Publication 1854 Rev 4 2024

Understanding IRS Publication 1854 Rev 4

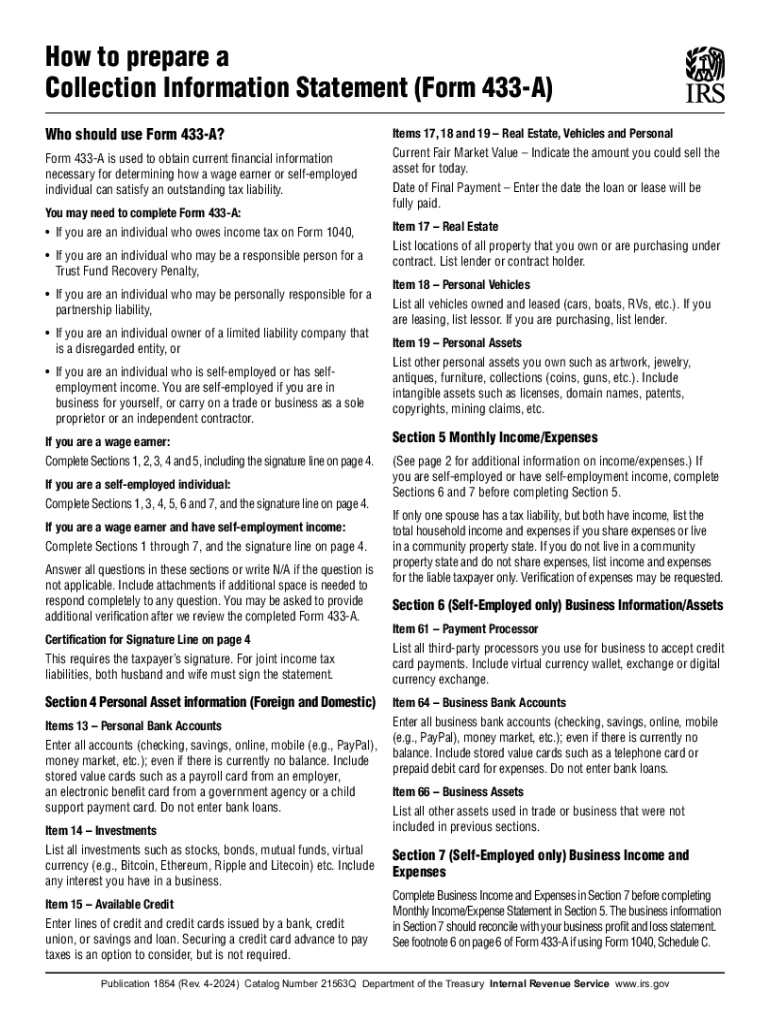

IRS Publication 1854 Rev 4 provides essential information regarding the IRS collection statement. It outlines the procedures and guidelines for taxpayers to understand their obligations and responsibilities concerning tax collection. This publication is particularly useful for individuals and businesses who need clarity on how the IRS manages collections and what steps they must take to comply with tax laws.

How to Utilize IRS Publication 1854 Rev 4

To effectively use IRS Publication 1854 Rev 4, taxpayers should first familiarize themselves with its contents. The publication includes detailed instructions on how to prepare the collection statement and the necessary documentation required. It is advisable to read through the entire publication to understand the context and specific requirements related to your tax situation. By following the guidelines, taxpayers can ensure they meet all compliance requirements and avoid potential penalties.

Steps to Complete IRS Publication 1854 Rev 4

Completing IRS Publication 1854 Rev 4 involves several key steps:

- Review the publication thoroughly to understand the requirements.

- Gather all necessary documents, including financial statements and previous tax returns.

- Fill out the collection statement accurately, ensuring all information is complete and correct.

- Double-check your entries for accuracy before submission.

- Submit the completed statement to the IRS through the appropriate channels.

Key Elements of IRS Publication 1854 Rev 4

IRS Publication 1854 Rev 4 includes several key elements that are crucial for taxpayers:

- Definitions of terms related to tax collection.

- Detailed instructions for filling out the collection statement.

- Information on required supporting documents.

- Guidelines for submitting the statement and any associated forms.

Filing Deadlines and Important Dates

It is critical to be aware of filing deadlines associated with IRS Publication 1854 Rev 4. Taxpayers should note specific dates for submission to avoid penalties. The publication typically outlines these deadlines, ensuring that individuals and businesses can plan their submissions accordingly. Staying informed about important dates helps maintain compliance with IRS regulations.

Penalties for Non-Compliance

Failure to comply with the guidelines set forth in IRS Publication 1854 Rev 4 can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance is essential for taxpayers to avoid unnecessary financial burdens. The publication provides insights into the types of penalties that may be incurred, emphasizing the importance of accurate and timely submissions.

Create this form in 5 minutes or less

Find and fill out the correct publication 1854 rev 4

Create this form in 5 minutes!

How to create an eSignature for the publication 1854 rev 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS collection statement?

An IRS collection statement is a document that outlines the amount owed to the IRS and the payment options available. It is crucial for individuals and businesses to understand their tax obligations and how to manage them effectively. Using airSlate SignNow, you can easily eSign and send your IRS collection statement securely.

-

How can airSlate SignNow help with IRS collection statements?

airSlate SignNow simplifies the process of managing IRS collection statements by allowing users to eSign documents quickly and securely. This ensures that your IRS collection statement is processed efficiently, reducing the time spent on paperwork. Additionally, our platform offers templates that can be customized for your specific needs.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan includes features that enhance the management of documents, including IRS collection statements. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for managing IRS collection statements?

Yes, airSlate SignNow integrates seamlessly with various applications, making it easier to manage IRS collection statements alongside your existing tools. This includes integrations with popular CRM systems, cloud storage services, and more. These integrations enhance workflow efficiency and document management.

-

What features does airSlate SignNow offer for IRS collection statements?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for IRS collection statements. These features help streamline the process, ensuring that your documents are signed and returned promptly. Additionally, you can automate reminders for outstanding IRS collection statements.

-

How secure is airSlate SignNow for handling IRS collection statements?

Security is a top priority at airSlate SignNow. We use advanced encryption and compliance measures to protect your IRS collection statements and other sensitive documents. You can trust that your information is safe while using our platform for eSigning and document management.

-

Can I access my IRS collection statements from mobile devices?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and manage your IRS collection statements from any device. This flexibility ensures that you can eSign and send documents on the go, making it easier to stay on top of your tax obligations.

Get more for Publication 1854 Rev 4

Find out other Publication 1854 Rev 4

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe