IRS Form 433 a Instructions & Purpose of This Statement 2023

Understanding IRS Form 433-A: Purpose and Instructions

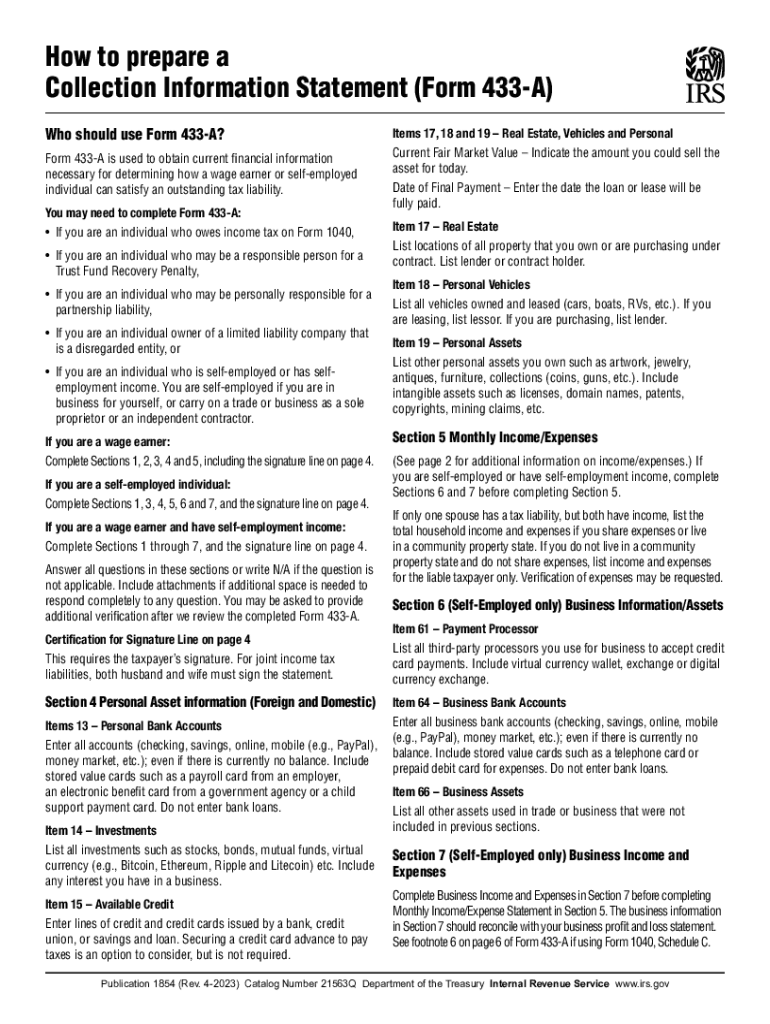

The IRS Form 433-A is a collection statement that provides the Internal Revenue Service with a detailed overview of an individual's financial situation. This form is essential for taxpayers who are seeking to negotiate a payment plan or settle their tax debts. By filling out this form, individuals can disclose their income, expenses, assets, and liabilities, allowing the IRS to assess their ability to pay. Understanding the purpose of this form is crucial for anyone facing tax collection issues.

Steps to Complete IRS Form 433-A

Completing the IRS Form 433-A involves several key steps to ensure accuracy and completeness. First, gather all necessary financial documents, including pay stubs, bank statements, and bills. Next, fill out the personal information section, providing your name, address, and Social Security number. After that, detail your income sources, including wages, self-employment income, and any other earnings. Following this, list your monthly expenses, categorizing them into necessary living costs such as housing, utilities, and transportation. Finally, report your assets, including bank accounts, real estate, and vehicles, along with any outstanding liabilities. Review the form carefully before submission to avoid errors that could delay processing.

Required Documents for IRS Form 433-A

When filing IRS Form 433-A, it is important to include supporting documentation to validate the information provided. Required documents typically include:

- Recent pay stubs or proof of income

- Bank statements for the last three months

- Documentation of monthly expenses, such as utility bills and lease agreements

- Statements for any outstanding debts or loans

- Proof of assets, including real estate appraisals or vehicle titles

Having these documents ready will facilitate the review process by the IRS and improve the chances of a favorable outcome.

