Cocodoc Comform2154997 Fillable How to PrepareHow to Prepare a Collection Information Statement Form 433 a 2021

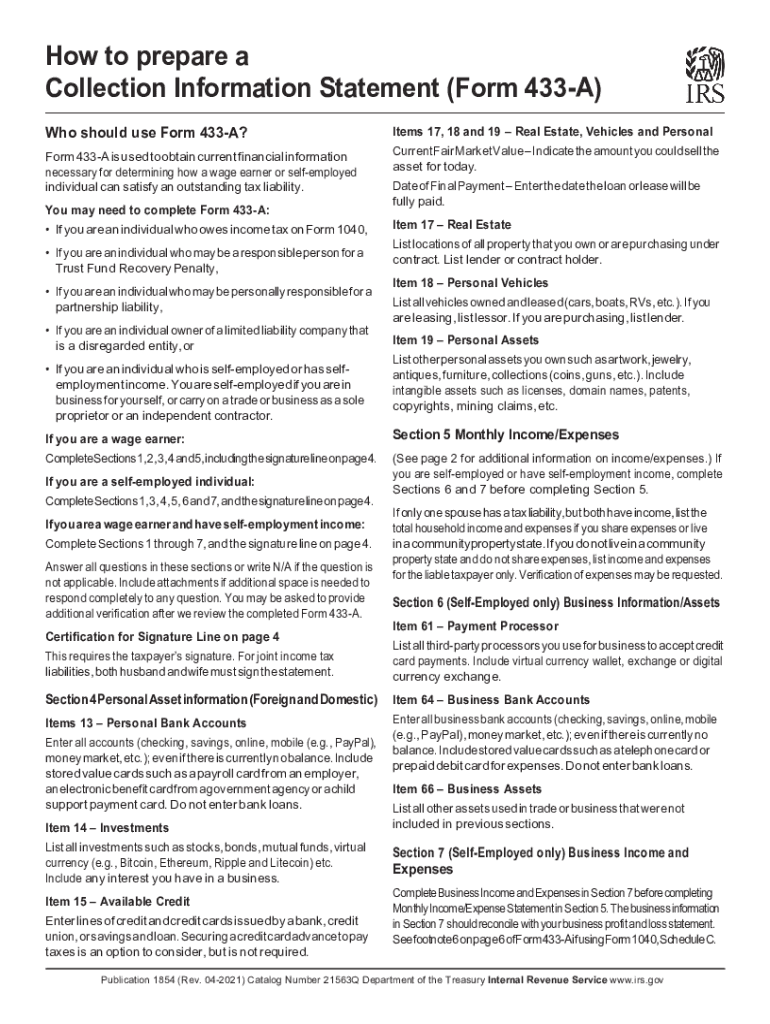

How to Prepare a Collection Information Statement Form 433-A

The Collection Information Statement Form 433-A is essential for individuals seeking to resolve tax liabilities with the Internal Revenue Service (IRS). This form provides the IRS with a comprehensive overview of your financial situation, including income, expenses, assets, and liabilities. To prepare this form accurately, gather all relevant financial documents, such as pay stubs, bank statements, and records of any other income sources. Ensure that you have a clear understanding of your monthly expenses to provide an accurate picture of your financial obligations.

Steps to Complete the Collection Information Statement Form 433-A

Completing the Form 433-A involves several key steps:

- Provide personal information, including your name, address, and Social Security number.

- Detail your income sources, including wages, self-employment income, and any other earnings.

- List your monthly expenses, such as housing, utilities, transportation, and food costs.

- Document your assets, including bank accounts, real estate, vehicles, and retirement accounts.

- Include any liabilities, such as loans, credit card debts, and other financial obligations.

- Sign and date the form to certify that the information provided is accurate and complete.

IRS Guidelines for Form 433-A

The IRS has specific guidelines for completing the Collection Information Statement Form 433-A. It is crucial to follow these guidelines to ensure that your form is accepted without delays. The IRS requires that all information be current and accurate. If you are unsure about any aspect of the form, consider consulting a tax professional for guidance. Additionally, be aware that the IRS may request supporting documentation to verify the information provided on the form, so keep your financial records organized.

Required Documents for Form 433-A

When preparing the Collection Information Statement Form 433-A, you will need to gather several documents to support your claims. These documents include:

- Recent pay stubs or proof of income.

