Publication 4513 Rev December Military Pensions and Federal Tax Withholding Form

Understanding Publication 4513 Rev December Military Pensions and Federal Tax Withholding

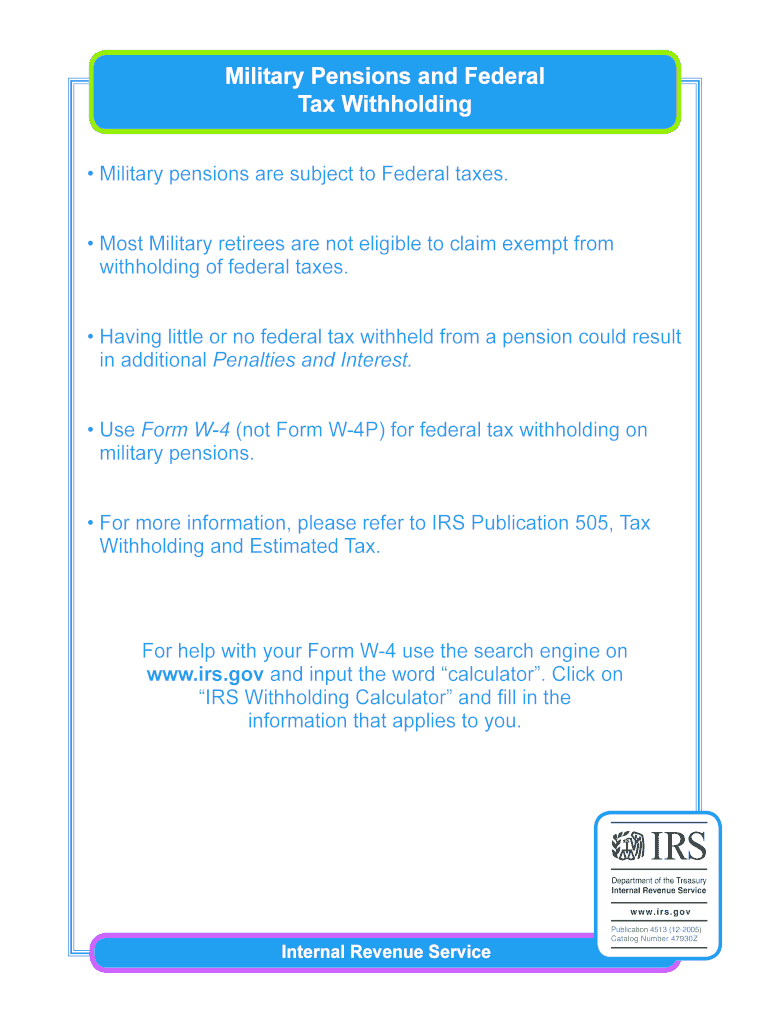

Publication 4513 Rev December provides essential guidance for military pension recipients regarding federal tax withholding. This document outlines how military pensions are treated for tax purposes, helping veterans and service members understand their tax obligations. It includes information on what constitutes a military pension, the tax implications of receiving such pensions, and how to ensure compliance with federal tax regulations.

How to Utilize Publication 4513 Rev December for Tax Withholding

To effectively use Publication 4513 Rev December, individuals should first review the document to understand the specific tax withholding requirements applicable to their military pensions. The publication explains how to calculate the correct amount of federal tax to withhold from pension payments. It also provides guidance on how to fill out necessary forms, ensuring that military pension recipients can accurately report their income and avoid potential penalties.

Steps for Completing Publication 4513 Rev December

Completing the requirements outlined in Publication 4513 Rev December involves several key steps:

- Review the publication to understand the definitions and tax implications of military pensions.

- Determine your eligibility for specific withholding allowances based on your personal tax situation.

- Fill out the necessary forms accurately, ensuring all information matches your military pension details.

- Submit the completed forms to the appropriate tax authority by the specified deadlines.

