and submission of California e file forms. It allows users to easily upload necessary documents, gather electronic signatures, and transmit files securely. This ensures a smooth workflow for businesses looking to file taxes efficiently.

-

What are the benefits of using airSlate SignNow for California e file forms?

Using airSlate SignNow for California e file forms provides several advantages, including reduced processing time and improved accuracy. The platform ensures that all documents are compliant with California regulations and allows for easy tracking of submissions. Moreover, users can access templates and automated reminders for deadlines.

-

Is there a cost to use airSlate SignNow for e filing California forms?

Yes, there is a cost associated with using airSlate SignNow for e filing California forms, but it is designed to be cost-effective for businesses of all sizes. Various pricing plans are available to fit different needs, and the features included can signNowly reduce administrative burden and enhance productivity.

-

Can airSlate SignNow integrate with other platforms for California e file forms?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting and financial software to optimize the process of completing California e file forms. These integrations ensure that data moves smoothly between systems, eliminating manual entry and reducing errors.

-

What features does airSlate SignNow offer for managing California e file forms?

AirSlate SignNow provides robust features for managing California e file forms, including document templates, e-signatures, and workflow automation. Users can track the status of their forms in real-time, making it easy to manage submissions and ensure compliance. These features help streamline the entire filing process.

-

How secure is airSlate SignNow for handling California e file forms?

Security is a top priority at airSlate SignNow when handling California e file forms. The platform employs industry-standard encryption and complies with data protection regulations to secure sensitive information. Users can trust that their documents and personal data are safe while using our services.

Get more for Form 8879 California E file Signature Authorization For

- Framing contract for contractor wyoming form

- Security contract for contractor wyoming form

- Insulation contract for contractor wyoming form

- Paving contract for contractor wyoming form

- Site work contract for contractor wyoming form

- Siding contract for contractor wyoming form

- Refrigeration contract for contractor wyoming form

- Drainage contract for contractor wyoming form

Find out other Form 8879 California E file Signature Authorization For

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors