Publication 1854 2014

What is the Publication 1854

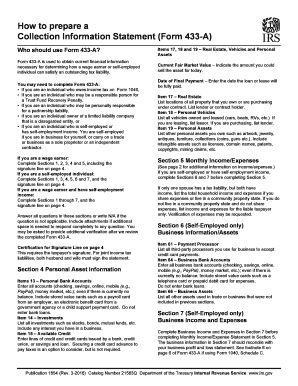

The Publication 1854 is a document issued by the IRS that provides guidance on the tax implications of certain transactions. It is particularly relevant for individuals and businesses involved in international trade and transactions. This publication outlines the necessary procedures and requirements for reporting income and expenses related to these activities. Understanding the contents of Publication 1854 is essential for compliance with federal tax laws and for ensuring accurate reporting on tax returns.

How to use the Publication 1854

Using the Publication 1854 involves reviewing the guidelines it provides and applying them to your specific tax situation. Taxpayers should start by determining if their activities fall under the purview of this publication. This may include assessing any international transactions or trade-related income. Once the relevant sections are identified, taxpayers can follow the outlined procedures to report their income and expenses accurately. It is advisable to consult a tax professional if there are uncertainties regarding the application of these guidelines.

Steps to complete the Publication 1854

Completing the requirements associated with Publication 1854 involves several key steps:

- Identify the relevant transactions that require reporting under this publication.

- Gather all necessary documentation related to income and expenses from these transactions.

- Follow the specific reporting guidelines outlined in the publication.

- Ensure that all information is accurately reflected on your tax return.

By following these steps, taxpayers can ensure compliance and avoid potential penalties.

Legal use of the Publication 1854

The legal use of Publication 1854 is grounded in its authority as an IRS document. Adhering to the guidelines set forth in this publication ensures that taxpayers comply with federal tax laws. It is crucial for individuals and businesses to understand that failure to follow these guidelines may result in penalties or audits. Therefore, utilizing the publication correctly not only aids in accurate reporting but also protects taxpayers from legal repercussions.

Key elements of the Publication 1854

Key elements of the Publication 1854 include:

- Definitions of terms related to international transactions.

- Reporting requirements for income derived from foreign sources.

- Guidelines for deducting expenses associated with these transactions.

- Examples of common scenarios that may arise in relation to the publication.

These elements provide a comprehensive framework for understanding the tax implications of international trade and transactions.

IRS Guidelines

The IRS guidelines within Publication 1854 are designed to assist taxpayers in navigating complex tax scenarios related to international transactions. These guidelines detail the specific forms and schedules that may need to be completed and submitted alongside a tax return. It is essential for taxpayers to familiarize themselves with these guidelines to ensure they are meeting all reporting obligations and to avoid any potential issues with the IRS.

Quick guide on how to complete publication 1854

Finish Publication 1854 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with everything required to create, modify, and eSign your documents rapidly without delays. Manage Publication 1854 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

Steps to alter and eSign Publication 1854 with ease

- Obtain Publication 1854 and click Get Form to begin.

- Utilize the options we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your delivery method for your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Publication 1854 and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 1854

Create this form in 5 minutes!

How to create an eSignature for the publication 1854

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is publication 1854 and how does it relate to airSlate SignNow?

Publication 1854 provides important guidelines on the electronic signature process and compliance laws. airSlate SignNow fully adheres to these regulations, ensuring that all signed documents meet legal requirements, giving businesses peace of mind when utilizing our eSigning solutions.

-

How does airSlate SignNow support compliance with publication 1854?

airSlate SignNow is designed to comply with publication 1854 regulations by employing advanced security features and maintaining an audit trail for all documents. This ensures that your electronic signatures are legally binding and compliant with applicable laws, which is crucial for businesses operating in regulated industries.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to various business needs. Prices can vary, and we ensure our solutions are cost-effective while adhering to standards like those provided in publication 1854, making our eSigning tool accessible for any business size.

-

What key features does airSlate SignNow offer to enhance document signing?

airSlate SignNow boasts features like advanced eSignature capabilities, templates, and team collaboration tools. These features not only streamline the signing process but also ensure that all practices align with publication 1854 standards, enhancing the overall efficiency and compliance of document management.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow seamlessly integrates with numerous applications such as CRM, cloud storage, and project management tools. This makes it easy for businesses to incorporate our eSigning solution into their existing workflows, all while remaining compliant with publication 1854.

-

What are the benefits of using airSlate SignNow for my business?

By using airSlate SignNow, businesses enhance their operational efficiency, reduce paper usage, and improve turnaround times for document signing. Furthermore, our alignment with publication 1854 ensures that signed documents are recognized for their legal validity, which protects your interests.

-

Is airSlate SignNow user-friendly for first-time users?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for first-time users to navigate. Our platform simplifies the signing process while ensuring compliance with publication 1854, so you can focus on what matters most—growing your business.

Get more for Publication 1854

- Form jd fm 159 download fillable pdf divorce complaint

- Pdf sc 26 request order alaska court system form

- 1250amp1625 form

- Fee waiver probate guardianship and conservatorship form

- Jv 330 s letters of guardianship juvenile spanish judicial council forms

- Jv 299 s de facto parent pamphlet spanish judicial council forms

- Or maryland before the register of wills for form

- Jv 297 s de facto parent order spanish judicial council forms

Find out other Publication 1854

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself