SCHEDULE L Form 990 or 990 EZ Department of the Treasury Internal Revenue Service Complete If the Organization Answered &quo

Understanding the SCHEDULE L Form 990 or 990-EZ

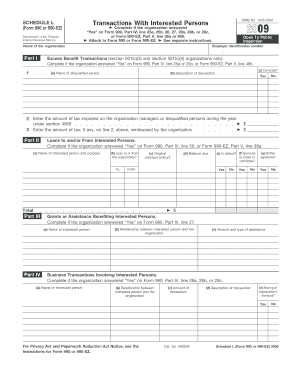

The SCHEDULE L Form 990 or 990-EZ is a crucial document used by tax-exempt organizations in the United States to report certain transactions and relationships with related parties. This form is part of the annual information return that organizations must file with the Internal Revenue Service (IRS). It helps ensure transparency and compliance with federal regulations by detailing financial activities that may affect the organization’s tax-exempt status.

Steps to Complete the SCHEDULE L Form 990 or 990-EZ

Completing the SCHEDULE L Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial records, including details of transactions with related parties.

- Identify the relevant sections of the form that apply to your organization.

- Fill out each section accurately, ensuring all required information is provided.

- Review the completed form for accuracy and completeness.

- Submit the form along with the primary Form 990 or 990-EZ by the filing deadline.

Key Elements of the SCHEDULE L Form 990 or 990-EZ

The SCHEDULE L Form includes several key elements that organizations must report. These elements typically encompass:

- Transactions with interested persons, including loans and grants.

- Compensation paid to officers, directors, and key employees.

- Details of any excess benefit transactions.

- Relationships with related organizations and the nature of those relationships.

Legal Use of the SCHEDULE L Form 990 or 990-EZ

The SCHEDULE L Form is legally required for tax-exempt organizations that meet specific criteria. Failure to complete and file this form can result in penalties from the IRS, including the potential loss of tax-exempt status. It is essential for organizations to understand their obligations under federal law and ensure compliance to maintain their standing.

Obtaining the SCHEDULE L Form 990 or 990-EZ

Organizations can obtain the SCHEDULE L Form 990 or 990-EZ directly from the IRS website. The form is available in PDF format, which can be printed and filled out manually or completed digitally. It is advisable to check for the most current version of the form to ensure compliance with any updates or changes in regulations.

Filing Deadlines for the SCHEDULE L Form 990 or 990-EZ

The filing deadline for the SCHEDULE L Form coincides with the due date for Form 990 or 990-EZ. Typically, organizations must file by the fifteenth day of the fifth month after the end of their fiscal year. Extensions may be available, but organizations should be aware of the requirements to avoid penalties.

Quick guide on how to complete schedule l form 990 or 990 ez department of the treasury internal revenue service complete if the organization answered ampquot

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The simplest method to modify and eSign [SKS] effortlessly

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Select your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SCHEDULE L Form 990 Or 990 EZ Department Of The Treasury Internal Revenue Service Complete If The Organization Answered &quo

Create this form in 5 minutes!

How to create an eSignature for the schedule l form 990 or 990 ez department of the treasury internal revenue service complete if the organization answered ampquot

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SCHEDULE L Form 990 Or 990 EZ Department Of The Treasury Internal Revenue Service?

The SCHEDULE L Form 990 Or 990 EZ Department Of The Treasury Internal Revenue Service is a required form for non-profit organizations that report transactions with interested parties. It provides detailed information about relationships and transactions involving officers, directors, and key employees.

-

How can airSlate SignNow help with filing the SCHEDULE L Form 990 Or 990 EZ?

airSlate SignNow streamlines the process of gathering signatures and required documentation necessary for the SCHEDULE L Form 990 Or 990 EZ Department Of The Treasury Internal Revenue Service. With our electronic signature capabilities, organizations can efficiently complete and manage forms without undue delays.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes various features such as secure document storage, customizable templates, and integration with other tools. These features support the completion of the SCHEDULE L Form 990 Or 990 EZ Department Of The Treasury Internal Revenue Service, making it easier for organizations to manage their compliance-related documents.

-

Is airSlate SignNow cost-effective for small organizations needing to file SCHEDULE L Forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing structure is competitive, making it accessible for small organizations that need to efficiently handle the SCHEDULE L Form 990 Or 990 EZ Department Of The Treasury Internal Revenue Service filing process.

-

Can I integrate airSlate SignNow with other software tools?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms. This means you can connect our service to your existing tools to facilitate the completion of the SCHEDULE L Form 990 Or 990 EZ Department Of The Treasury Internal Revenue Service.

-

What are the benefits of using airSlate SignNow for the SCHEDULE L Form 990 Or 990 EZ?

Using airSlate SignNow simplifies document management while ensuring your SCHEDULE L Form 990 Or 990 EZ Department Of The Treasury Internal Revenue Service is handled securely and efficiently. Our platform provides a user-friendly interface, reducing administrative burden and allowing you to focus on core organizational goals.

-

How does airSlate SignNow ensure document security during the filing of SCHEDULE L Forms?

airSlate SignNow prioritizes document security through encryption and robust access controls. This level of security is vital for organizations completing the SCHEDULE L Form 990 Or 990 EZ Department Of The Treasury Internal Revenue Service, ensuring that sensitive information remains protected at all times.

Get more for SCHEDULE L Form 990 Or 990 EZ Department Of The Treasury Internal Revenue Service Complete If The Organization Answered &quo

- Scale drawing word problems worksheet with answers form

- Dbia 535 form

- Biggest loser rules printable form

- Correlation vs causation worksheet 94795253 form

- Brookside terrace apartments form

- Onepath nz permanent emigration withdrawal form

- Dr rawlinson south australia form

- Wisconsin fixed rate note form 3250 pdf

Find out other SCHEDULE L Form 990 Or 990 EZ Department Of The Treasury Internal Revenue Service Complete If The Organization Answered &quo

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document