Form 941 M Rev January , Fill in Version Employer's Monthly Federal Tax Return

What is the Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return

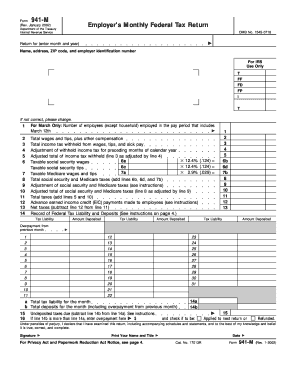

The Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return is a crucial document for employers in the United States. This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It also serves to report the employer's portion of Social Security and Medicare taxes. This monthly return is essential for maintaining compliance with federal tax regulations and ensuring accurate reporting of payroll taxes.

How to use the Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return

Using the Form 941 M involves several steps to ensure accurate completion. Employers should first gather all necessary payroll data, including total wages paid, taxes withheld, and the number of employees. After collecting this information, employers can fill out the form, ensuring that all sections are completed accurately. The form must then be submitted to the IRS by the designated deadline to avoid penalties. Utilizing digital tools can streamline this process, making it easier to fill out and submit the form electronically.

Steps to complete the Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return

Completing the Form 941 M involves a systematic approach:

- Gather payroll records, including wages, tips, and any other compensation.

- Calculate the total taxes withheld for the reporting month.

- Fill in the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the due date.

Key elements of the Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return

Key elements of the Form 941 M include the employer's identification information, total wages paid, taxes withheld, and the employer's share of Social Security and Medicare taxes. Additionally, the form requires information on any adjustments for prior periods and any credits that may apply. Accurate reporting of these elements is essential for compliance and to avoid potential penalties.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Form 941 M. The form is typically due on the last day of the month following the reporting month. For example, the January form is due by the end of February. It is essential to adhere to these deadlines to avoid late fees and penalties, which can accumulate rapidly if not addressed promptly.

Penalties for Non-Compliance

Failure to file the Form 941 M on time or inaccuracies in reporting can result in significant penalties. The IRS imposes fines based on the amount of tax owed and the duration of the delay. Employers may face penalties for late filing, late payment, or inaccuracies in the reported information. Understanding these penalties can motivate timely and accurate submissions, helping to maintain compliance with federal tax laws.

Quick guide on how to complete form 941 m rev january fill in version employers monthly federal tax return

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and digitally sign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and digitally sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with features that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 941 M Rev January , Fill in Version Employer's Monthly Federal Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 941 m rev january fill in version employers monthly federal tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return'?

The 'Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return' is a crucial document that employers use to report payroll taxes. This form helps businesses ensure compliance with federal tax regulations while accurately calculating and paying their payroll taxes. Using airSlate SignNow, you can easily fill out and submit this form digitally.

-

How can airSlate SignNow assist me in completing the 'Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return'?

With airSlate SignNow, you can efficiently complete the 'Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return' online. Our user-friendly platform allows you to fill in necessary fields, add eSignatures, and share the document securely with your tax professionals or team members, making the entire process seamless.

-

Is there a cost associated with using airSlate SignNow for the 'Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return'?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our competitive pricing ensures that you receive a cost-effective solution for electronically filling out forms, including the 'Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return'. Check our pricing page for detailed information.

-

What features does airSlate SignNow provide for filling out tax forms?

airSlate SignNow offers numerous features designed to streamline the form-filling process. You can utilize templates, form fields, and eSignature capabilities specifically for the 'Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return'. These features enhance efficiency and ensure compliance with federal guidelines.

-

Can I integrate airSlate SignNow with my existing software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This means you can link your current systems for a more efficient workflow while preparing the 'Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return'.

-

What are the benefits of using airSlate SignNow for my monthly tax returns?

Using airSlate SignNow for your monthly tax returns, including the 'Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return', brings signNow benefits. You can save time with our quick fill-in options, maintain accuracy with electronic records, and enhance security with advanced data protection measures. It’s a smart investment for any business.

-

Is training available for new users of airSlate SignNow?

Yes, airSlate SignNow provides comprehensive training resources for new users. We offer tutorials, webinars, and customer support designed to help you quickly learn how to use the platform effectively. Master the 'Form 941 M Rev January, Fill in Version Employer's Monthly Federal Tax Return' and other features in no time.

Get more for Form 941 M Rev January , Fill in Version Employer's Monthly Federal Tax Return

- Michigan notary application pdf form

- Swot templates editable form

- Ua local 803 pay scale form

- Efekta insurance claim form

- Training proposal template word form

- Two year permit application abusable volatile chemical avc dshs texas form

- Tax file number application or enquiry for individuals living outside australia form

- Copyright glencoe mcgraw hill answer key form

Find out other Form 941 M Rev January , Fill in Version Employer's Monthly Federal Tax Return

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now