Legal Considerations for Publication 4513 Rev December

Publication 4513 Rev December is legally binding and provides the framework for military pension tax withholding. Understanding its legal implications is crucial for compliance. Failure to adhere to the guidelines may result in penalties, including fines or additional tax liabilities. It is important for recipients to stay informed about any changes in tax law that may affect their pensions and withholding requirements.

Key Elements of Publication 4513 Rev December

Several key elements are essential to understanding Publication 4513 Rev December:

- Definitions of military pensions and the types of income considered taxable.

- Guidelines for calculating federal tax withholding based on pension amounts.

- Information on how to adjust withholding amounts if financial circumstances change.

- Details on filing requirements and deadlines to ensure timely compliance.

Obtaining Publication 4513 Rev December

Publication 4513 Rev December can be obtained through the Internal Revenue Service (IRS) website or by contacting the IRS directly. It is advisable for military pension recipients to keep a copy of this publication for reference when preparing their taxes. Additionally, local tax assistance centers may provide copies and further assistance in understanding the publication's content.

Quick guide on how to complete publication 4513 rev december military pensions and federal tax withholding

Finish [SKS] effortlessly on any gadget

Web-based document administration has become increasingly favored by enterprises and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the appropriate template and securely archive it online. airSlate SignNow provides all the resources you need to produce, alter, and eSign your documents swiftly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

The simplest method to alter and eSign [SKS] without any hassle

- Find [SKS] and click on Get Form to initiate.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate the worries of lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Modify and eSign [SKS] and ensure seamless communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Publication 4513 Rev December Military Pensions And Federal Tax Withholding

Create this form in 5 minutes!

How to create an eSignature for the publication 4513 rev december military pensions and federal tax withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Publication 4513 Rev December Military Pensions And Federal Tax Withholding?

Publication 4513 Rev December Military Pensions And Federal Tax Withholding is an IRS document that outlines the tax implications of military pensions. It provides guidance on how federal tax withholding applies to military retirement benefits, ensuring that veterans understand their tax responsibilities.

-

How can airSlate SignNow help with tax documents related to Publication 4513 Rev December Military Pensions And Federal Tax Withholding?

AirSlate SignNow simplifies the process of sending and signing tax documents, including those related to Publication 4513 Rev December Military Pensions And Federal Tax Withholding. With our platform, you can securely eSign and manage documents with ease, ensuring compliance and efficiency in handling your tax obligations.

-

What features does airSlate SignNow offer for managing documents related to military pensions?

AirSlate SignNow offers features like customizable templates and document storage, which are particularly beneficial for managing documents related to Publication 4513 Rev December Military Pensions And Federal Tax Withholding. Users can efficiently create, distribute, and eSign documents, streamlining their workflow and reducing paperwork.

-

Is airSlate SignNow a cost-effective solution for signing tax-related documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses and individuals alike. By enabling electronic signatures and document management, you can save time and resources, particularly when dealing with tax-related documents like those outlined in Publication 4513 Rev December Military Pensions And Federal Tax Withholding.

-

Can I integrate airSlate SignNow with other platforms for tax preparation?

Absolutely! AirSlate SignNow offers integrations with various platforms that are crucial for tax preparation. This allows you to seamlessly manage and eSign documents concerning Publication 4513 Rev December Military Pensions And Federal Tax Withholding while linking to your existing financial systems.

-

What are the benefits of using airSlate SignNow for military pension documents?

Using airSlate SignNow for military pension documents ensures a streamlined and secure process for eSigning, which is particularly important for documents related to Publication 4513 Rev December Military Pensions And Federal Tax Withholding. This enhances both accessibility and compliance, allowing you to focus on your financial planning.

-

How secure is airSlate SignNow for handling sensitive tax documents?

AirSlate SignNow prioritizes security, implementing advanced encryption and access controls for handling sensitive documents like those involved in Publication 4513 Rev December Military Pensions And Federal Tax Withholding. You can trust that your information is protected and accessible only to authorized users.

Get more for Publication 4513 Rev December Military Pensions And Federal Tax Withholding

Find out other Publication 4513 Rev December Military Pensions And Federal Tax Withholding

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF