Treasury Dept TDF 90 22 56A Rev October Fill in Capable Suspicious Activity Report Money Services Business Individual Form Suppl

Understanding the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report

The Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report is a crucial document used by Money Services Businesses (MSBs) to report suspicious activities that may indicate potential money laundering or other financial crimes. This form is part of the compliance requirements set forth by the Financial Crimes Enforcement Network (FinCEN) and helps ensure that MSBs adhere to federal regulations aimed at preventing illicit financial activities. It is essential for businesses to understand the significance of this report in maintaining transparency and accountability in their operations.

Steps to Complete the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report

Completing the Treasury Dept TDF 90 22 56A involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the suspicious activity, including details about the transaction, parties involved, and the nature of the suspicion. Next, accurately fill out each section of the form, providing clear and concise information. It is important to double-check for any errors or omissions, as these can lead to delays or penalties. Once completed, the form should be submitted to the appropriate authorities as outlined in the submission guidelines.

Legal Use of the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report

The legal use of the Treasury Dept TDF 90 22 56A is primarily to fulfill the reporting obligations of MSBs under the Bank Secrecy Act (BSA). This report must be filed whenever a business detects suspicious activity that may involve money laundering or fraud. Failure to file this report can result in significant penalties, including fines and legal repercussions. Therefore, understanding the legal framework surrounding this report is vital for compliance and risk management.

Key Elements of the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report

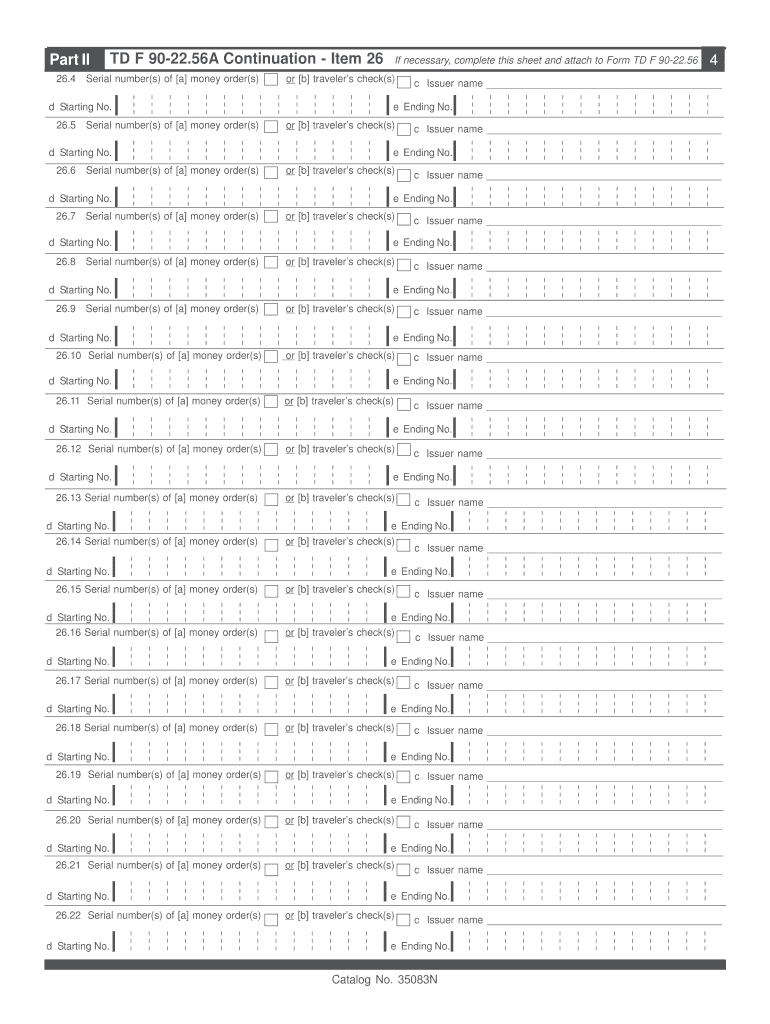

Key elements of the Treasury Dept TDF 90 22 56A include detailed sections that require specific information about the suspicious activity. This includes the date and nature of the transaction, the amount involved, and a description of the suspicious behavior observed. Additionally, the form requires information about the individuals or entities involved, as well as any relevant account numbers. Providing comprehensive and accurate details is essential for effective reporting and compliance.

Form Submission Methods

The Treasury Dept TDF 90 22 56A can be submitted through various methods, including online filing, mailing, or in-person submission. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. When mailing the form, it is important to use a reliable postal service and retain proof of mailing. In-person submissions may be appropriate for urgent cases or when additional documentation is required.

Examples of Using the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report

Examples of scenarios that may necessitate the use of the Treasury Dept TDF 90 22 56A include instances where an MSB detects unusual patterns of transactions, such as large cash deposits that do not align with a customer’s known business activities. Other examples include transactions involving individuals or entities listed on government watchlists or those that appear to be structured to evade reporting thresholds. Documenting these instances through the form is vital for regulatory compliance and helps authorities investigate potential financial crimes.

Quick guide on how to complete treasury dept tdf 90 22 56a rev october fill in capable suspicious activity report money services business individual form

Complete [SKS] effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

The easiest way to modify and electronically sign [SKS] without stress

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method to send your form, such as email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report Money Services Business Individual Form Suppl

Create this form in 5 minutes!

How to create an eSignature for the treasury dept tdf 90 22 56a rev october fill in capable suspicious activity report money services business individual form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report?

The Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report is a form designed for Money Services Businesses to report suspicious activities. This essential document helps organizations maintain compliance with federal regulations and protect themselves from financial crimes. Utilizing airSlate SignNow simplifies the completion and submission of this report.

-

How can airSlate SignNow assist in filling out the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report?

airSlate SignNow provides an intuitive platform that allows users to fill out the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report digitally. With features to streamline form filling, you can complete the report efficiently and accurately. The eSignature feature further facilitates faster submission, ensuring regulatory compliance.

-

Is there a cost associated with using airSlate SignNow for the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be affordable and cost-effective. The plans vary based on features and the number of users, allowing your business to select the best option for your needs. Investing in airSlate SignNow for the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report can lead to signNow time and cost savings.

-

What features does airSlate SignNow offer for managing the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report?

airSlate SignNow offers various features tailored to streamline the management of the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report. Key features include document templates, customizable workflows, electronic signatures, and secure cloud storage. These functionalities ensure that your report is managed efficiently and securely.

-

Can airSlate SignNow integrate with other software for handling the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report?

Yes, airSlate SignNow integrates seamlessly with various software solutions, enhancing your ability to manage the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report. This includes CRM systems and financial software, enabling better data management and workflow automation. The integrations help streamline processes and improve overall productivity.

-

What are the benefits of using airSlate SignNow for the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report?

The benefits of using airSlate SignNow for the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report include faster document turnaround, improved compliance, and enhanced user experience. The platform's simplicity allows for quick form filling and submission, reducing the risk of errors. Overall, it is a reliable solution for still meeting regulatory requirements efficiently.

-

Is airSlate SignNow secure for handling sensitive reports like the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report?

Absolutely, airSlate SignNow prioritizes security and compliance, providing a safe environment for handling sensitive documents like the Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report. The platform employs robust encryption methods and secure data handling practices to protect your information. You can trust that your reports are safeguarded at all times.

Get more for Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report Money Services Business Individual Form Suppl

Find out other Treasury Dept TDF 90 22 56A Rev October Fill In Capable Suspicious Activity Report Money Services Business Individual Form Suppl

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors