Form 5305 RA Rev March Roth Individual Retirement Custodial Account

Understanding the Form 5305 RA Rev March Roth Individual Retirement Custodial Account

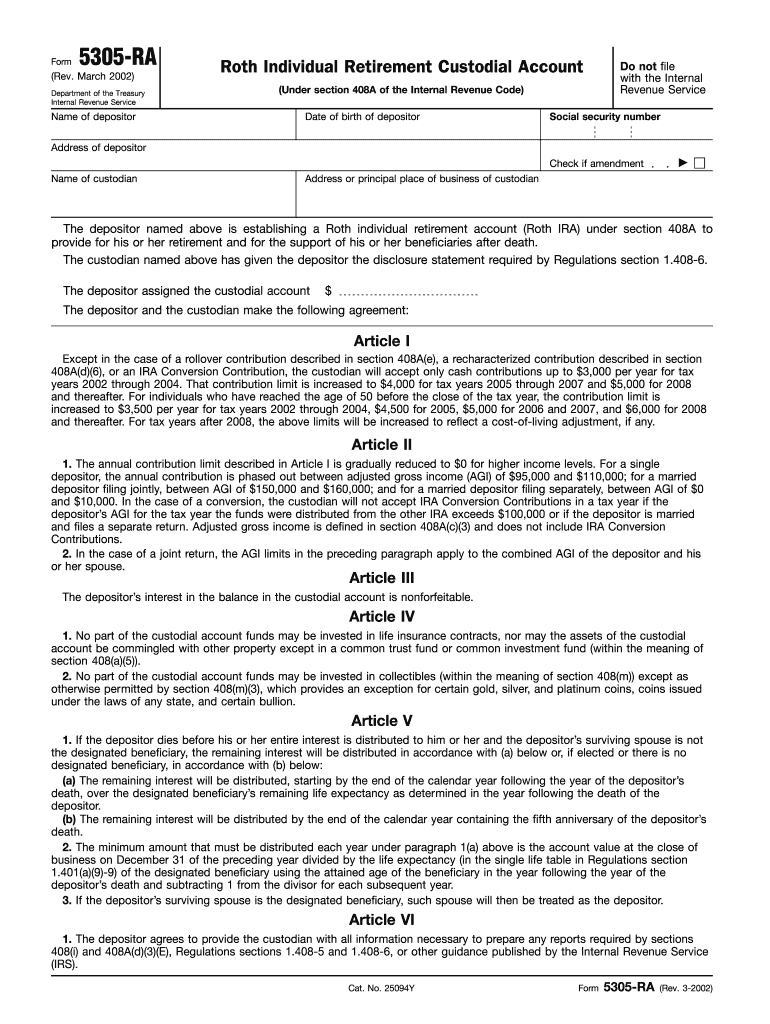

The Form 5305 RA Rev March is used to establish a Roth Individual Retirement Custodial Account. This form is essential for individuals who wish to set up a tax-advantaged retirement savings account that allows for tax-free growth and tax-free withdrawals in retirement, provided certain conditions are met. The Roth IRA is particularly appealing for those who anticipate being in a higher tax bracket during retirement than they are currently. By using this form, individuals can designate a custodian to manage their retirement funds in compliance with IRS regulations.

Steps to Complete the Form 5305 RA Rev March Roth Individual Retirement Custodial Account

Completing the Form 5305 RA Rev March involves several straightforward steps. First, gather necessary personal information, including your name, address, and Social Security number. Next, provide details about the custodian, which is typically a financial institution or bank. You will also need to specify the contributions you plan to make to the account. After filling out the required fields, review the form for accuracy and completeness. Finally, sign and date the form to validate it. Ensure that you retain a copy for your records.

Legal Use of the Form 5305 RA Rev March Roth Individual Retirement Custodial Account

The legal framework surrounding the Form 5305 RA Rev March is established by the Internal Revenue Service. This form complies with IRS regulations governing Roth IRAs, ensuring that custodians adhere to specific guidelines for managing the accounts. It is crucial for account holders to understand the legal implications of their contributions and withdrawals, as failing to comply with IRS rules can result in penalties or disqualification of the account. Consulting with a financial advisor can provide clarity on the legal aspects of managing a Roth IRA.

Eligibility Criteria for the Form 5305 RA Rev March Roth Individual Retirement Custodial Account

To be eligible to establish a Roth IRA using the Form 5305 RA Rev March, individuals must meet certain criteria set by the IRS. Primarily, contributors must have earned income, which can include wages, salaries, or self-employment income. Additionally, there are income limits that may affect eligibility; individuals who exceed these limits may not be able to contribute directly to a Roth IRA. It is essential to check the current IRS guidelines for specific income thresholds and contribution limits to ensure compliance.

How to Obtain the Form 5305 RA Rev March Roth Individual Retirement Custodial Account

The Form 5305 RA Rev March can be obtained directly from the IRS website or through financial institutions that offer Roth IRA accounts. Many custodians provide the form as part of their account opening process, simplifying the setup for new account holders. It is advisable to use the most recent version of the form to ensure compliance with current regulations. Always verify that the form is complete and accurate before submission to avoid any delays in account establishment.

Filing Deadlines and Important Dates for the Form 5305 RA Rev March Roth Individual Retirement Custodial Account

When establishing a Roth IRA using the Form 5305 RA Rev March, it is important to be aware of filing deadlines and important dates. Contributions to a Roth IRA can be made until the tax filing deadline for the year, typically April fifteenth. However, for those seeking to maximize their contributions, planning ahead is advisable. Keeping track of these dates helps ensure that individuals can take full advantage of their retirement savings opportunities without incurring penalties.

Quick guide on how to complete form 5305 ra rev march roth individual retirement custodial account

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-conscious alternative to conventional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any device using the airSlate SignNow apps available for Android or iOS, and enhance any document-related procedure today.

The Easiest Method to Edit and eSign [SKS] without Stress

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method of delivery for your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS], and maintain superb communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5305 RA Rev March Roth Individual Retirement Custodial Account

Create this form in 5 minutes!

How to create an eSignature for the form 5305 ra rev march roth individual retirement custodial account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5305 RA Rev March Roth Individual Retirement Custodial Account?

The Form 5305 RA Rev March Roth Individual Retirement Custodial Account is a specific IRS form used to establish a Roth IRA, which allows individuals to save for retirement with tax-free withdrawals. This form outlines the terms and conditions of the account and ensures compliance with IRS regulations.

-

How do I fill out the Form 5305 RA Rev March Roth Individual Retirement Custodial Account?

To fill out the Form 5305 RA Rev March Roth Individual Retirement Custodial Account, you need to provide personal information such as your name, address, and Social Security number. Additionally, you must designate a custodian who will manage your Roth IRA, ensuring that you adhere to IRS guidelines during the process.

-

What are the benefits of using the Form 5305 RA Rev March Roth Individual Retirement Custodial Account?

Utilizing the Form 5305 RA Rev March Roth Individual Retirement Custodial Account offers several advantages, including tax-free growth of your investments and tax-free withdrawals in retirement, provided certain conditions are met. This allows you to maximize your savings and enjoy financial freedom during your retirement.

-

Is there a cost associated with the Form 5305 RA Rev March Roth Individual Retirement Custodial Account?

While the Form 5305 RA Rev March Roth Individual Retirement Custodial Account itself does not have a filing fee, there may be fees associated with account maintenance and the custodian. It’s important to review any costs involved with your selected financial institution or custodian before establishing the account.

-

Can I integrate the Form 5305 RA Rev March Roth Individual Retirement Custodial Account with other financial tools?

Yes, you can integrate the Form 5305 RA Rev March Roth Individual Retirement Custodial Account with various financial planning tools and software to streamline your retirement savings strategy. This integration can help you track contributions, manage investments, and plan for your financial future more effectively.

-

What are the contribution limits for the Form 5305 RA Rev March Roth Individual Retirement Custodial Account?

For the Form 5305 RA Rev March Roth Individual Retirement Custodial Account, contribution limits are set by the IRS and can change yearly. As of 2023, individuals can contribute up to $6,500 annually, or $7,500 if aged 50 or older, subject to income restrictions.

-

What documents do I need to open the Form 5305 RA Rev March Roth Individual Retirement Custodial Account?

To open the Form 5305 RA Rev March Roth Individual Retirement Custodial Account, you will typically need a government-issued ID, Social Security number, proof of residency, and any financial information required by your chosen custodian. Ensuring you have these documents ready can expedite the account opening process.

Get more for Form 5305 RA Rev March Roth Individual Retirement Custodial Account

Find out other Form 5305 RA Rev March Roth Individual Retirement Custodial Account

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form