- Bank statements for the last few months.

- Documentation of any other income sources, such as rental income or investment earnings.

- Receipts or statements for monthly expenses.

- Records of assets, including titles for vehicles and property deeds.

Form Submission Methods for Form 433-A

Once you have completed the Collection Information Statement Form 433-A, you can submit it to the IRS using various methods. The options include:

- Mailing the form to the address specified by the IRS for your region.

- Submitting the form in person at your local IRS office.

- Using e-filing options if applicable, though this may depend on the specific circumstances of your case.

Penalties for Non-Compliance with Form 433-A

Failing to comply with the requirements of the Collection Information Statement Form 433-A can lead to significant penalties. The IRS may impose fines or additional interest on unpaid tax liabilities. Additionally, non-compliance can hinder your ability to negotiate a payment plan or settle your tax debts effectively. It is essential to ensure that all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete cocodoccomform2154997 fillable how to preparehow to prepare a collection information statement form 433 a

Complete Cocodoc comform2154997 fillable how to prepareHow To Prepare A Collection Information Statement Form 433 A effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without any holdups. Manage Cocodoc comform2154997 fillable how to prepareHow To Prepare A Collection Information Statement Form 433 A across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Cocodoc comform2154997 fillable how to prepareHow To Prepare A Collection Information Statement Form 433 A with ease

- Find Cocodoc comform2154997 fillable how to prepareHow To Prepare A Collection Information Statement Form 433 A and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form-finding, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Cocodoc comform2154997 fillable how to prepareHow To Prepare A Collection Information Statement Form 433 A and guarantee excellent communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cocodoccomform2154997 fillable how to preparehow to prepare a collection information statement form 433 a

Create this form in 5 minutes!

People also ask

-

What is the role of airSlate SignNow in managing internal revenue service information?

airSlate SignNow provides a streamlined platform for businesses to securely send and eSign documents related to internal revenue service information. By utilizing our service, you can ensure that your sensitive data is protected while simplifying the management of important tax-related documents.

-

How does airSlate SignNow ensure the security of internal revenue service information?

Security is a top priority for airSlate SignNow. We implement advanced encryption methods and compliance standards to protect internal revenue service information from unauthorized access and ensure that all documents are handled securely during the eSigning process.

-

What features does airSlate SignNow offer for handling internal revenue service information?

airSlate SignNow offers features like customizable templates, real-time tracking, and audit trails, making it perfect for managing internal revenue service information. These tools empower businesses to collaborate efficiently and maintain comprehensive records of all tax documents.

-

What are the pricing options for airSlate SignNow services related to internal revenue service information?

airSlate SignNow offers flexible pricing plans to accommodate various business needs regarding internal revenue service information. Whether you are a small business or a large enterprise, we have options that provide value and fit your budget while ensuring access to essential features.

-

Can airSlate SignNow integrate with other tools to manage internal revenue service information?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications, enhancing your ability to manage internal revenue service information efficiently. These integrations allow you to automate workflows and ensure that all tax-related documents are easily accessible within your existing systems.

-

What are the benefits of using airSlate SignNow for internal revenue service information management?

Using airSlate SignNow simplifies the management of internal revenue service information by reducing paperwork and speeding up document processing. Our user-friendly interface ensures that even those unfamiliar with eSigning can quickly adapt, leading to increased productivity in your financial processes.

-

How does airSlate SignNow support compliance with internal revenue service information regulations?

airSlate SignNow is designed to help businesses comply with regulations related to internal revenue service information. We ensure that our processes align with legal requirements, which helps mitigate risks and ensures your documents are accepted by the IRS.

Get more for Cocodoc comform2154997 fillable how to prepareHow To Prepare A Collection Information Statement Form 433 A

- Liberty university transcript request form

- Providerexcellusbcbscomcontactjoin ourbecome a participating providerprovidersexcellus form

- Board of bar examiners 110 east main street suite 715 po box 2748 form

- Mn vehicle inspection form

- Cbp form 6059b english customs declaration fillable english

- Gc 7 medical benefits claim instructions accessible pdf form

- Authorization agreement for electronic payments eft form

- Guarantee by individuals for application to hang seng commercial form

Find out other Cocodoc comform2154997 fillable how to prepareHow To Prepare A Collection Information Statement Form 433 A

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online