Submission Methods for IRS Form 433-A

IRS Form 433-A can be submitted through various methods, allowing for flexibility based on individual preferences. Taxpayers can choose to file the form online through the IRS website, ensuring a quicker processing time. Alternatively, the form can be mailed directly to the appropriate IRS office, which may take longer for processing. In some cases, individuals may opt to deliver the form in person at a local IRS office, providing an opportunity to discuss their situation directly with an IRS representative. Each submission method has its own benefits, so it's important to consider which option best suits your needs.

Eligibility Criteria for Using IRS Form 433-A

To utilize IRS Form 433-A, individuals must meet specific eligibility criteria. This form is primarily designed for taxpayers who owe back taxes and are unable to pay the full amount due. It is applicable for individuals who wish to establish an installment agreement or seek an offer in compromise with the IRS. Additionally, the form is suitable for those who have received a notice of levy or are facing other collection actions. Understanding these criteria is essential to ensure that the form is used appropriately and effectively.

Quick guide on how to complete irs form 433 a instructions ampamp purpose of this statement

Complete IRS Form 433 A Instructions & Purpose Of This Statement effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle IRS Form 433 A Instructions & Purpose Of This Statement on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign IRS Form 433 A Instructions & Purpose Of This Statement with ease

- Locate IRS Form 433 A Instructions & Purpose Of This Statement and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IRS Form 433 A Instructions & Purpose Of This Statement and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 433 a instructions ampamp purpose of this statement

Create this form in 5 minutes!

How to create an eSignature for the irs form 433 a instructions ampamp purpose of this statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Statement 433A?

The IRS Statement 433A is a form used by taxpayers to provide a comprehensive overview of their financial situation to the IRS. It is often required during tax negotiations or to apply for a payment plan. Understanding how to accurately complete this form is essential for effective communication with the IRS.

-

How can airSlate SignNow assist with IRS Statement 433A submissions?

airSlate SignNow simplifies the process of preparing and submitting the IRS Statement 433A by allowing you to eSign documents directly. Our platform ensures that your forms are securely completed and shared with the IRS quickly. This eliminates potential delays in your application process.

-

Is airSlate SignNow compliant with IRS regulations for eSignatures?

Yes, airSlate SignNow complies with the IRS regulations regarding eSignatures, ensuring your IRS Statement 433A submissions are valid. Our platform meets all necessary security standards for electronic signatures, making it a trustworthy choice for your tax documents. This compliance helps to facilitate smoother transactions with the IRS.

-

What are the pricing options for using airSlate SignNow for IRS Statement 433A?

airSlate SignNow offers flexible pricing plans suitable for individuals and businesses alike. Depending on your needs, you can choose from monthly or annual subscriptions that provide access to all features necessary for preparing and signing documents, including the IRS Statement 433A. This cost-effective solution aims to save you time and resources.

-

What features does airSlate SignNow offer to enhance my experience with IRS Statement 433A?

airSlate SignNow includes features such as real-time collaboration, document tracking, and customizable templates for IRS Statement 433A. These tools help streamline the document preparation process so you can focus on getting your tax obligations sorted efficiently. Enhanced security measures also protect your sensitive information.

-

Can I integrate airSlate SignNow with other applications for managing IRS Statement 433A?

Absolutely, airSlate SignNow seamlessly integrates with numerous applications like CRM and document management systems. This integration enhances productivity by allowing you to manage your IRS Statement 433A within your existing workflows. Streamlined processes ensure you maintain a complete overview of your financial documents.

-

How does airSlate SignNow ensure the security of my IRS Statement 433A?

Security is a top priority at airSlate SignNow. We employ robust encryption and authentication measures to protect your IRS Statement 433A and other sensitive documents. Regular security audits further reinforce our commitment to keeping your data safe and secure.

Get more for IRS Form 433 A Instructions & Purpose Of This Statement

- K 12 education expense credit worksheet form

- The girl and the chenoo form

- Review and reinforce probability and heredity form

- Liftline application 227158481 form

- Saif forms oregon

- Quit claim deed form massachusetts

- Cflc firearms shipment approval letter request form

- Landscape certificate of compliance sonoma county sonoma county form

Find out other IRS Form 433 A Instructions & Purpose Of This Statement

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF